POOL CORPORATION Reports Fourth Quarter of FY2022 Earnings Results Ending February 16 2023.

February 22, 2023

Earnings Overview

POOL CORPORATION ($NASDAQ:POOL) released their fourth quarter FY2022 earnings results on December 31 2022, which concluded on February 16 2023. Despite a 33.2% drop in total revenue year-on-year, their net income rose 5.8% to USD 1095.9 million.

Transcripts Simplified

POOLCORP’s fourth quarter sales exceeded $1 billion, with a gross profit percentage of 28.8%. Operating expenses grew 7% to $208 million in the fourth quarter. Full year 2022 sales reached $6 billion, representing 17% top line and 21% EPS growth.

Market share grew due to new greenfields, increased consumer interest in automation, higher price point products, and expanded backyard features. For 2022, domestic pool distribution revenue was comprised of 60% maintenance and 14% retail products.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pool Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 6.18k | 748.46 | 12.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pool Corporation. More…

| Operations | Investing | Financing |

| 484.85 | -50.87 | -411.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pool Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.57k | 2.33k | 30.49 |

Key Ratios Snapshot

Some of the financial key ratios for Pool Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.5% | 44.3% | 16.6% |

| FCF Margin | ROE | ROA |

| 7.1% | 53.8% | 18.0% |

Price History

After the announcement, POOL CORPORATION’s stock opened at $376.9 and closed at $389.7. This marks an increase of 1.3% from the previous closing price of $384.6. This demonstrates the company’s continued commitment to increasing shareholder value and return on investments.

Overall, the company’s fourth quarter results reflect solid performance, as POOL CORPORATION continues to invest in its growth and profitability. As investors await further updates on POOL CORPORATION’s performance and growth, the company’s stock prices are expected to remain strong in the upcoming months. Live Quote…

Analysis

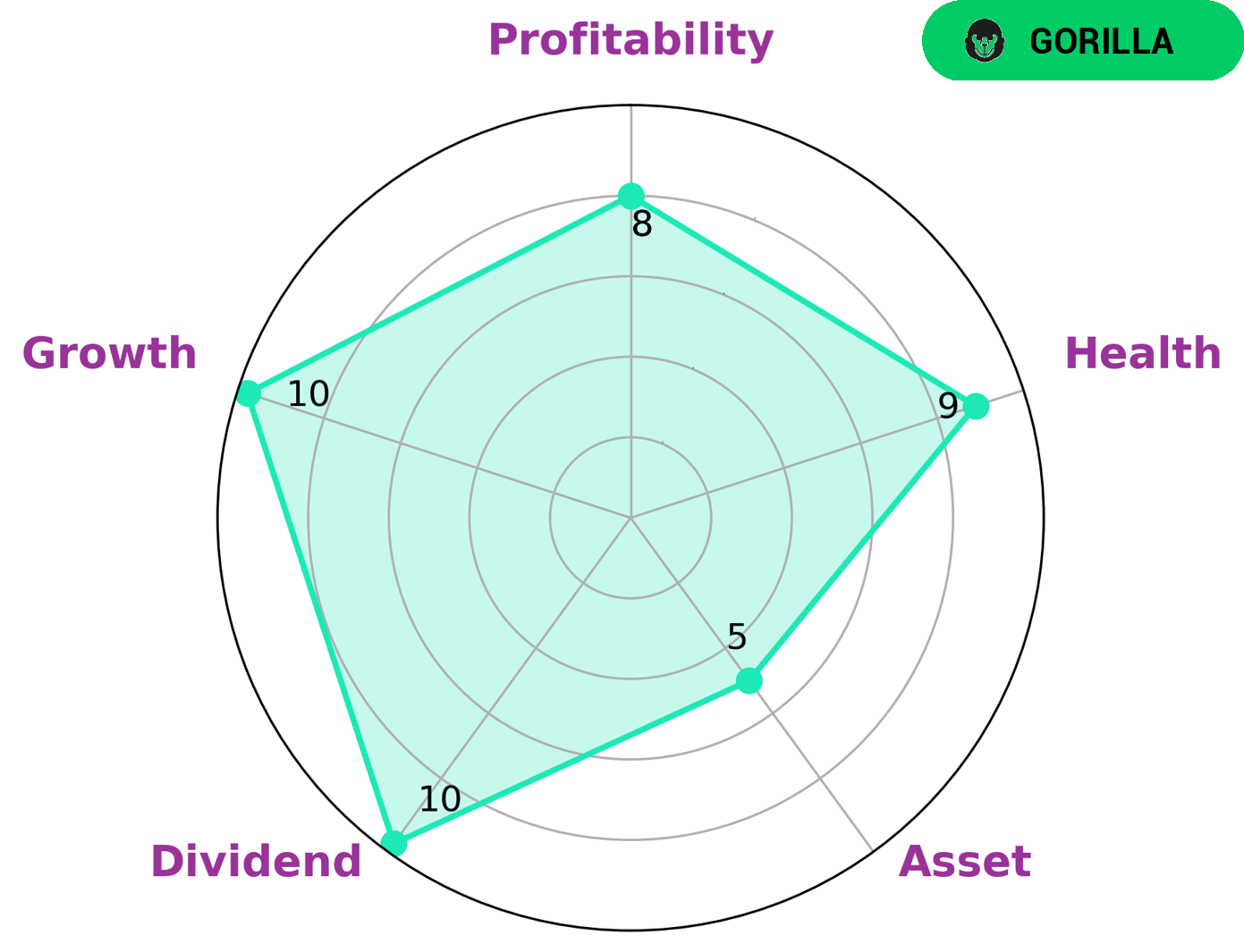

GoodWhale recently conducted an analysis of POOL CORPORATION to assess their well-being. Based on our Star Chart, it is classified as a ‘gorilla’ company, which indicates that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes it an attractive asset for all types of investors. Looking at their financial condition, POOL CORPORATION has a high health score of 9/10. This means that, in the event of any unforeseen crisis, the company is capable of riding it out safely without the risk of bankruptcy. Additionally, the company has scored high marks in terms of dividend, growth, and profitability and had a medium score in asset. This indicates that POOL CORPORATION is likely to remain a safe and profitable investment for years to come. More…

Peers

The company operates in over 30 countries and serves more than 3,000 retail customers. Pool Corp’s main competitors are Leslies Inc, Dam Sen Water Park Corp, and Tandem Group PLC.

– Leslies Inc ($NASDAQ:LESL)

Leslies Inc is a pool and spa company that has a market cap of 2.38B as of 2022. The company has a Return on Equity of -51.73%. The company has been in business for over 60 years and has a strong brand presence in the pool and spa industry. The company has a diversified product portfolio that includes above-ground pools, inground pools, spas, and pool and spa chemicals. The company operates in North America, Europe, and Asia Pacific.

– Dam Sen Water Park Corp ($HOSE:DSN)

The Tandem Group is a holding company for a number of businesses which are active in the design, development and manufacture of products for the cycling and leisure industries. Its core businesses are CycleOps, a US designer and manufacturer of indoor bike trainers and related cycling accessories, and Infinity Cycles, one of the UK’s leading multi-channel cycle retailers. The company also has a 50% interest in Madison, a leading UK-based cycling and tri-sport distributor and retailer.

The Tandem Group’s market capitalisation is 13.55M as of 2022. The company has a Return on Equity of 9.17%.

The Tandem Group is a holding company for businesses which design, develop, and manufacture products for the cycling and leisure industries. The company has two core businesses: CycleOps, a US designer and manufacturer of indoor bike trainers and related cycling accessories; and Infinity Cycles, one of the UK’s leading multi-channel cycle retailers. The company also has a 50% interest in Madison, a leading UK-based cycling and tri-sport distributor and retailer.

Summary

Investors analyzing POOL CORPORATION saw a decrease in the company’s total revenue of 33.2% from the previous year, yet net income was up 5.8% year-over-year. This could be indicative of the company’s ability to utilize existing assets to its advantage and take advantage of cost efficiencies while still maintaining profitability. With a forward-looking approach to managing risk, this company presents some interesting opportunities for investors. Investors should look to continued trends with regard to operating income and cash flow to best analyze the long-term outlook for the company.

Recent Posts