PLAINS ALL AMERICAN PIPELINE Reports Fourth Quarter Earnings Results for FY2022

March 14, 2023

Earnings Overview

On February 8, 2023, PLAINS ALL AMERICAN PIPELINE ($NASDAQ:PAA) released their financial results for the fourth quarter of FY2022 (ending December 31, 2022). Total revenue for the quarter was USD 263.0 million, a decrease of 41.6% from the same quarter of the prior year. Net income for the period remained unchanged at USD 12952.0 million year-over-year.

Transcripts Simplified

Plains All American reported fourth quarter adjusted EBITDA of $659 million, which includes crude oil segment benefits from increased volumes in the Permian and NGL segments benefits from stronger seasonal sales. For the full year, Plains All American reported adjusted EBITDA of $2.51 billion. For 2023, Plains All American expects adjusted EBITDA of $2.45 billion to $2.55 billion with year-over-year growth in their crude oil segment and a reduction in the NGL segment.

They also expect to generate $2.3 billion in cash flow from operations and $1.6 billion of free cash flow. Intended uses of cash flow are expected to include allocating approximately $1 billion to common and preferred distributions and retirement of $1.1 billion of senior notes.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PAA. More…

| Total Revenues | Net Income | Net Margin |

| 57.34k | 831 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PAA. More…

| Operations | Investing | Financing |

| 2.71k | 386 | -1.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PAA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.89k | 14.57k | 14.24 |

Key Ratios Snapshot

Some of the financial key ratios for PAA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | -8.2% | 3.2% |

| FCF Margin | ROE | ROA |

| 4.0% | 11.4% | 4.1% |

Price History

The stock opened at $12.6 and closed at $12.7, representing a 1.0% increase from the prior closing price of $12.6. The company is well-positioned to benefit from increased demand in the petroleum sector and continued investment in pipeline infrastructure. Live Quote…

Analysis

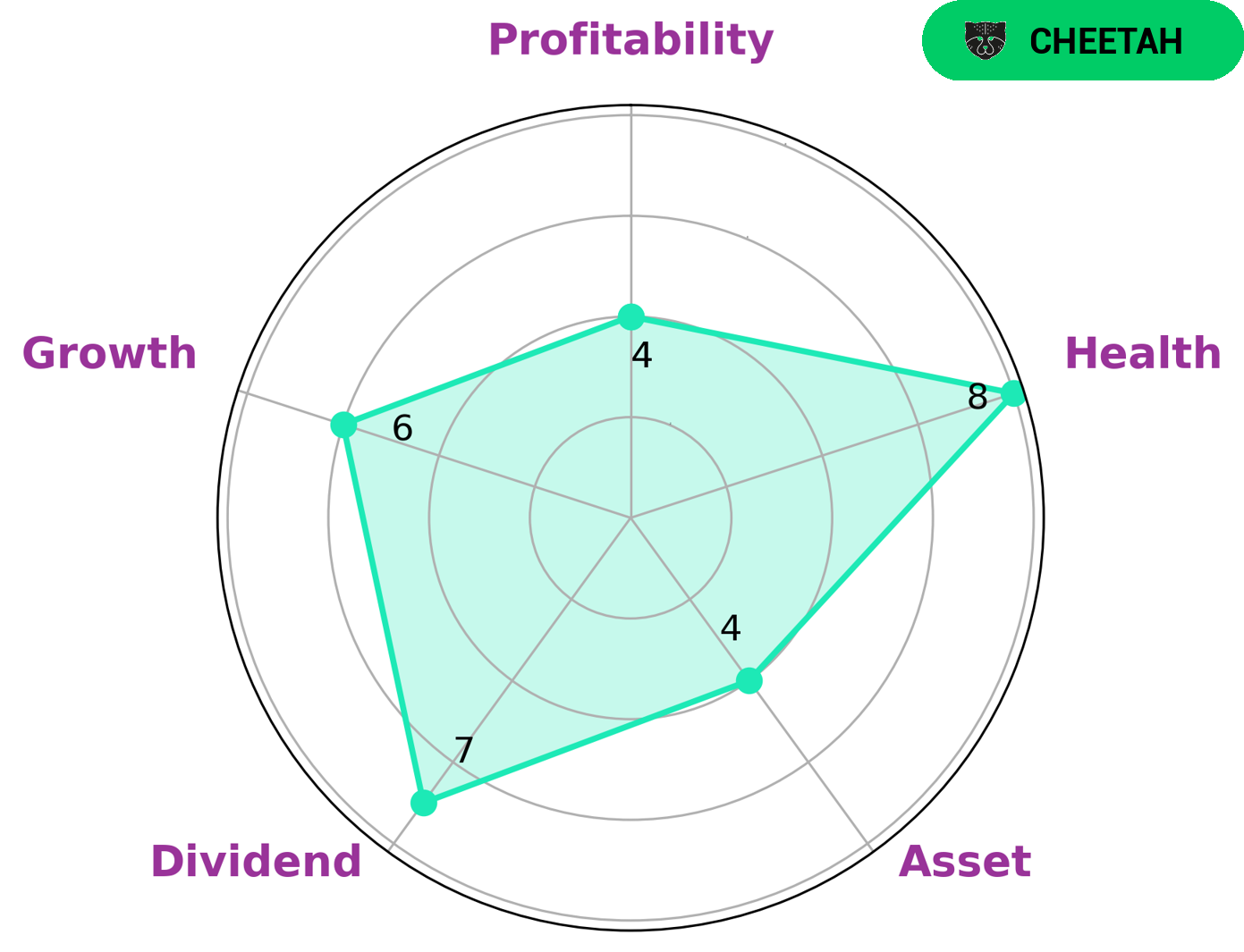

GoodWhale has performed an analysis of PLAINS ALL AMERICAN PIPELINE’s wellbeing, finding that it has a high health score of 8/10 when considering its cashflows and debt. This indicates that PLAINS ALL AMERICAN PIPELINE is capable of paying off debt and funding future operations. Additionally, PLAINS ALL AMERICAN PIPELINE is classified as ‘Cheetah’, which is a company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. For potential investors seeking to invest in PLAINS ALL AMERICAN PIPELINE, it is strong in dividend and moderate in asset, growth and profitability. Additionally, it is important to consider the stability of the company given its lower profitability ratings. Investing in PLAINS ALL AMERICAN PIPELINE may suit investors seeking short-term growth through a high dividend yield and capital appreciation, but may not be suitable for those looking for long-term stability or consistent returns. More…

Peers

Plains All American Pipeline LP, Plains GP Holdings LP, MPLX LP, and Valero Energy Corp are all leading companies in the oil and gas industry. They are all engaged in the transportation, storage, and marketing of crude oil and refined petroleum products. These companies have a significant impact on the global energy market.

– Plains GP Holdings LP ($NASDAQ:PAGP)

Plains GP Holdings LP is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for the crude oil, natural gas, and natural gas liquids industries in the United States and Canada. The company’s market cap is $2.37B as of 2022 and its ROE is 79.65%. The company is headquartered in Houston, Texas.

– MPLX LP ($NYSE:MPLX)

MPLX LP is a publicly traded master limited partnership that owns and operates a diversified portfolio of midstream energy assets. The company’s assets include crude oil and refined products pipelines, storage facilities, and terminals. MPLX LP is headquartered in Findlay, Ohio.

MPLX LP has a market cap of $32.72 billion as of 2022. The company has a return on equity of 20.4%. MPLX LP’s assets include crude oil and refined products pipelines, storage facilities, and terminals. The company is headquartered in Findlay, Ohio.

– Valero Energy Corp ($NYSE:VLO)

Valero Energy Corp is a publicly traded company with a market capitalization of $49.03 billion as of 2022. The company is engaged in the business of refining and marketing petroleum products and related services. Valero Energy Corp has a return on equity of 30.7%.

Summary

PLAINS ALL AMERICAN PIPELINE reported their financial results for the fourth quarter of FY2022, ending December 31, 2022. Total revenue decreased 41.6% year-over-year to USD 263.0 million, while net income stayed the same at USD 12952.0 million. This could suggest a challenging market environment as compared to the previous year and a difficult investment climate. Analysts should pay close attention to the company’s overall performance in the coming quarters to get a better understanding of the financial health of PLAINS ALL AMERICAN PIPELINE and its prospects for future growth.

Recent Posts