OPEN TEXT Reports Strong Earnings for FY2023 Q2 as of December 31 2022

March 26, 2023

Earnings Overview

On February 2 2023, OPEN TEXT ($NASDAQ:OTEX) released its financial results for the second quarter of their fiscal year ending December 31 2022. The company reported total revenue of USD 258.5 million, an increase of 192.7% from the same quarter in the prior year. Net income was USD 897.4 million, representing a 2.4% year-on-year growth.

Transcripts Simplified

OpenText reported a strong quarter of results, with Enterprise Cloud bookings totaling $145 million, up 12% year-over-year. Cloud revenue of $409 million was up 12% as reported and 15% in constant currency, and ARR of $725 million was up 3.6% as reported and 8.7% in constant currency. Operating cash flow for the quarter was $195 million and free cash flow was $163 million or 18% of revenue. Trailing 12-month cloud bookings totaled a record $511 million, up 25%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Open Text. More…

| Total Revenues | Net Income | Net Margin |

| 3.53k | 318.43 | 10.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Open Text. More…

| Operations | Investing | Financing |

| 902.63 | -144.25 | 588.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Open Text. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.22k | 7.1k | 15.23 |

Key Ratios Snapshot

Some of the financial key ratios for Open Text are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 1.7% | 17.3% |

| FCF Margin | ROE | ROA |

| 22.0% | 9.6% | 3.4% |

Stock Price

On Thursday, OPEN TEXT reported its strong earnings for FY2023 Q2 as of December 31 2022. The stock opened at $33.4 and closed at $33.3, up by 0.8% from the previous closing price of 33.0. This is a positive indicator for the company’s financial performance in the upcoming quarters. This was mainly due to a significant increase in sales, fueled by demand for the company’s product offerings.

The strong financial performance was also underpinned by an efficient cost management approach, which helped the company reduce costs and improve efficiency. The strong results from OPEN TEXT demonstrate the company’s commitment to delivering shareholder value through continuous growth and profitability. The management is confident that this trend is likely to continue in the future and will remain committed to delivering value for its shareholders over the long-term. Live Quote…

Analysis

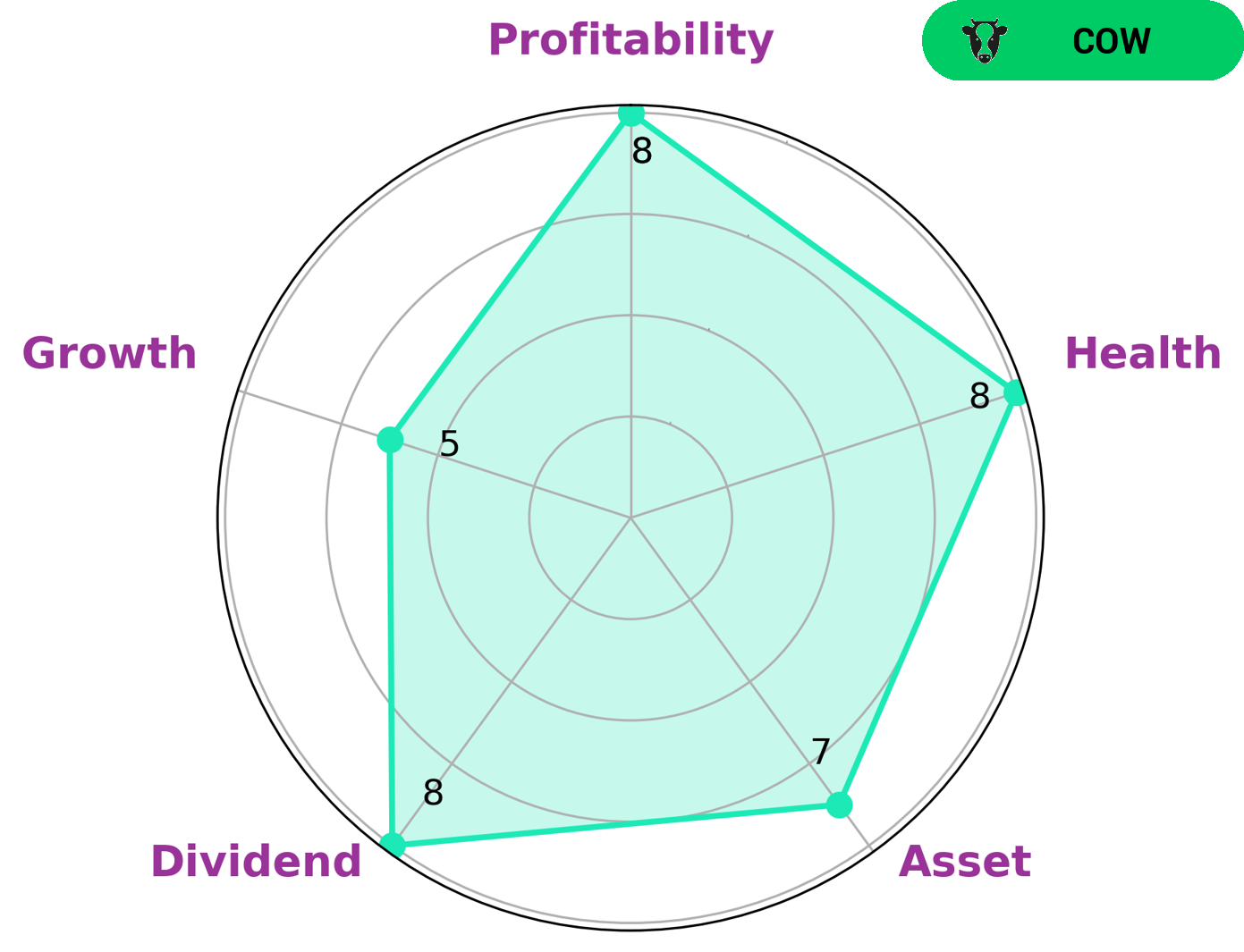

At GoodWhale, we conducted an analysis of OPEN TEXT‘s wellbeing to evaluate its financial health. After researching the company’s cashflows and debts, we came up with an overall health score of 8/10. We found that OPEN TEXT is strong in terms of assets, dividend, and profitability, and medium in terms of growth. Based on our Star Chart, we classified this company as a ‘cow’, a type of company that is able to pay out consistent and sustainable dividends. We believe that OPEN TEXT would be an attractive option for investors looking for steady income and long-term growth potential. More…

Summary

Open Text Corporation reported strong earnings for the second quarter of its fiscal year 2023, with total revenue up 192.7%, reaching USD 258.5 million. Net income also increased 2.4% year-over-year, to USD 897.4 million. This positive financial performance and significant revenue growth demonstrate the company’s strong competitive advantage in the market and provide a positive picture for investors. The company is well-positioned to continue to generate substantial returns as the economy recovers, making it an attractive option for long-term investments.

Recent Posts