NEXTERA ENERGY PARTNERS Reports Fourth Quarter Earnings Results for FY2022

February 13, 2023

Earnings report

NEXTERA ENERGY PARTNERS ($NYSE:NEP) is a publicly-traded investment and management company that specializes in energy infrastructure investments. The company focuses on owning and financing energy-related assets with long-term, stable cash flows. On January 25 2023, NEXTERA ENERGY PARTNERS reported its earnings results for the fourth quarter of FY2022, ending December 31 2022. Total revenue was USD 35.0 million, representing a 488.9% increase year over year.

Net income was USD 266.0 million, up 15.2% from the same period the year before. Net income was USD 266.0 million, up 15.2% from the same period the year before. The company expects to continue to benefit from strong demand for its products and services in the coming quarters.

Stock Price

The results came in lower than expected, as the company’s stock opened at $74.2 and closed at $71.7, down by 4.7% from its last closing price of 75.2. NEXTERA ENERGY PARTNERS is an independent, publicly traded company that focuses on clean energy infrastructure and renewable energy projects. The company has strategic investments in wind and solar energy projects across the US and Canada and is a leader in the development of clean energy storage projects in the United States. The company is committed to reducing carbon emissions, investing in clean energy infrastructure, and creating jobs in the renewable energy sector. It has also been investing in innovative technologies like smart grids, electric vehicles, and battery storage systems.

However, the company remains committed to its mission and is confident that it will continue to make progress in delivering a cleaner, more sustainable future for generations to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NEP. More…

| Total Revenues | Net Income | Net Margin |

| 1.21k | 477 | 36.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NEP. More…

| Operations | Investing | Financing |

| 776 | -1.19k | 551 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NEP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.05k | 8.27k | 39.43 |

Key Ratios Snapshot

Some of the financial key ratios for NEP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.3% | -11.6% | 13.3% |

| FCF Margin | ROE | ROA |

| 48.4% | 3.0% | 0.4% |

Analysis

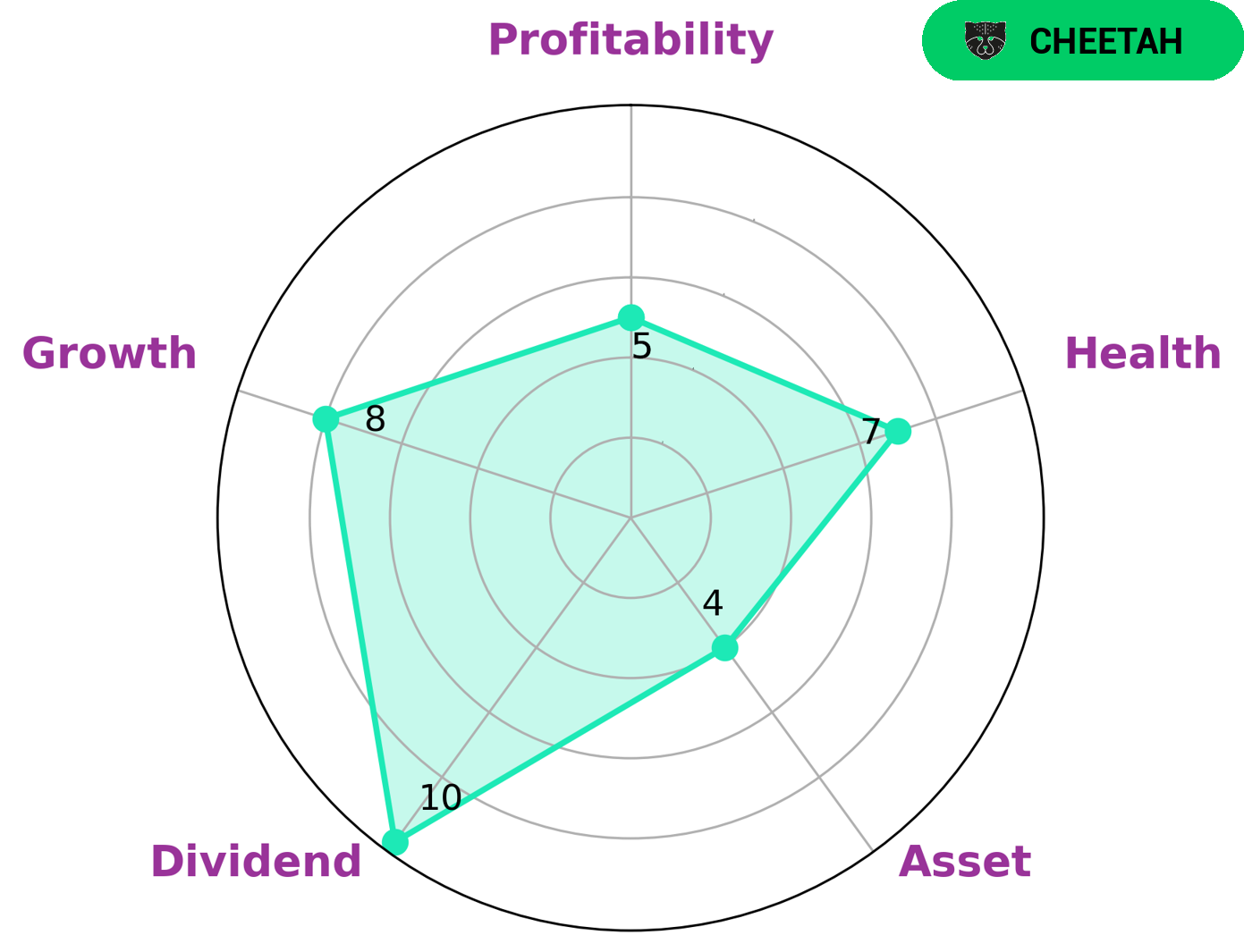

NEXTERA ENERGY PARTNERS is classified as a ‘cheetah’ company based on GoodWhale’s Star Chart analysis. This type of company has achieved high revenue or earnings growth, but is considered to be less stable due to lower profitability. Cheetah companies may be of interest to investors who are looking for potential opportunities for higher returns, but are willing to accept a degree of risk. NEXTERA ENERGY PARTNERS has a strong performance in terms of dividend and growth and a medium performance in terms of assets and profitability. The company has a high health score of 7/10, indicating it has the capacity to sustain operations even in times of crisis. This makes it a good option for investors who are looking for steady returns but are also aware of the risks associated with investing in a cheetah company. Overall, NEXTERA ENERGY PARTNERS is an attractive investment option for those who are willing to take on the risk associated with investing in a cheetah company. The company’s strong dividend, growth, asset and profitability performance, as well as its high health score, make it an attractive option for investors looking for potential opportunities for higher returns. More…

Peers

The company’s main competitors are NextEra Energy Inc, Brookfield Renewable Partners LP, and Clearway Energy Inc.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc. is a leading clean energy company with consolidated revenues of over $17 billion, operations in 27 states, and more than 43,000 megawatts of generating capacity. NextEra Energy’s principal subsidiaries are Florida Power & Light Company, which serves more than 10 million customer accounts in Florida, and NextEra Energy Resources, LLC, which, together with its affiliated entities, is the world’s largest generator of renewable energy from the wind and sun.

– Brookfield Renewable Partners LP ($TSX:BEP.UN)

Brookfield Renewable Partners LP is a renewable energy company with a portfolio of hydroelectric, wind, and solar assets. The company has a market cap of 10.53B and a ROE of 15.58%. Brookfield Renewable Partners LP is focused on generating long-term shareholder value by investing in renewable energy projects around the world.

– Clearway Energy Inc ($NYSE:CWEN.A)

Clearway Energy Inc is a leading provider of clean energy solutions in the United States. The company has a market cap of 3.7 billion as of 2022 and a return on equity of 47.1%. Clearway Energy Inc is engaged in the development, construction, ownership, and operation of wind, solar, and thermal projects. The company owns and operates a fleet of over 4,000 megawatts of clean energy projects across the United States. Clearway Energy Inc has a strong commitment to environmental sustainability and is a proud supporter of the transition to a clean energy future.

Summary

Investors interested in Nextera Energy Partners (NEP) should consider the company’s strong fourth quarter earnings results. Revenue of USD 35.0 million represented a 488.9% increase year over year, and net income of USD 266.0 million was up 15.2%. Despite these impressive results, the stock price declined on the day the earnings were reported, signaling that there may be some hesitation in the market about investing in NEP. Analysts advise taking a closer look at the company’s fundamentals, such as its dividend yield, debt levels, and competitive advantages. A thorough analysis of financials, operations, and management’s strategy should be conducted before deciding to invest in NEP.

Additionally, investors should compare NEP to its peers in order to get an understanding of how it is performing relative to the industry. Overall, NEP has shown strong performance in its fourth quarter earnings, but investors should take a closer look at the company before investing. By researching the company’s fundamentals, comparing it to its peers, and understanding the latest industry news, investors can make an informed decision about whether or not to invest in NEP.

Recent Posts