PLAY Intrinsic Value – DAVE & BUSTER’S ENTERTAINMENT Reports Positive Fourth Quarter FY2023 Earnings Results

March 30, 2023

Earnings Overview

On March 28 2023, DAVE & BUSTER’S ENTERTAINMENT ($NASDAQ:PLAY) released its fiscal fourth quarter report for the period ending January 31 2023. The company experienced a 52.6% growth in total revenue from the same period the year before, reaching USD 39.1 million, and a 64.3% increase in net income at USD 563.8 million.

Transcripts Simplified

All participants will be in listen-only mode. Operator Instructions. Please note this event is being recorded. Steve King: Thank you, Operator. I’m Steve King, Chief Executive Officer, and with me today is Brian Jenkins, Chief Financial Officer. We have filed our third quarter earnings release with the SEC and it is available on our website. Before we begin, I’d like to remind you that during this call, we will make forward-looking statements based on current expectations. Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied.

Please refer to our SEC filings for more information on risks that could impact our results. Now I’ll turn it over to Brian and he will provide a review of our third quarter results. Brian Jenkins: Thank you, Steve. Steve King: Thanks Brian. We are very pleased with our third quarter results as well as the performance of our new stores for the quarter. We’re excited about the opportunities ahead of us as we continue to focus on balancing our top line growth initiatives with strategic investments in technology and guest experience initiatives that will further differentiate us in the marketplace and drive long-term shareholder value creation. Now I’ll turn it over to the operator to take your questions at this time.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PLAY. More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | 137.13 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PLAY. More…

| Operations | Investing | Financing |

| 444.47 | -1.05k | 762.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PLAY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.76k | 3.35k | 8.48 |

Key Ratios Snapshot

Some of the financial key ratios for PLAY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.2% | 21.0% | 12.9% |

| FCF Margin | ROE | ROA |

| 10.7% | 41.0% | 4.2% |

Market Price

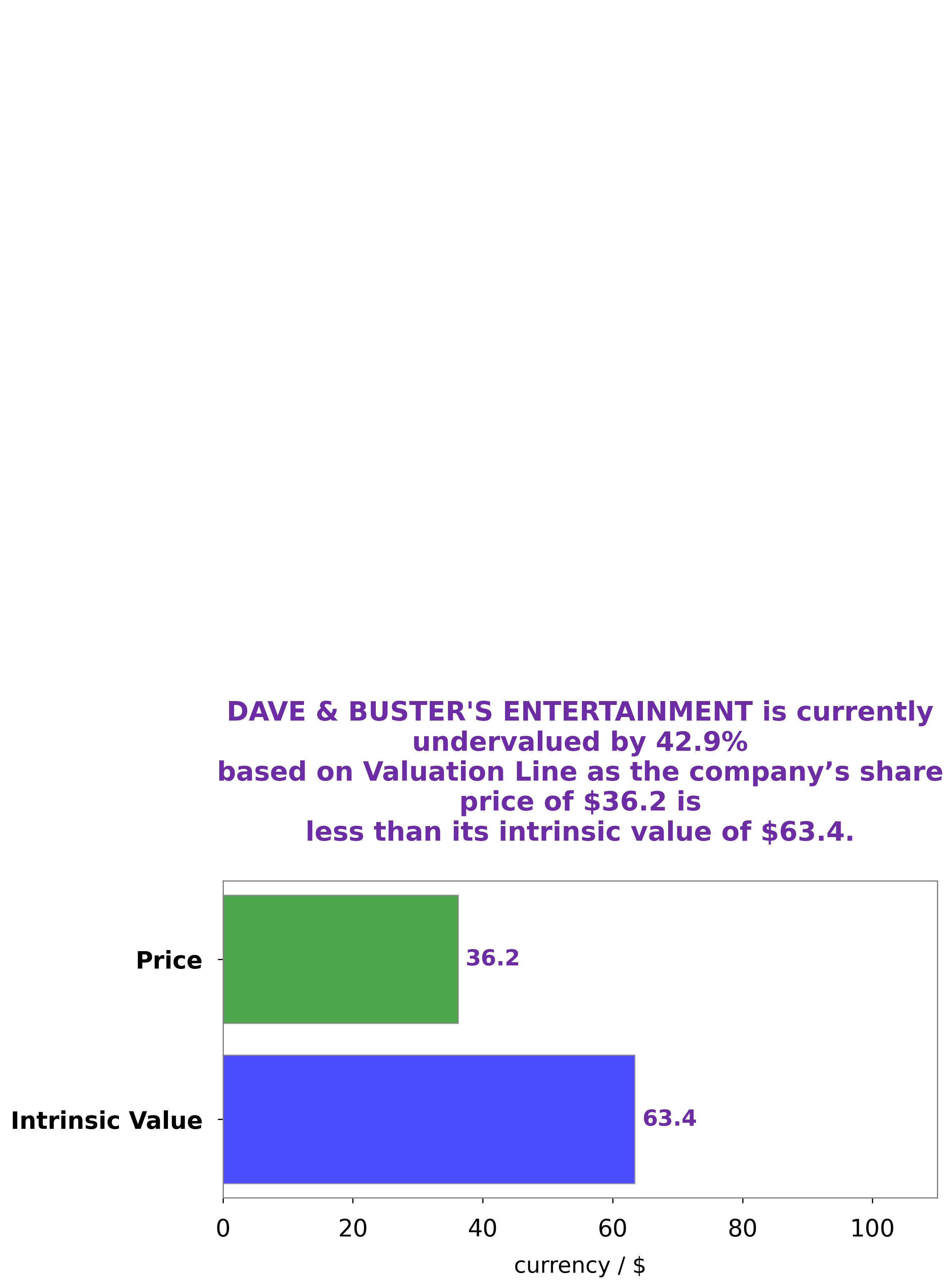

On Tuesday, DAVE & BUSTER’S ENTERTAINMENT reported positive fourth quarter FY2023 earnings results as its stock opened at $35.9 and closed at $36.2, up by 0.4% from previous closing price of 36.1. Additionally, the company noted that customers continued to respond positively to new menu offerings launched during the quarter, resulting in increased customer satisfaction and higher repeat visits. The company plans to continue investing in its digital services and menu offerings in order to capitalize on opportunities to further increase same-store sales and customer satisfaction. Live Quote…

Analysis – PLAY Intrinsic Value

At GoodWhale, we take a deep dive into the fundamentals of DAVE & BUSTER’S ENTERTAINMENT, Inc. We analyze the company’s financial statements, management team, competitive landscape and industry trends to assess its potential. Based on this analysis, we believe that the fair value of DAVE & BUSTER’S ENTERTAINMENT stock is around $63.4, as determined by our proprietary Valuation Line. Currently, DAVE & BUSTER’S ENTERTAINMENT is trading at $36.2, which means that the stock is undervalued by 42.9%. This presents an opportunity for investors looking to add value to their portfolios. More…

Peers

The competition in the entertainment industry is intense. Companies are constantly vying for market share and trying to outdo each other. Dave & Buster’s Entertainment Inc is no different. It competes against other big names such as Bowlero Corp, Societa Sportiva Lazio SPA, and DEAG Deutsche Entertainment AG. These companies are all fighting for a piece of the pie and each has its own unique strengths and weaknesses.

– Bowlero Corp ($NYSE:BOWL)

Bowlero Corporation is the world’s largest operator of bowling centers, with more than 300 locations across the United States. The company was founded in 2013 and is headquartered in New York, New York. Bowlmor AMF is the largest operator of bowling alleys in the world. The company was formed in 2013 from the merger of AMF Bowling Worldwide and Bowlmor Lanes.

– Societa Sportiva Lazio SPA ($LTS:0MS9)

Societa Sportiva Lazio SPA is an Italian professional sports club based in Rome, Lazio. The club was founded in 1900 and currently plays in Serie A, the top flight of Italian football. Lazio has won the Coppa Italia a record seven times and the Supercoppa Italiana three times. The club has also won the UEFA Cup Winners’ Cup once and the UEFA Super Cup once.

As of 2022, Societa Sportiva Lazio SPA has a market capitalization of 68.42 million and a return on equity of -538.84%. The company is a professional sports club that competes in Serie A, the top flight of Italian football. Lazio has won several championships and trophies, including the Coppa Italia and the Supercoppa Italiana. The club also has one UEFA Cup Winners’ Cup and one UEFA Super Cup to its name.

Summary

DAVE & BUSTER’S ENTERTAINMENT reported strong financial results for Q4 FY2023, with total revenue increasing by 52.6% year-over-year to USD 39.1 million, while net income rose 64.3% to USD 563.8 million. These impressive figures demonstrate the company’s success in leveraging its brand offerings and strategic marketing initiatives to drive growth, making it a promising investment opportunity. Investors should closely monitor further developments and keep an eye on upcoming earnings releases for further insight on the company’s financial performance.

Recent Posts