Playags Intrinsic Stock Value – PLAYAGS Reports Fourth Quarter Results for FY2022 on March 9, 2023

April 7, 2023

Earnings Overview

PLAYAGS ($NYSE:AGS) released the results from their fourth quarter of FY2022, which ended on December 31 2022, on March 9 2023. There was a dramatic jump in revenue, with USD 2.5 million being reported, 127.9% greater than the same quarter of the prior year. Net income also showed positive growth with a 16.4% increase, totaling USD 81.7 million.

Transcripts Simplified

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Playags. More…

| Total Revenues | Net Income | Net Margin |

| 309.44 | -8.04 | 0.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Playags. More…

| Operations | Investing | Financing |

| 77.71 | -72.09 | -62.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Playags. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 684.75 | 635.39 | 1.17 |

Key Ratios Snapshot

Some of the financial key ratios for Playags are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.5% | 9.2% | 9.8% |

| FCF Margin | ROE | ROA |

| 2.7% | 40.5% | 2.8% |

Share Price

On Thursday, March 9, 2023, PLAYAGS reported their fourth quarter results for the fiscal year 2022. Upon the release of these results, PLAYAGS stock opened at $6.6 and closed at $6.4, a decrease of 4.7% from their prior closing price of $6.7. The fourth quarter results were composed of various factors including revenues, expenses, profits, and losses. Analysts had expected the company to report strong fourth quarter performance due to their improved customer base and product portfolio.

However, due to various external factors outside of the company’s control, such as economic instability and market volatility, the results failed to meet expectations. In spite of the disappointing results, the company’s board of directors expressed its confidence in the management team and its plans to improve performance in the coming quarters.

Additionally, they highlighted several positive developments such as new products launches, increased customer acquisition, and market share growth as potential catalysts for long-term growth. Going forward, PLAYAGS is confident that it can deliver better fourth quarter results in FY2023 and continue to build upon its success in the long-term. Investors should closely monitor the company’s progress to assess whether its strategies will bear fruit in the future. Live Quote…

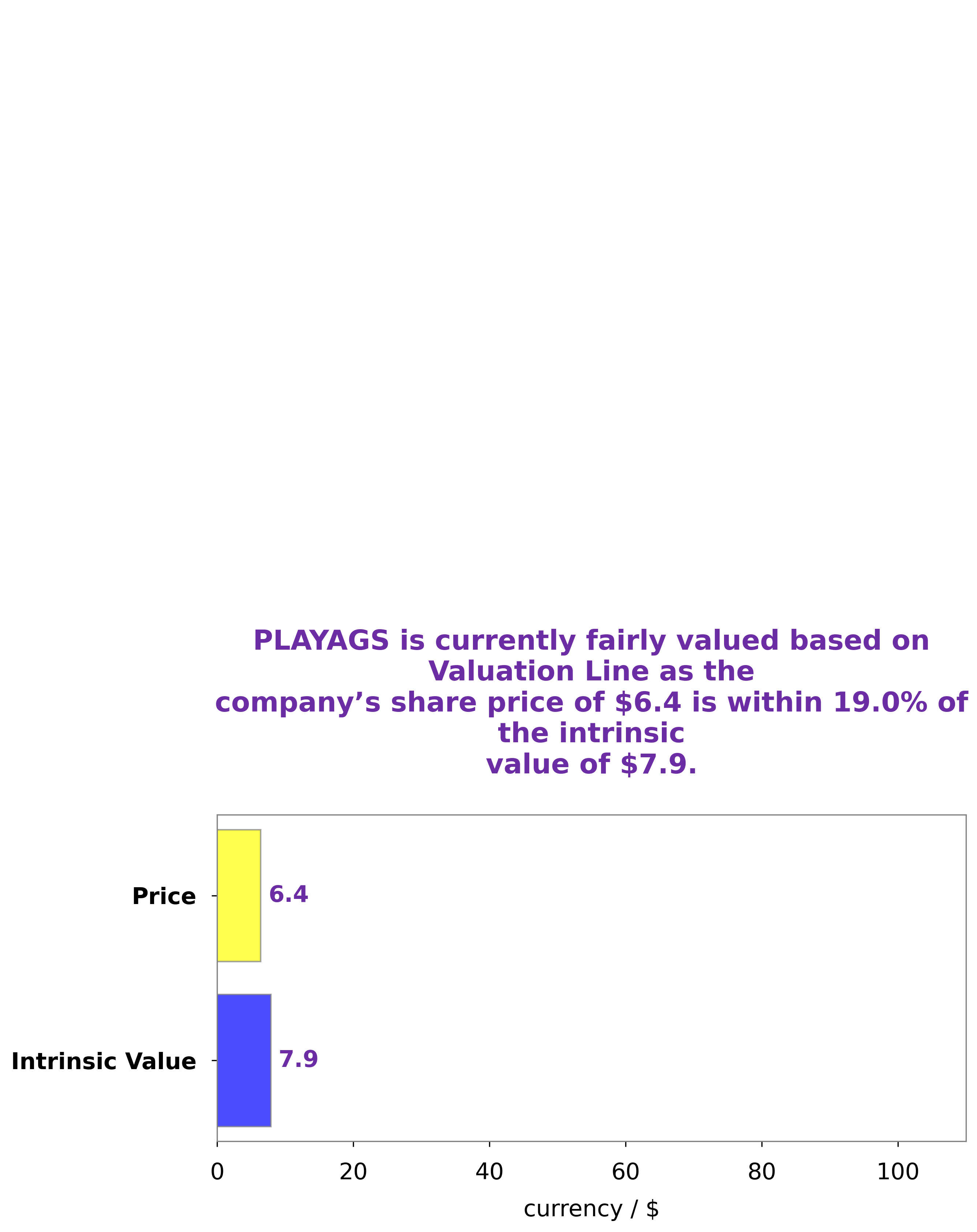

Analysis – Playags Intrinsic Stock Value

At GoodWhale, we conducted an analysis of PLAYAGS‘s financials and concluded that the fair value of PLAYAGS share is around $7.9. This value was determined using our proprietary Valuation Line, which is tailored to each company’s situation. Despite this calculated fair value for PLAYAGS, the stock is currently being traded at $6.4, resulting in PLAYAGS being undervalued by 18.6%. This makes it a great opportunity for investors looking to purchase a quality stock at a fair price. More…

Peers

In the gambling and gaming industry, PlayAGS Inc. faces stiff competition from Inspired Entertainment Inc, Galaxy Gaming Inc, and Scientific Games Corp. These companies are all large and well-established in the industry, with a long history of success. While the competition is fierce, PlayAGS Inc. is confident in its ability to continue to grow and succeed in the market.

– Inspired Entertainment Inc ($NASDAQ:INSE)

Inspired Entertainment is a global gaming technology company that provides virtual sports and iGaming products to regulated markets around the world. The Company’s virtual sports products are delivered through its Virtual Sports product line, which offers a portfolio of over 30 games, including football, horse racing, greyhound racing, motor racing, speedway, cycling, baseball, basketball, cricket, rugby union, rugby league, darts and more. The Company’s iGaming products are delivered through its GamING platform, which offers a portfolio of casino games, including slots, table games, bingo and more. The Company also offers a suite of supporting services, including customer relationship management, customer intelligence, marketing and retention tools, payment processing and more.

– Galaxy Gaming Inc ($OTCPK:GLXZ)

Galaxy Gaming, Inc. develops, manufactures, and distributes casino table games, related equipment, and software products worldwide. The company offers a portfolio of proprietary table games, including side bets, progressives, and multi-hand games. It also provides casino table products, such as bases, chip trays, and casino chairs; and gaming peripheral products that include dice, roulette balls, and shufflers. The company sells its products through a network of sales representatives and distributors. Galaxy Gaming, Inc. was founded in 2000 and is headquartered in Las Vegas, Nevada.

Summary

PLAYAGS reported strong fourth quarter results for FY2022, with total revenue up 127.9% from the previous year. Net income also increased significantly, rising 16.4%. Despite the impressive numbers, investors reacted negatively to the news, as the stock price dropped on the announcement.

Analysts have suggested that this could be due to market expectations being too high for the company, as well as uncertainty over future performance. They are still optimistic about the company’s long-term prospects, however, given its impressive growth in the past year.

Recent Posts