OLIN CORPORATION Reports Fourth Quarter Earnings Results for Fiscal Year 2022

February 2, 2023

Earnings report

OLIN CORPORATION ($NYSE:OLN), a publicly traded company specializing in manufacturing and distribution of chemicals and polymers, recently reported its earnings results for the fourth quarter of Fiscal Year 2022 (ending December 31, 2022). On January 26, 2023, the company showed total revenue of USD 196.6 million, representing a decrease of 35.9% from the same period the previous year. Furthermore, the net income for the quarter was USD 1977.0 million, which is an 18.7% decrease compared to the same period the previous year. OLIN CORPORATION offers a variety of products and services to customers in a variety of industries and applications, such as oil & gas, pulp & paper, and water treatment. The company’s fourth quarter performance was adversely affected by the impact of the pandemic on the global economy and its customers’ businesses. The decrease in revenue and net income is a reflection of the challenging economic conditions caused by the pandemic.

However, despite the decrease in revenue and net income, OLIN CORPORATION remains well-positioned for continued growth and profitability in the future. The company has taken steps to reduce costs and improve operational efficiency, which has improved its financial flexibility.

Additionally, OLIN CORPORATION has increased its focus on developing innovative products and services to meet customer needs and capitalize on new opportunities in the market. Overall, OLIN CORPORATION’s fourth quarter earnings results are a reflection of the challenging economic environment caused by the pandemic. Despite the decrease in revenue and net income, the company is well-positioned to capitalize on growth opportunities that may emerge in the future.

Stock Price

The stock opened at $57.4 and closed at $58.6, up by 2.0% from last closing price of 57.4. This was the company’s biggest jump in the last three months. This was largely due to the company’s continued focus on cost-cutting initiatives, which have helped to improve efficiency and lower overhead costs.

Overall, OLIN CORPORATION had a successful fourth quarter of fiscal year 2022, with increases in both revenue and profit margins. The company’s efforts to reduce costs and increase efficiency have paid off, and the stock market reaction has been positive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Olin Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 9.38k | 1.33k | 14.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Olin Corporation. More…

| Operations | Investing | Financing |

| 1.92k | -259.7 | -1.65k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Olin Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.04k | 5.5k | 18.62 |

Key Ratios Snapshot

Some of the financial key ratios for Olin Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 92.2% | 19.4% |

| FCF Margin | ROE | ROA |

| 18.0% | 44.7% | 14.1% |

Analysis

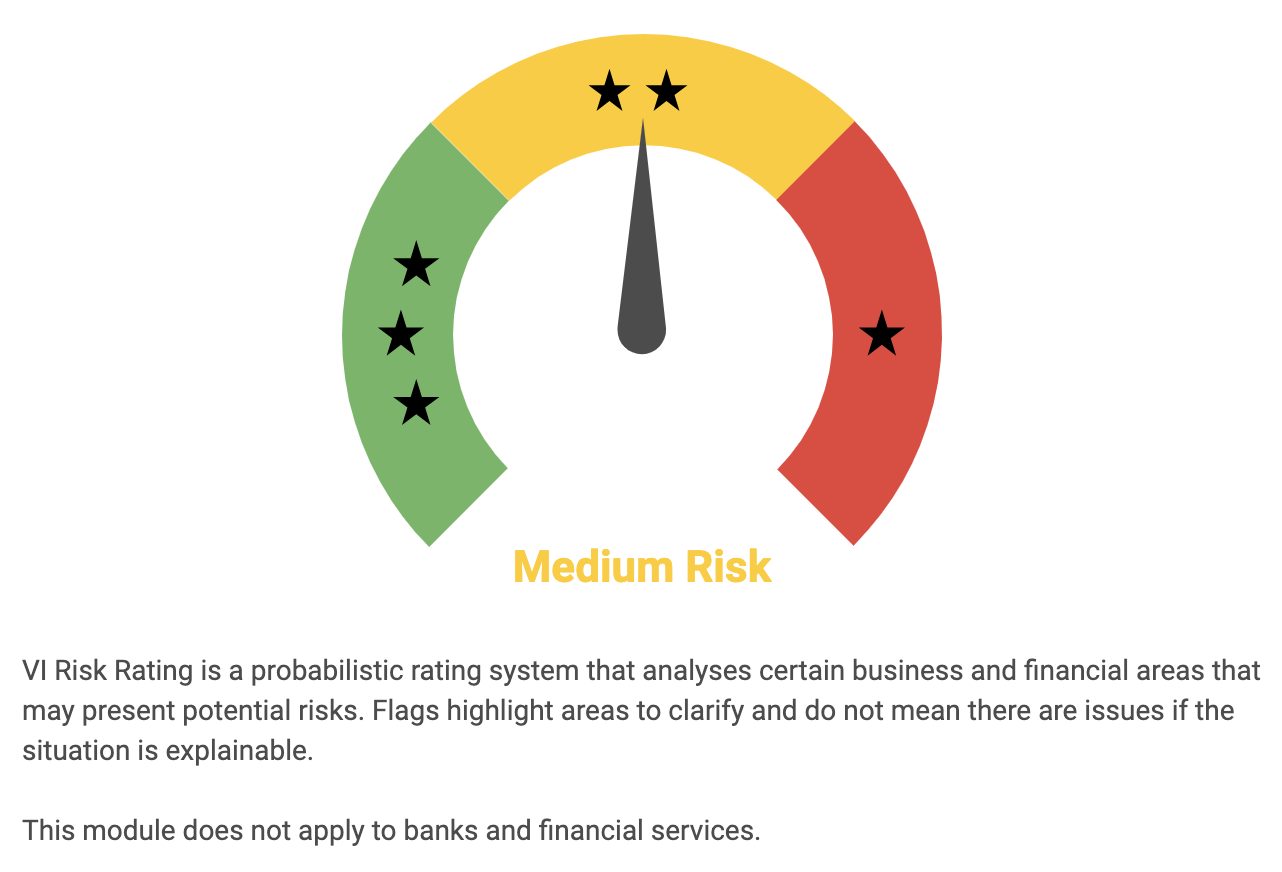

GoodWhale’s analysis of OLIN CORPORATION’s fundamentals reveals it to be a medium risk investment. GoodWhale’s Risk Rating ranks investment risk from low to high, and OLIN CORPORATION falls into the medium risk bracket. This means that there are potentially some risks associated with investing in the company. The GoodWhale system has detected 3 risk warnings in the income sheet, balance sheet, and non-financial aspects of the business. To access these warnings and get a deeper understanding of the risk involved, users need to register with GoodWhale. When investing in a company, it’s important to consider the company’s financial strength and liquidity, as well as its ability to create cash flow. GoodWhale assesses these factors to give investors an idea of the risk involved. Investors should also consider the management team’s ability to manage the company and its strategy, as well as its competitive environment. GoodWhale’s analysis of OLIN CORPORATION’s fundamentals indicates that it is a medium risk investment. It is important for investors to understand the risks associated with an investment before committing funds. By registering with GoodWhale investors can gain access to further information about OLIN CORPORATION’s risk profile and make an informed decision about whether to invest. More…

Peers

Olin Corp is a leading manufacturer of chlor alkali products, vinyls, and epoxy, with a significant presence in the global market. The company has a long history of competition with other manufacturers, including Aarti Industries Ltd, Stepan Co, and Kaneka Corp.

– Aarti Industries Ltd ($BSE:524208)

Aarti Industries Ltd is an Indian company that manufactures and sells chemicals. It has a market cap of 285.93B as of 2022 and a ROE of 17.74%. The company was founded in 1972 and is based in Mumbai, India.

– Stepan Co ($NYSE:SCL)

Stepan Co. has a market capitalization of $2.11 billion as of March 2022 and a return on equity of 11.75%. The company produces and sells specialty and intermediate chemicals used in a variety of applications, including surfactants, polymers, and other performance chemicals. Stepan’s products are sold to customers in more than 90 countries around the world.

– Kaneka Corp ($TSE:4118)

Kaneka Corporation is a Japanese chemical company with a market capitalization of 245.56 billion as of 2022. The company has a return on equity of 6.58%. Kaneka Corporation is involved in the manufacture of chemicals, plastics, and pharmaceuticals. The company was founded in 1934 and is headquartered in Osaka, Japan.

Summary

Investors interested in OLIN CORPORATION should take note of the company’s fourth quarter Fiscal Year 2022 (ending December 31, 2022) financial results reported on January 26, 2023. Total revenue for the quarter was USD 196.6 million, a decrease of 35.9% year-over-year, while net income for the quarter was USD 1977.0 million, a decrease of 18.7% from the same period the previous year. While these results indicate a decline in the company’s financial performance, investors should take into account the broader industry context and any other factors that may have influenced the results.

Investors should also be aware of any strategic changes the company has made in response to changing market conditions, as well as any potential catalysts for improvement in the company’s financial performance. Ultimately, investors will need to conduct their own due diligence and assess whether OLIN CORPORATION is a good fit for their investment portfolio.

Recent Posts