NORTHWEST NATURAL HOLDING Reports Fourth Quarter 2022 Earnings Results for Fiscal Year 2022 Ending February 24, 2023

March 7, 2023

Earnings report

NORTHWEST NATURAL HOLDING ($NYSE:NWN) reported its earnings results for the fourth quarter of the fiscal year 2022, ending February 24, 2023, on December 31, 2022. Total revenue for the quarter was USD 47.9 million, a significant 18.3% increase from the same period the previous year. The company also reported a net income of USD 375.2 million, up 27.6% from the same period the year prior. These results demonstrate the success of NORTHWEST NATURAL HOLDING’s commitment to creating value for their customers and shareholders. The management team credited this growth to increased demand for the company’s products and services, as well as their continued focus on cost control and operational efficiencies. This strategic focus enabled NORTHWEST NATURAL HOLDING to increase its market share and strengthen its competitive position in the industry.

In addition, the company has made extensive investments in technology to ensure that its service offering remains competitive and up-to-date. The earnings results demonstrate that NORTHWEST NATURAL HOLDING is well-positioned for further growth in the future. The company plans to continue building upon its successful strategies, with a focus on developing new products and services to meet customer needs.

Additionally, NORTHWEST NATURAL HOLDING plans to continue investing in technology to ensure that its processes remain competitive and cost-effective. With these plans in place, the company expects to continue delivering strong financial results in the future.

Price History

The stock opened at $47.8 and closed at $47.6, which is a 1.2% decrease from the prior closing price of $48.2. This development in stock prices came after the company’s announcement of their financial data of the quarter. Investors will be closely watching the company’s financial performance in the upcoming quarters to gauge their progress. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NWN. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 86.3 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NWN. More…

| Operations | Investing | Financing |

| 147.67 | -435.46 | 301.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NWN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.75k | 3.57k | 33.09 |

Key Ratios Snapshot

Some of the financial key ratios for NWN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 5.3% | 16.3% |

| FCF Margin | ROE | ROA |

| -18.5% | 9.2% | 2.2% |

Analysis

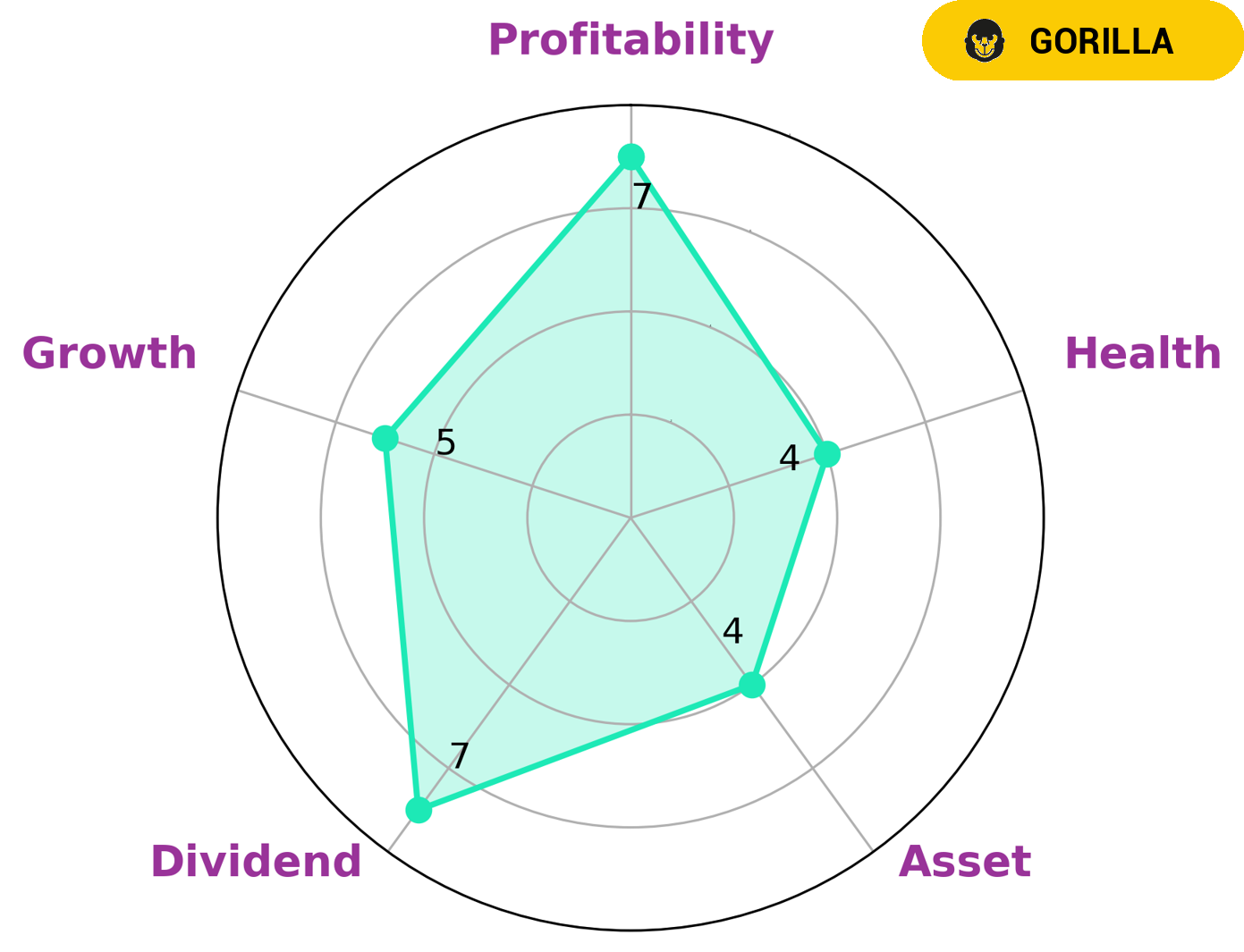

At GoodWhale, we believe in doing thorough research when it comes to looking at the fundamentals of a company. Using our Star Chart, we have identified NORTHWEST NATURAL HOLDING as a ‘gorilla’ – a type of company with strong competitive advantages that have allowed it to achieve a stable and high revenue or earnings growth. This makes the company an attractive option for a range of investors. In terms of its financial health, NORTHWEST NATURAL HOLDING is strong in dividend and profitability, and medium in asset and growth. Furthermore, they have an intermediate health score of 4/10 with regard to its cashflows and debt, giving them the risk of bankruptcy being low. Generally speaking, NORTHWEST NATURAL HOLDING is likely to ride out any crisis without issues. Overall, NORTHWEST NATURAL HOLDING is a great choice for investors who are looking for a reliable stock with strong fundamentals. More…

Peers

Its competitors include RGC Resources Inc, ONE Gas Inc, and Indraprastha Gas Ltd. The company has a strong market position and is well-positioned to continue its growth.

– RGC Resources Inc ($NASDAQ:RGCO)

RGC Resources is a diversified energy services company that provides natural gas and electricity to residential, commercial, and industrial customers in Virginia, North Carolina, and South Carolina. The company also provides energy-related products and services to customers in Virginia and North Carolina. RGC Resources has a market cap of 206.32M as of 2022, a Return on Equity of -13.92%. The company has been in operation for over 100 years and is headquartered in Roanoke, Virginia.

– ONE Gas Inc ($NYSE:OGS)

Natl Gas Co is a holding company, which engages in the distribution of natural gas. It operates through the following segments: Natural Gas and Others. The Natural Gas segment offers natural gas to residential, commercial and industrial customers. The Others segment includes activities of the Company’s subsidiaries in the electricity, water and waste industries. The company was founded on December 28, 1922 and is headquartered in Buenos Aires, Argentina.

– Indraprastha Gas Ltd ($BSE:532514)

Indraprastha Gas Ltd (IGL) is an Indian natural gas distribution company. It is engaged in the business of marketing and distributing natural gas in the National Capital Region of India. IGL also has a city gas distribution network in the cities of Agra and Kanpur. The company has a customer base of over 2.6 million customers.

IGL has a market capitalization of Rs 296.1 billion as of March 31, 2022. The company has a return on equity of 17.79%. IGL is a leading player in the city gas distribution market in India. The company has a strong presence in the National Capital Region of India, with a customer base of over 2.6 million customers.

Summary

Net income also rose 27.6% to USD 375.2 million, signifying increased profitability and financial strength. These results indicate that Northwest Natural Holding Co. may be an attractive investment for those looking for growth potential.

Recent Posts