OLIN CORPORATION Reports Fourth Quarter FY2022 Earnings Results on January 26 2023

February 13, 2023

Earnings report

OLIN CORPORATION ($NYSE:OLN) announced their earnings results for the fourth quarter of FY2022, ending December 31 2022 on January 26 2023. OLIN CORPORATION is a leading global manufacturer and distributor of specialty chemicals and products for consumer and industrial markets. The company specializes in providing high-quality products for a wide range of applications including construction, automotive, household, and industrial products. The total reported revenue was USD 196.6 million, a decrease of 35.9% compared to the same period the previous year. The net income was also down 18.7% year over year, amounting to USD 1977.0 million. This decrease is mainly attributed to lower sales in the company’s automotive and industrial sectors due to the ongoing pandemic.

Despite the revenue and net income decreases, OLIN CORPORATION showed signs of improvement in other areas. Looking ahead, OLIN CORPORATION remains optimistic that their strategies will help them recover from the impacts of the pandemic and continue to drive growth in the future. They are actively working on cost management initiatives and expanding their presence in new markets to ensure long-term success. With their strong balance sheet, OLIN CORPORATION is well positioned to weather any future economic challenges and capitalize on opportunities as they arise.

Share Price

The stock opened at $57.4 and closed at $58.6, representing a 2.0% increase from its prior closing price of $57.4. This is the first quarter of the fiscal year for OLIN CORPORATION and the company has already seen a positive return. Its products are used in a variety of applications, from consumer product packaging to automotive fuel systems. This is largely attributed to stronger customer demand and improved pricing by the company’s major customers. In addition to its strong financial performance, OLIN CORPORATION has also been successful in introducing new products to the market.

The company has launched several new products in recent months that have been well-received by customers. This has helped to boost sales and increase the company’s market share. Overall, OLIN CORPORATION’s fourth quarter FY2022 earnings report was positive news for investors as the company posted strong financial results and introduced new products to the market. The company is well-positioned to continue its growth trajectory in the coming quarters and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Olin Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 9.38k | 1.33k | 14.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Olin Corporation. More…

| Operations | Investing | Financing |

| 1.92k | -259.7 | -1.65k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Olin Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.04k | 5.5k | 18.62 |

Key Ratios Snapshot

Some of the financial key ratios for Olin Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 92.2% | 19.4% |

| FCF Margin | ROE | ROA |

| 18.0% | 44.7% | 14.1% |

Analysis

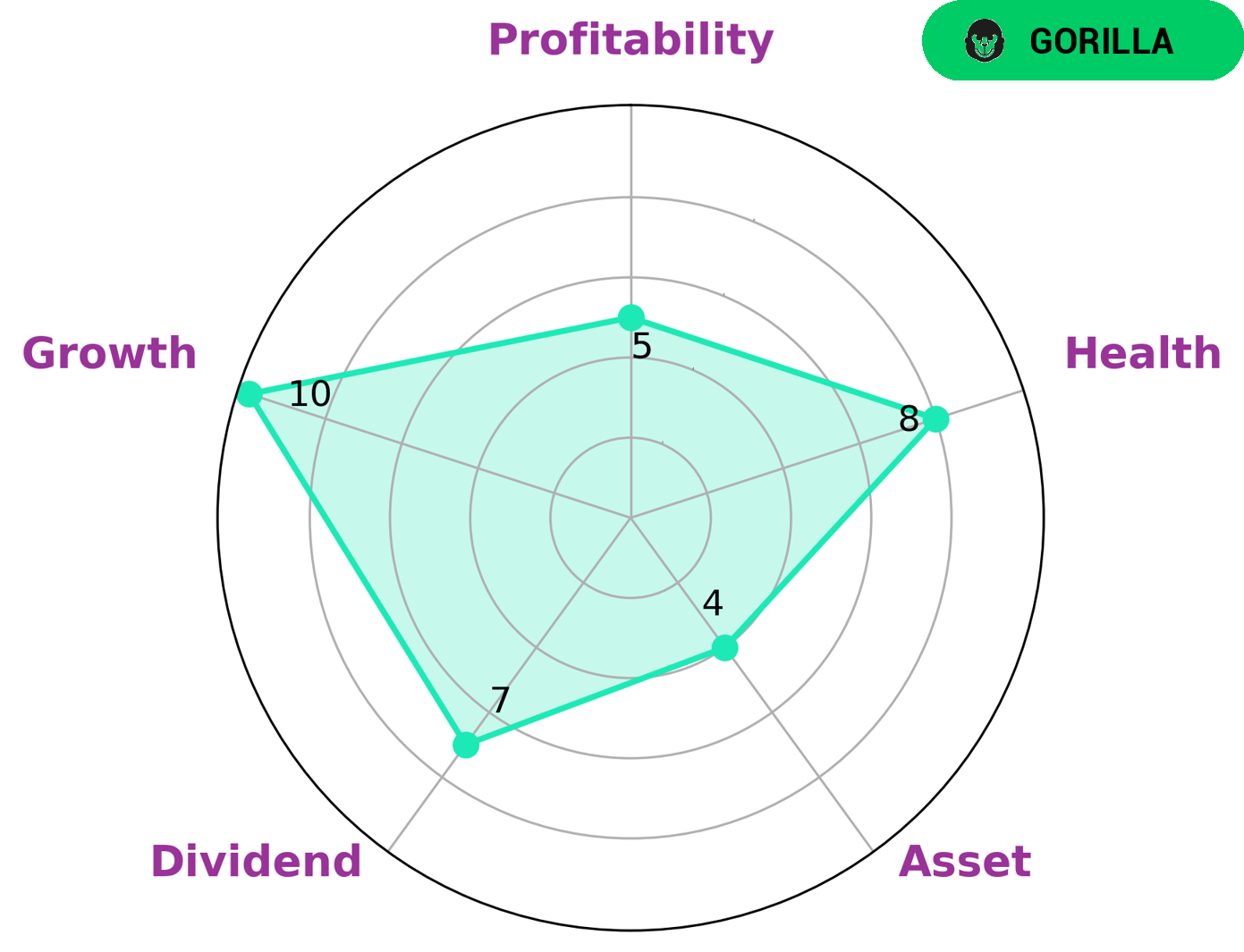

Investors interested in OLIN CORPORATION should be pleased with GoodWhale’s analysis. The Star Chart shows that the company is strong in dividend and growth, and medium in asset and profitability. Additionally, OLIN CORPORATION has a high health score of 8/10 with regard to its cashflows and debt, meaning it is capable to pay off debt and fund future operations. Furthermore, the company is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Thus, long-term investors with a focus on dividend yields and capital appreciation should be interested in this company. Moreover, since OLIN CORPORATION is capable of funding its operations with cash flows generated from its operations, investors looking to invest in stable companies with low risk should consider this company. Furthermore, investors who are looking for companies with strong competitive advantages should also take a closer look at OLIN CORPORATION. Finally, investors looking to invest in technology-driven companies should also consider OLIN CORPORATION, given its stable financials and competitive advantages. More…

Peers

Olin Corp is a leading manufacturer of chlor alkali products, vinyls, and epoxy, with a significant presence in the global market. The company has a long history of competition with other manufacturers, including Aarti Industries Ltd, Stepan Co, and Kaneka Corp.

– Aarti Industries Ltd ($BSE:524208)

Aarti Industries Ltd is an Indian company that manufactures and sells chemicals. It has a market cap of 285.93B as of 2022 and a ROE of 17.74%. The company was founded in 1972 and is based in Mumbai, India.

– Stepan Co ($NYSE:SCL)

Stepan Co. has a market capitalization of $2.11 billion as of March 2022 and a return on equity of 11.75%. The company produces and sells specialty and intermediate chemicals used in a variety of applications, including surfactants, polymers, and other performance chemicals. Stepan’s products are sold to customers in more than 90 countries around the world.

– Kaneka Corp ($TSE:4118)

Kaneka Corporation is a Japanese chemical company with a market capitalization of 245.56 billion as of 2022. The company has a return on equity of 6.58%. Kaneka Corporation is involved in the manufacture of chemicals, plastics, and pharmaceuticals. The company was founded in 1934 and is headquartered in Osaka, Japan.

Summary

In assessing OLIN CORPORATION’s fourth quarter financial results for FY2022, analysts are noting a significant decrease in both total revenue and net income compared to the same period in the previous year. Total revenue for the quarter was USD 196.6 million, a decrease of 35.9%, while net income was down 18.7%, amounting to USD 1977.0 million. Investors may be concerned about the company’s decreased profitability and may wish to further investigate their financials to determine the cause of the decrease. This could include examining the company’s cost structure, competitive landscape, and market trends.

Additionally, investors should consider the company’s future prospects, such as their strategic plans and goals, to determine if they can turn around their decreased profitability. Analysts should also take into account any recent developments in the industry or other external factors that could be impacting OLIN CORPORATION’s results. For example, a pandemic or recession could have caused a decrease in demand for the company’s products or services. Overall, investors should closely monitor OLIN CORPORATION’s financial results and assess their current performance and future prospects before making any decisions about investing in the company.

Recent Posts