Neuca Sa Stock Intrinsic Value – NEUCA SA Reports Positive Earnings Results for Q1 of FY2023.

May 23, 2023

Earnings Overview

NEUCA SA ($LTS:0MJR) reported their first quarter of FY2023 earnings results, ending on March 31st 2023. A total revenue of PLN 3001.9 million was achieved – a 6.6% increase from the same quarter the year prior. Unfortunately, their reported net income was PLN 47.3 million, a 20.8% decrease year over year.

Price History

On Tuesday, NEUCA SA reported positive earnings results for the first quarter of FY2023. The stock opened at €263.8 and closed at the same price, indicative of a successful financial quarter. Overall, the first quarter of FY2023 was a success for NEUCA SA.

Despite the global pandemic and economic uncertainty, the company was able to maintain a strong presence in the market and report positive earnings results. With increasing investments in technology and healthcare, NEUCA SA is well-positioned to continue its success in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Neuca Sa. More…

| Total Revenues | Net Income | Net Margin |

| 11.42k | 123.26 | 1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Neuca Sa. More…

| Operations | Investing | Financing |

| 346.34 | -302.77 | -14.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Neuca Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.9k | 3.9k | 202.36 |

Key Ratios Snapshot

Some of the financial key ratios for Neuca Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 4.3% | 2.1% |

| FCF Margin | ROE | ROA |

| 2.3% | 16.6% | 3.1% |

Analysis – Neuca Sa Stock Intrinsic Value

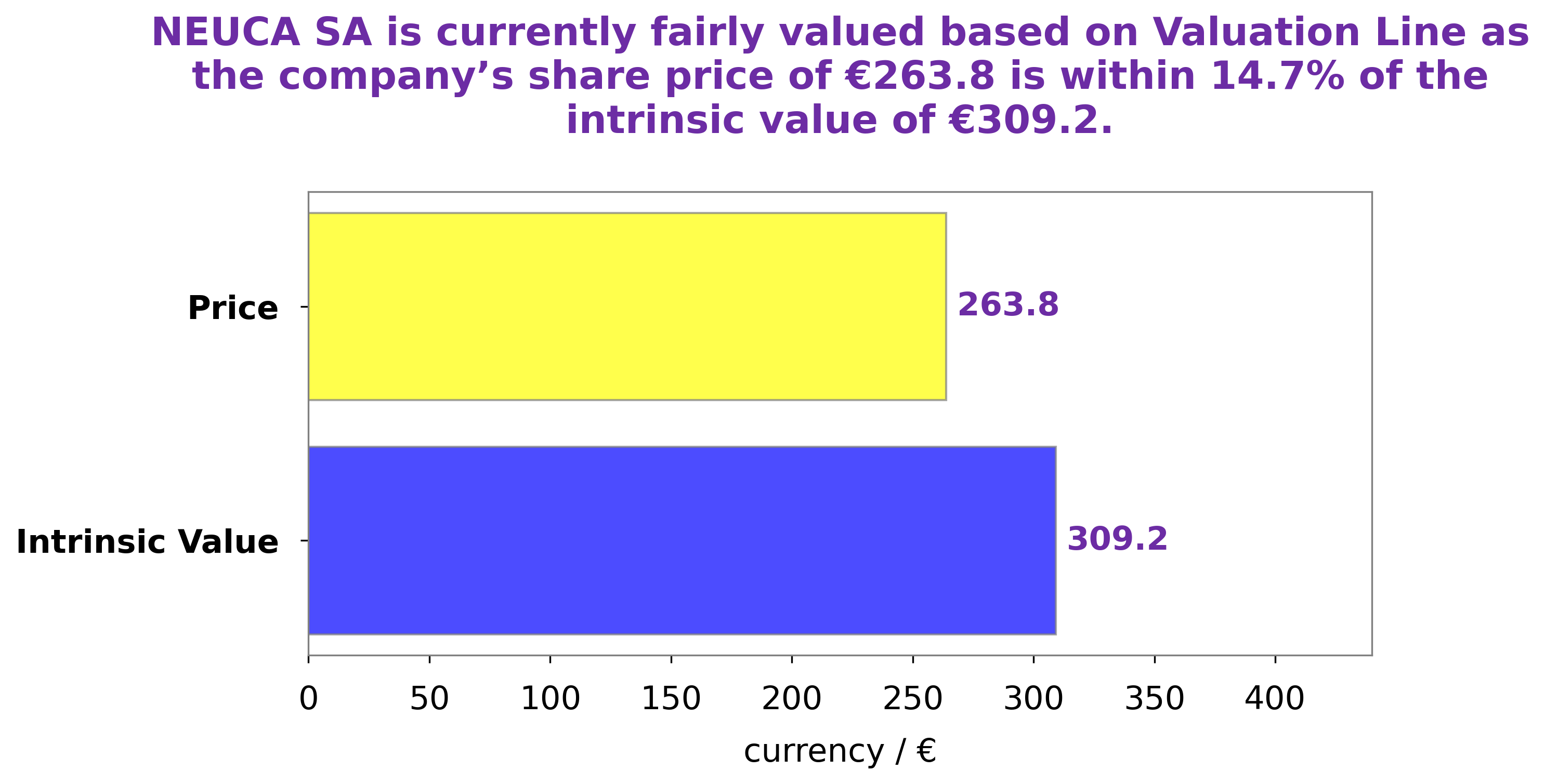

At GoodWhale, we believe in providing you with the best and most accurate analysis on companies and their stocks. Recently, we’ve analyzed NEUCA SA‘s financials and have come up with an intrinsic value of €309.2 for each of their shares. This number represents our proprietary Valuation Line, which looks at the company’s financial performance and future potential. Currently, NEUCA SA stock is being traded at €263.8. This represents a 14.7% undervaluation of the company, making it a fairly priced stock at the moment. Therefore, if you’re looking to invest in NEUCA SA, now might be a good opportunity to do so. More…

Peers

As one of the leading players in the space, Neuca distributes a wide range of drugs, medical devices, and beauty products across the European Union. It faces competition from companies such as Trxade Health Inc., Hai-O Enterprise Bhd, and Progressive Care Inc., who all provide similar services. Despite the competition, Neuca SA remains an industry leader by consistently providing quality service and value for its clients.

– Trxade Health Inc ($NASDAQ:MEDS)

Trxade Health Inc is a leading healthcare technology platform that focuses on providing innovative solutions to streamline the procurement and distribution of prescription medications. With a market cap of 3.01 Million as of 2023, Trxade Health Inc has seen impressive growth in its market value year over year. The company’s Return on Equity (ROE) of -253.17% signifies that it is not generating enough returns from its shareholders’ investments. Despite this, the company has continued to focus its efforts on innovating new technologies and services to improve the pharmacy industry.

– Hai-O Enterprise Bhd ($KLSE:7668)

Hai-O Enterprise Bhd is a diversified business group that manufactures and distributes health and wellness products, trading products, and investments in other businesses. It has a market cap of 336.12M as of 2023. The market capitalization is an indication of the company’s size and value in the stock market. Additionally, the company has a Return on Equity (ROE) of 5.82%, which is an indication of the profitability of the company. This shows that the company is able to effectively manage its resources and generate returns for its investors.

– Progressive Care Inc ($OTCPK:RXMD)

Progressive Care Inc is a healthcare technology and services company specializing in the delivery, management and monetization of pharmaceutical products. It has a market capitalization of $22.83 million as of 2023, making it a small-cap stock. The company has a Return on Equity (ROE) of -34.51%, which indicates that it is not generating sufficient profits to cover its cost of equity. This suggests that the company may not be deploying its capital efficiently and should consider ways to improve its operations and profitability.

Summary

Investors should consider the recent financial results of NEUCA SA for the first quarter of FY2023, with total revenue of PLN 3001.9 million increasing 6.6% year over year. However, net income of PLN 47.3 million declined 20.8% from the same period in the prior year. This suggests that although the company is seeing improved revenue, profitability is not keeping pace. Investors should keep an eye on future earnings reports to understand whether this trend is continuing.

Recent Posts