NETEASE Reports Fiscal Year 2022 Fourth Quarter Earnings Results for December 31, 2022.

March 5, 2023

Earnings report

NETEASE ($NASDAQ:NTES) recently reported its earnings results for the fourth quarter of Fiscal Year 2022, ending December 31, 2022, on February 23, 2023. To investors’ surprise, total revenue for the quarter slumped by 30.6%, amounting to CNY 4.0 billion in comparison to the same quarter the previous year.

However, net income for the quarter was more positive, increasing by 4.0% year over year to CNY 25.4 billion. This is a stark contrast from the preceding quarters of the year, which had seen gradual increases in total revenue. The decrease was attributed to the lack of new content and slower adoption of the company’s new products. In spite of this decline, NETEASE still saw net income increase by 4.0% year over year. This increase was attributed to several factors, including higher of gross margin and a decrease in operating costs. These quarterly earnings results demonstrate the overall strength and agility of NETEASE as a business, showing that despite hardships and changes in the market, the company can still remain successful and turn a profit. Investors should remain optimistic as the company continues to focus on innovation and growth for Fiscal Year 2023.

Share Price

The company’s stock opened at $88.0 and closed at $82.9, representing a 3.7% decrease from its previous closing price of 86.0. Both the total revenue and net income figures were consistent with expectations. With these reslts, NETEASE is positioned for a successful fiscal year 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netease. More…

| Total Revenues | Net Income | Net Margin |

| 96.5k | 20.34k | 19.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netease. More…

| Operations | Investing | Financing |

| 27.71k | -7.37k | -10.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netease. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 172.76k | 63.89k | 148.71 |

Key Ratios Snapshot

Some of the financial key ratios for Netease are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.7% | 12.5% | 20.3% |

| FCF Margin | ROE | ROA |

| 26.0% | 11.7% | 7.1% |

Analysis

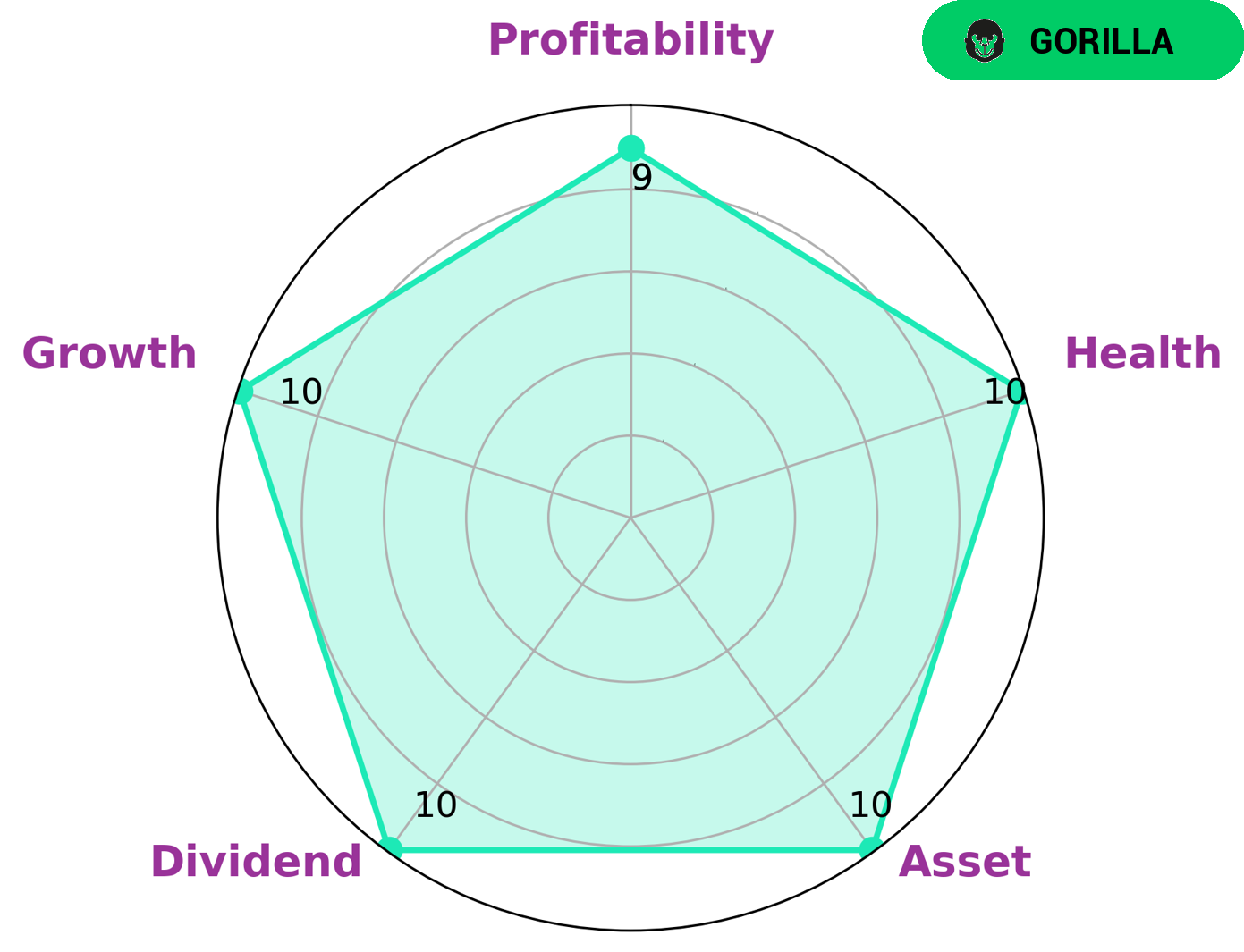

GoodWhale has conducted an in-depth analysis of NETEASE‘s financials. The results from the Star Chart show that NETEASE falls under the classification of ‘gorilla’, a type of company which has achieved impressive and sustained growth in terms of revenue and earnings due to its strong competitive advantage. Investors who are looking for a robust and lucrative investment opportunity would certainly find NETEASE an attractive prospect. The company has earned a high rank in terms of asset, dividend, growth, and profitability. Furthermore, the health score of 10/10 when it comes to its cash flow and debt is an assurance that the company is capable to sustain operations in times of crisis. More…

Summary

Despite the drop in overall revenue, NetEase was able to increase their net income by 4.0%, reaching CNY 25.4 billion. On the back of these results, the company’s stock price moved down on the same day. Overall, investors appear wary of NetEase’s prospects in the near term, given their declining revenues and lack of net income growth.

Recent Posts