NETEASE Reports Fourth Quarter Earnings Results for 2022 Fiscal Year

March 7, 2023

Earnings Overview

On February 23 2023, NETEASE ($NASDAQ:NTES) announced their fourth quarter earnings results for the fiscal year concluding December 31 2022. Total revenue for the quarter was CNY 4.0 billion, representing a decrease of 30.6% compared to the same period in the previous year. Nevertheless, net income was CNY 25.4 billion, a 4.0% increase from the prior year.

Transcripts Simplified

In the fourth quarter, NETEASE experienced success with legacy titles such as Fantasy Westward Journey Online and the Westward Journey Online series, as well as their new game Eggy Party, which has grown to 13 million daily active users. They have also seen success with their award-winning adventure game Sky and maintained popularity with their titles Invincible and the mobile version of New Ghost. For 2023, NETEASE is preparing more exciting games for the pipeline.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netease. More…

| Total Revenues | Net Income | Net Margin |

| 96.5k | 20.34k | 19.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netease. More…

| Operations | Investing | Financing |

| 27.71k | -7.37k | -10.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netease. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 172.76k | 63.89k | 148.71 |

Key Ratios Snapshot

Some of the financial key ratios for Netease are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.7% | 12.5% | 20.3% |

| FCF Margin | ROE | ROA |

| 26.0% | 11.7% | 7.1% |

Share Price

The company’s stock opened at $88.0 and closed at $82.9, down by 3.7% from the prior day’s closing price of $86.0. This decline reflected the overall decline in the stock market at the time as well as investor concerns about the company’s outlook. The company’s CEO, Huateng Ma, credited the good results to their focus on user experience, customer satisfaction, and technology innovation. NETEASE has also continued to invest in research and development to create new products and services to keep up with evolving customer needs and trends. Overall, NETEASE seems well-positioned to continue to deliver strong results in the coming quarters.

The company’s focus on technology innovation and user experience will help them continue to gain a competitive edge in the industry and capture more market share. Investors should keep an eye on NETEASE going forward as it is likely to continue to report strong earnings results over the coming quarters. Live Quote…

Analysis

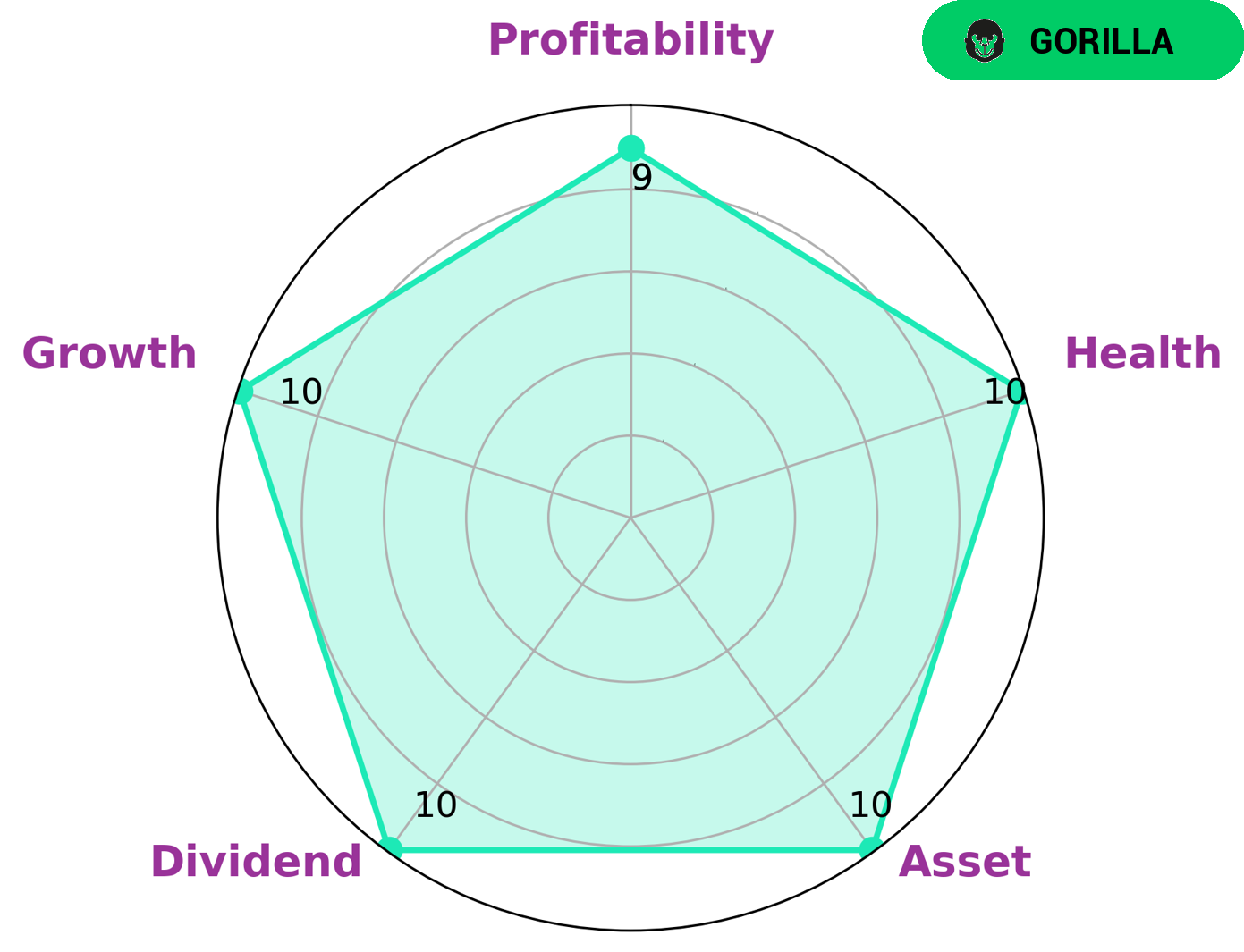

As GoodWhale, we conducted an analysis of NETEASE‘s financials. From the Star Chart, it is clear that NETEASE is classified as a ‘gorilla’, a company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Given NETEASE’s strong performance in terms of assets, dividends, growth, and profitability, investors that prioritize these criteria may be particularly interested in this company. In addition, NETEASE has a high health score of 10/10 with regard to its cashflows and debt, indicating that the firm is capable of paying off debt and funding future operations. This is another attractive trait for investors. More…

Summary

NETEASE reported its fiscal year ending December 31 2022 fourth quarter earnings results on February 23 2023, with total revenue of CNY 4.0 billion and net income of CNY 25.4 billion. This represented a 30.6% decrease in revenue and a 4.0% increase in net income year over year. Despite the growth in net income, the stock price dropped on the news, indicating investors’ concern about the future performance of the company. Investors should carefully assess NETEASE’s financials and management strategies to determine whether buying into the stock at this time is a wise decision.

Recent Posts