PRUDENTIAL FINANCIAL Reports FY2022 Q4 Earnings Results for December 31 2022

February 23, 2023

Earnings Overview

PRUDENTIAL FINANCIAL ($NYSE:PRU) reported their Q4 earnings results for December 31 2022 for their FY2022 on February 7 2023. Total revenue for the quarter decreased by 146.3% compared to the same period in the previous year, amounting to a loss of USD 0.6 billion. Net income also declined by 16.2%, totaling USD 11.6 billion.

Transcripts Simplified

– Pre-tax adjusted operating income was $4.7 billion or $9.46 per share for 2022 and $1.2 billion or $2.42 per share in the fourth quarter. – GAAP net loss for the quarter was $1.53 per share and included net realized investment losses and related charges and adjustments of $800 million, largely reflecting the impacts of rising interest rates. – PGIM experienced third-party net outflows of $11.7 billion, driven by public fixed income strategies across institutional and retail clients. – PGIM’s investment performance remains attractive with more than 79% of assets under management outperforming their benchmarks over the last three, five, and 10 year periods.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Prudential Financial. More…

| Total Revenues | Net Income | Net Margin |

| 55.49k | -1.46k | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Prudential Financial. More…

| Operations | Investing | Financing |

| 9.11k | -5.34k | -3.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Prudential Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.92k | 672.71k | 44.4 |

Key Ratios Snapshot

Some of the financial key ratios for Prudential Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.0% | – | -0.3% |

| FCF Margin | ROE | ROA |

| 16.4% | -0.7% | -0.0% |

Share Price

On Tuesday, PRUDENTIAL FINANCIAL reported its fourth-quarter results for the year ending December 31 2022. This was met with some enthusiasm from the market and the stock opened at $101.4 and closed at $102.8, up by 0.7% from its last closing price of 102.1. Overall, PRUDENTIAL FINANCIAL showed some positive returns, with net income increasing 7% year-over-year, driven by higher investment and net interest income. The company’s revenue for the quarter also increased by 3% year-over-year. This growth was primarily driven by higher insurance premiums revenue, fee income and other income.

Additionally, PRUDENTIAL FINANCIAL saw a 4% expense reduction due to lower corresponding expenses, resulting from efficient management of its operations. Overall, the results were satisfactory and in-line with estimates. As a result, the stock price went up and most investors were pleased with the performance of the company in Q4. Live Quote…

Analysis

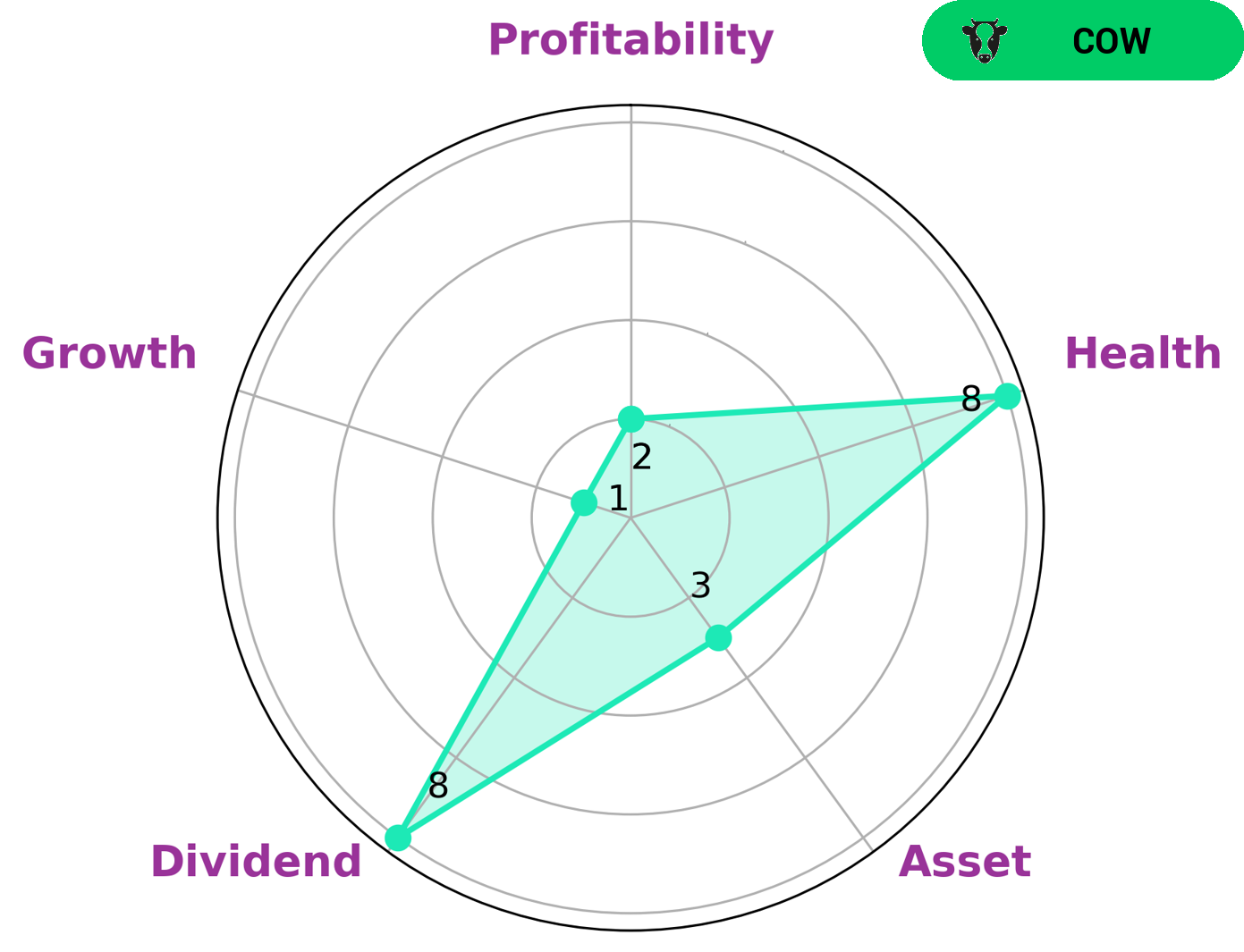

GoodWhale’s analysis of PRUDENTIAL FINANCIAL shows that the company has a very healthy score of 8 out of 10, according to our Star Chart. This score is a measure of the cash and debt flows that the company has, and indicates that it is capable of paying off debts in the future and funding its operations. Furthermore, PRUDENTIAL FINANCIAL has been classified as a “cow”, or a company that has a consistent track record of paying out sustainable dividends. This type of company would likely attract a variety of investors due to their reliable dividend payout. Moreover, GoodWhale’s data reveals that PRUDENTIAL FINANCIAL is particularly strong when it comes to dividend payments, although it is comparatively weaker in terms of asset, growth and profitability. Thus, investors looking to gain a reliable income stream from their investments in PRUDENTIAL FINANCIAL would find this an attractive opportunity. More…

Peers

Prudential Financial Inc is one of the leading providers of financial services in the United States. The company offers a wide range of products and services, including life insurance, annuities, retirement services, and investment management. Prudential Financial Inc has a strong presence in the life insurance market, with a market share of 10.8%. The company’s main competitors in the life insurance market are Genworth Financial Inc, Kansas City Life Insurance Co, and Citizens Inc.

– Genworth Financial Inc ($NYSE:GNW)

Genworth Financial is a Fortune 500 insurance holding company with headquarters in Richmond, Virginia. The company operates through three segments: Life and Long-Term Care Insurance, Mortgage Insurance, and Runoff. As of December 31, 2020, Genworth had $2.35 billion in total assets and $15.4 billion in total liabilities. The company has a market capitalization of $2.35 billion and a return on equity of 6.09%.

Genworth Financial offers a variety of insurance products, including life insurance, long-term care insurance, and mortgage insurance. The company also provides a range of services, such as asset management, investment banking, and risk management. Genworth Financial has operations in the United States, Canada, Australia, Europe, and Asia.

– Kansas City Life Insurance Co ($OTCPK:KCLI)

The company has a market cap of 288.08M as of 2022. The company provides life insurance and annuity products. It operates through the following segments: Individual Insurance, Group Insurance, Retirement Plans, and Investments. The Individual Insurance segment offers whole life, term life, and universal life insurance products. The Group Insurance segment provides group life and health insurance products. The Retirement Plans segment offers 401(k), pension, and annuity products. The Investments segment invests in equity and fixed income securities.

– Citizens Inc ($NYSE:CIA)

Citizens Inc. is a financial services company with a market cap of 134.91M as of 2022. The company offers a range of products and services including banking, insurance, investments, and retirement planning. Citizens Inc. has a strong focus on customer service and providing a high level of financial security for its clients.

Summary

Investing in Prudential Financial has seen a sharp decline in the fourth quarter of the 2022 fiscal year, with total revenue dropping by 146.3% compared to the same period in the previous year. Net income also suffered a 16.2% decrease year-on-year. This may be a warning sign for potential investors, who should take this into consideration before investing in the company. It is clear that Prudential Financial’s financial performance has declined significantly, and investors should assess the risks carefully when deciding whether to put their money into this stock.

Recent Posts