NRP Intrinsic Stock Value – NATURAL RESOURCE PARTNERS L.P Reports FY2022 Fourth Quarter Earnings Results on March 2, 2023.

April 3, 2023

Earnings Overview

NATURAL RESOURCE PARTNERS L.P ($NYSE:NRP) announced their fourth quarter of FY2022 financial results on March 2, 2023. For the period ending December 31, 2022, total revenue grew 13.6% year-over-year to USD 63.2 million. Net income also increased 10.4% to USD 80.9 million compared to the same period in the prior year.

Share Price

The stock opened at $60.0 and closed at $61.0, which was a 7.1% increase from the prior closing price of $57.0. This positive performance was attributed to the company’s strong financial results for the fourth quarter, which exceeded analysts’ estimates for the period. Overall, NATURAL RESOURCE PARTNERS L.P posted solid financial results for the fourth quarter, leading to an increase in the stock price on Thursday. Investors remain optimistic that the company will continue to outperform in the coming quarters and generate returns for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NRP. More…

| Total Revenues | Net Income | Net Margin |

| 328.08 | 233.72 | 84.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NRP. More…

| Operations | Investing | Financing |

| 266.84 | 2.69 | -365.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NRP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 877.13 | 235.09 | 51.34 |

Key Ratios Snapshot

Some of the financial key ratios for NRP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 19.5% | 89.8% |

| FCF Margin | ROE | ROA |

| 81.3% | 30.2% | 21.0% |

Analysis – NRP Intrinsic Stock Value

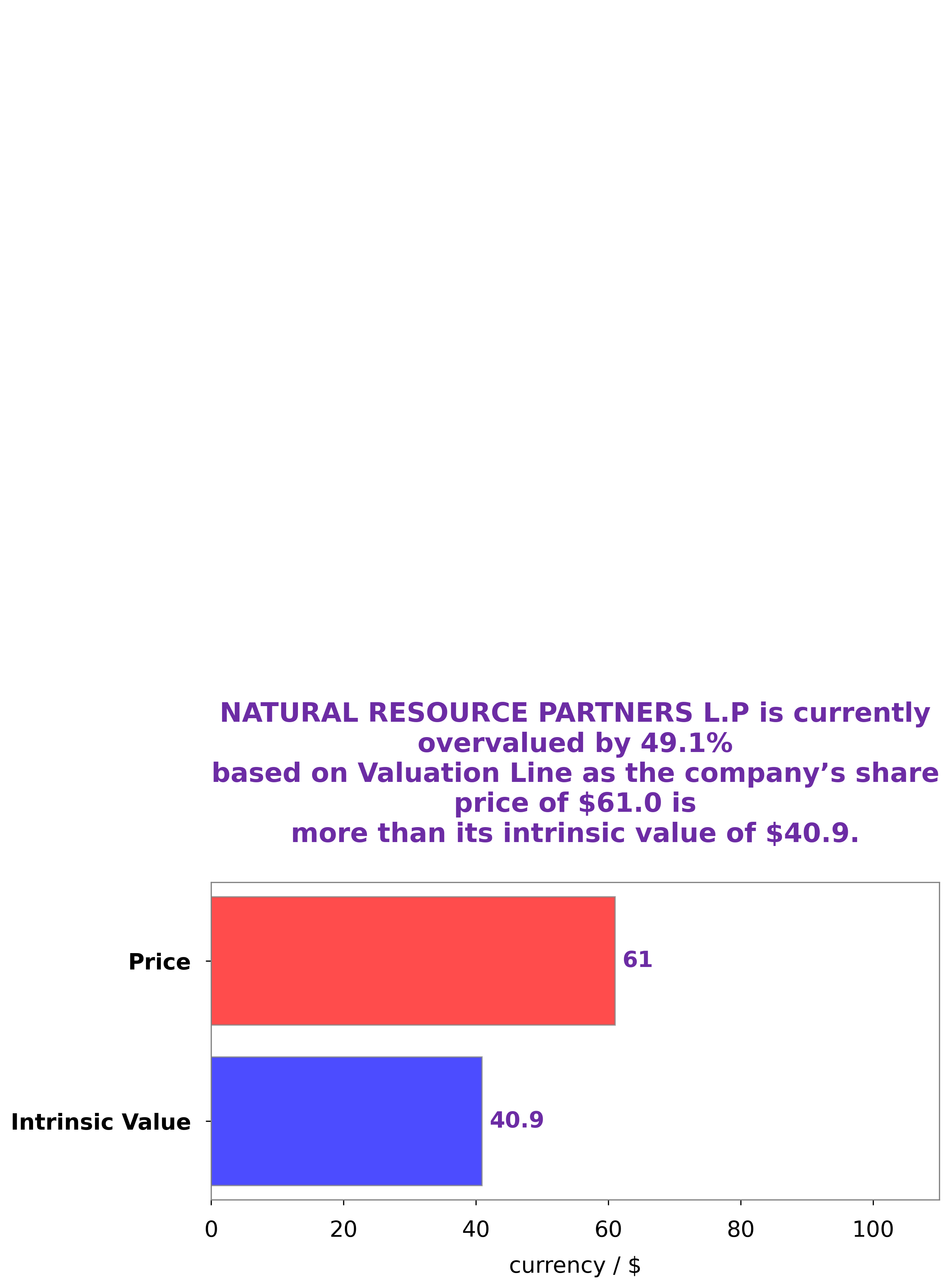

At GoodWhale, we have conducted an analysis of NATURAL RESOURCE PARTNERS L.P’s financials. Our proprietary Valuation Line indicates that the intrinsic value of NATURAL RESOURCE PARTNERS L.P share is around $40.9. However, currently the stock is being traded at $61.0, which is overvalued by 49.1%. This suggests that there is potential downside risk to the stock price. Therefore, investors should do their own research and make an informed decision before investing in NATURAL RESOURCE PARTNERS L.P. More…

Peers

The competition between Natural Resources Partners LP and its competitors, BlackGold Natural Resources Ltd, PT Alfa Energi Investama Tbk, and Sharpe Resources Corp, is intense as they vie to become the leading natural resource partner in the global market. Each company brings its own unique set of strengths and expertise to the table, making the competition challenging and dynamic.

– BlackGold Natural Resources Ltd ($SGX:41H)

BlackGold Natural Resources Ltd is a Canadian energy company focused on developing and producing oil and gas assets in Alberta and Saskatchewan. The company has a current market cap of 6.45M as of 2023 and a Return on Equity of -4.73%. Market capitalization is a measure of the company’s overall size and is calculated by multiplying the current share price by the total number of outstanding shares. The ROE, on the other hand, measures how efficiently the company is using its shareholders’ equity to generate profits. A negative ROE indicates that the company is not generating profits, which may indicate poor management or weak market conditions.

– PT Alfa Energi Investama Tbk ($IDX:FIRE)

PT Alfa Energi Investama Tbk is an Indonesian power company that specializes in the generation, transmission, distribution, and trading of electricity. The company has a market capitalization of 172.18B as of 2023 and a Return on Equity of -18.75%. This indicates that the company’s shareholders are not seeing a return on their investments due to the company’s poor financial performance. Despite this, the company remains a major player in the Indonesian energy industry, with plans to expand its operations in the near future.

– Sharpe Resources Corp ($OTCPK:SHGP)

Sharp Resources Corp is an energy exploration and production company that operates in the US and Canada. The company has a market capitalization of $197.29k as of 2023, which is a reflection of its size and financial stability. It has a Return on Equity (ROE) of 4.55%, which shows that the company is able to efficiently use its investments to generate profits. Overall, Sharp Resources Corp is an attractive investment opportunity for investors looking for long-term growth potential.

Summary

NATURAL RESOURCE PARTNERS L.P has just released its fourth quarter results for FY2022, with total revenue increasing 13.6% year-over-year to USD 63.2 million and net income growing 10.4% to USD 80.9 million. This is a positive sign for investors, as it shows that the company is continuing to generate strong returns from its operations. The stock price responded positively to the news, indicating investor optimism about the company’s prospects going forward. As such, this could be a good time to invest in NATURAL RESOURCE PARTNERS L.P, as the fundamentals are healthy and there is potential for further growth in the future.

Recent Posts