PROGRESS SOFTWARE Reports Record Earnings for Q1 of 2023

April 8, 2023

Earnings Overview

On February 28 2023, PROGRESS SOFTWARE ($NASDAQ:PRGS) announced their first-quarter fiscal year 2023 earnings results, with total revenue at USD 23.7 million, a 15.7% increase from the same quarter of the previous year. Net income for the quarter stood at USD 164.2 million, 13.3% higher than the same quarter in the prior year.

Transcripts Simplified

My name is Name, and I’ll be your moderator for today’s call. At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. As a reminder, this conference call is being recorded for replay purposes. Now, I’d like to turn the call over to your host, Mr. Phil Pead, Chairman and Chief Executive Officer of Progress Software. Please go ahead, sir. Phil Pead: Thanks, Name. I’m joined today by Yogesh Gupta, our President and Chief Operating Officer; and Brian Flanagan, our Chief Financial Officer. Before we start, let me remind everyone that during this call we may make statements about our current expectations for our future financial performance and future events.

These forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from those expressed in the statements made today. Please refer to the Risk Factors section of our most recent Annual Report on Form 10-K for a discussion of factors that could cause actual results to differ materially from those projected in such forward-looking statements. We assume no obligation to update these forward-looking statements as a result of new information or future events or developments. Furthermore, this call includes discussion of non-GAAP financial measures. Please refer to the earnings press release posted in the Investor Relations section of our website for reconciliations of non-GAAP measures to their most comparable GAAP measures. This revenue growth was driven by strong demand at both our core product lines and our newer cloud offerings. Overall, we are very pleased with our strong quarterly performance and continued progress in delivering value for our customers and shareholders.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Progress Software. More…

| Total Revenues | Net Income | Net Margin |

| 621.32 | 98.29 | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Progress Software. More…

| Operations | Investing | Financing |

| 194.83 | -333.68 | 102.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Progress Software. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.64k | 1.23k | 9.21 |

Key Ratios Snapshot

Some of the financial key ratios for Progress Software are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.8% | 15.1% | 22.9% |

| FCF Margin | ROE | ROA |

| 30.4% | 21.9% | 5.4% |

Stock Price

On Tuesday, PROGRESS SOFTWARE reported record earnings for Q1 of 2023, with their stock opening at $58.6 and closing at the same price, down by 0.3% from the previous closing price of 58.8. This marks a remarkable achievement for the company, as it demonstrates their ability to achieve consistent financial growth and stability even amidst turbulent market conditions. These impressive results show that PROGRESS SOFTWARE is well-positioned to capitalize on the growing demand for the advanced software solutions that they offer. Their success serves as an example for other companies in the space, and investors will undoubtedly be watching them closely as they continue to report record earnings. Live Quote…

Analysis

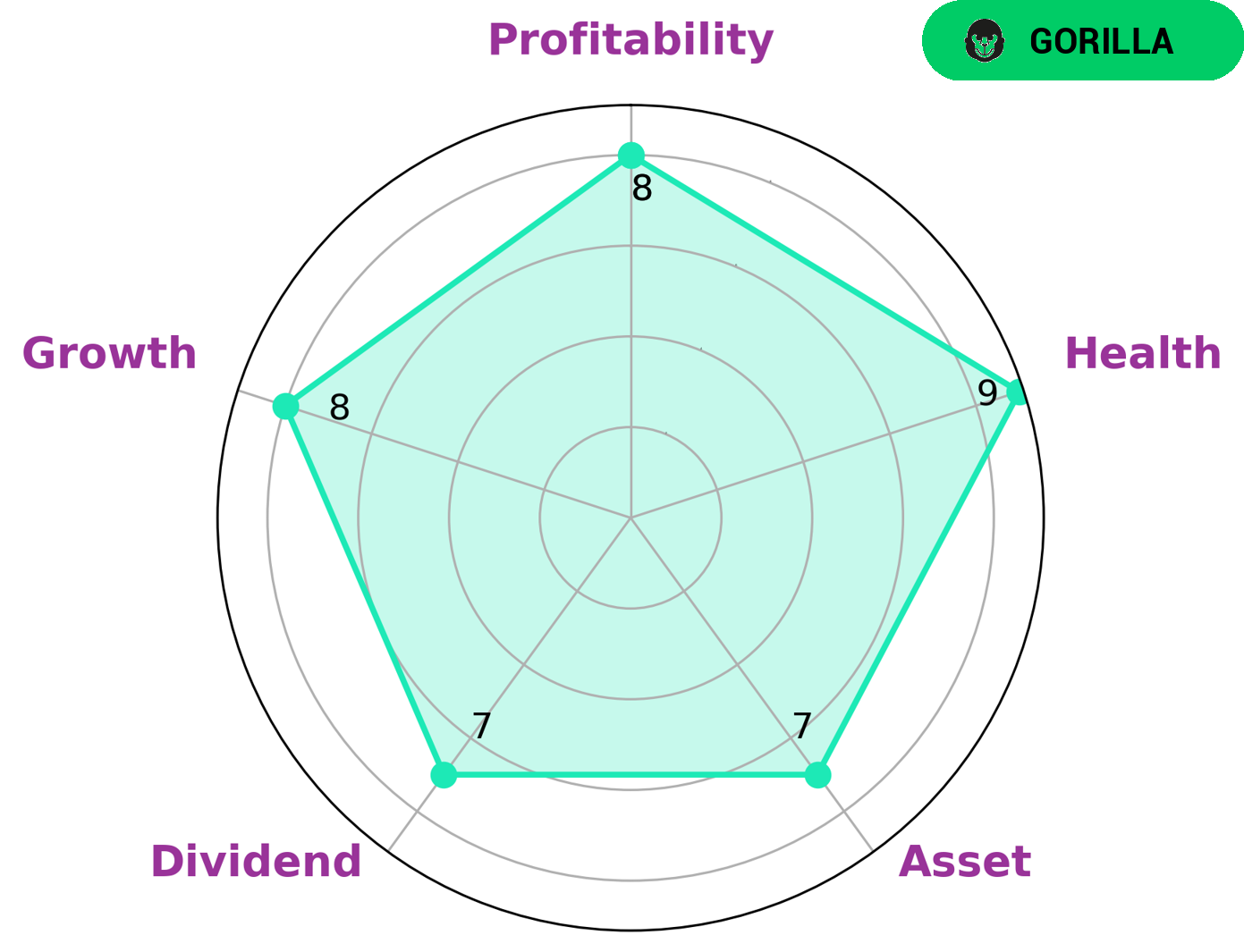

As an analysis of PROGRESS SOFTWARE‘s fundamentals done by GoodWhale, we are able to provide an assessment of the company’s health. Based on our Star Chart, PROGRESS SOFTWARE has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable of paying off debt and funding future operations. We have also classified PROGRESS SOFTWARE as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. As such, PROGRESS SOFTWARE may be of great interest to investors who are seeking a company with a strong asset base, dividend structure, growth potential, and profitability. Furthermore, due to the stability of its operations and the security of its position in the market, it is likely to be a safe investment for those who are looking for long-term returns. More…

Peers

Progress Software Corporation is an American publicly traded company headquartered in Bedford, Massachusetts. The company develops software products and services for businesses. Progress Software’s main competitors are DocuSign Inc, Pros Holdings Inc, and Sprout Social Inc.

– DocuSign Inc ($NASDAQ:DOCU)

DocuSign Inc is a US provider of electronic signature technology and digital transaction management services, founded in 2003. The company’s software allows users to electronically sign, send, and manage documents. As of 2022, DocuSign has a market cap of 8.52B and a ROE of -15.28%.

– Pros Holdings Inc ($NYSE:PRO)

A market cap of 1.17B means that the company is worth 1.17 billion dollars. The company’s ROE is 195.47%, which means that the company has made 195.47% profit on every dollar that it has invested. The company does business in the healthcare industry.

– Sprout Social Inc ($NASDAQ:SPT)

Sprout Social is a social media management platform that helps brands grow their social media presence. The company has a market cap of $2.61B and a ROE of -17.92%. Sprout Social’s platform helps brands with tasks such as scheduling and publishing content, analyzing social media analytics, andEngaging with their audience.

Summary

Investors should consider PROGRESS SOFTWARE as a long-term investment due to the company’s healthy financial performance in the first quarter of fiscal year 2023. Revenue for the quarter was up 15.7% year-on-year and net income increased by 13.3%. This demonstrates PROGRESS SOFTWARE’s ability to grow despite challenging conditions in the market. The company’s strong balance sheet, favorable fundamentals, and potential for future growth indicate that PROGRESS SOFTWARE could be an attractive investment opportunity.

Recent Posts