NEO Intrinsic Stock Value – Neo Performance Materials to Announce Quarterly Earnings Results on May 12th, 2023

May 10, 2023

Trending News 🌥️

Neo Performance Materials ($TSX:NEO) is a Canadian-based, global specialty chemicals producer that specializes in rare earth magnets, rare earth metals, and other high-performance materials. As the company is set to report its quarterly earnings results on May 12th, 2023, investors are expecting a solid return for their investment. Analysts and investors alike have expressed confidence in Neo Performance Materials’ ability to deliver strong financial performance due to its diversified product line. The company’s rare earth magnets are widely used in a variety of industries, including automotive, aerospace, and medical device sectors. The company also provides rare earth metals to a variety of customers such as electronics and semiconductor manufacturers. With its presence in such a diverse range of industries, Neo Performance Materials is well-positioned to reap the benefits of an expanding global economy. On the other hand, Neo Performance Materials faces several challenges in the current market. The company is expected to face competition from both domestic and international competitors, which could put pressure on its margins.

Additionally, geopolitical tensions between the US and China could cause fluctuations in the demand for rare earth metals and magnets.

Market Price

The stock opened on the Toronto Stock Exchange at a price of CA$8.3 and closed at CA$8.5, a 2.5% increase from the previous closing price of CA$8.3. Investors are now looking forward to how NEO PERFORMANCE MATERIALS will report their next quarter’s earnings results. The company is expected to provide further updates and details on the upcoming earnings announcement in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NEO. More…

| Total Revenues | Net Income | Net Margin |

| 640.3 | 25.95 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NEO. More…

| Operations | Investing | Financing |

| 3.7 | -17.43 | 74.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NEO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 676.46 | 198.82 | 10.61 |

Key Ratios Snapshot

Some of the financial key ratios for NEO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.3% | 15.7% | 6.6% |

| FCF Margin | ROE | ROA |

| -2.2% | 5.5% | 3.9% |

Analysis – NEO Intrinsic Stock Value

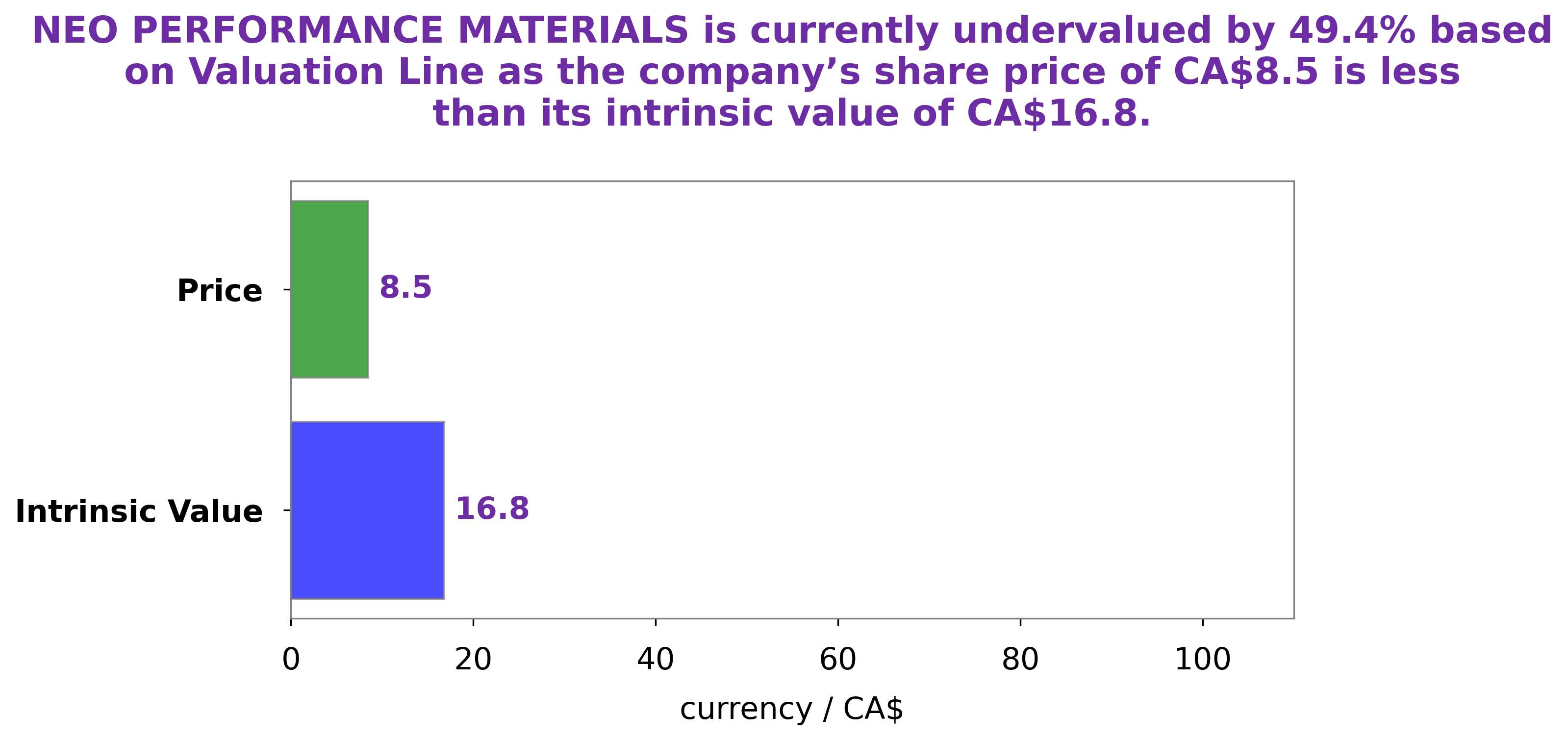

At GoodWhale, we have extensively analyzed the fundamentals of NEO PERFORMANCE MATERIALS. Our proprietary Valuation Line suggests that the intrinsic value of the company’s share is around CA$16.8. However, the current market price of NEO PERFORMANCE MATERIALS stock is CA$8.5, significantly lower than its intrinsic value. This represents a 49.5% undervaluation of the company’s stock, making it an attractive investment opportunity for potential investors. More…

Peers

The company’s products include rare earth metals and alloys, as well as a variety of other materials. Neo Performance Materials Inc’s competitors include 5N Plus Inc, Zeon Corp, and NOF Corp.

– 5N Plus Inc ($TSX:VNP)

Hanesbrands Inc. is a publicly traded clothing company based in Winston-Salem, North Carolina. The company was founded in 1901 and has since grown to become one of the largest clothing manufacturers in the world. Hanesbrands Inc. is best known for its underwear, t-shirts, and socks. The company also manufactures a variety of other clothing items including outerwear, sleepwear, and hosiery. Hanesbrands Inc. has a market cap of 178.43M as of 2022 and a Return on Equity of 1.18%. The company’s products are sold in over 50 countries around the world and it has over 60,000 employees.

– Zeon Corp ($TSE:4205)

Zeon Corporation is a Japanese chemical company that was founded in 1950. The company is headquartered in Tokyo, Japan, and its products include synthetic rubber, plastics, and chemicals. Zeon Corporation has a market cap of 268.61B as of 2022, and a return on equity of 8.53%. The company’s products are used in a variety of industries, including automotive, electronics, and healthcare.

– NOF Corp ($TSE:4403)

As of 2022, NOF Corp has a market cap of 417.73B and a Return on Equity of 12.06%. The company is engaged in the business of providing services to the oil and gas industry.

Summary

Investors are eyeing Neo Performance Materials’ upcoming earnings announcement on May 12th, 2023. Analysts predict that the company’s financial results will have a significant impact on its share price. Investors are advised to keep an eye on the quarterly report to assess the current performance and future prospects of the company. Profit outlook, balance sheet, and cash flow statements should be closely monitored to gauge the direction of the stock.

In addition, investors should also take into consideration any news or developments related to the company that could affect its share price.

Recent Posts