N-ABLE Reports Positive Financial Results for Fourth Quarter of Fiscal Year 2022-2023

March 4, 2023

Earnings report

N-ABLE ($NYSE:NABL) achieved positive financial results for the fourth quarter of fiscal year 2022, ending February 23, 2023. On December 31, 2022, they reported total revenue of $7.0 million, a 238.8% increase compared to the same period the previous year.

Additionally, their net income was reported as $95.8 million, a 7.0% increase from the prior year. This is an impressive achievement for N-ABLE, with their financial results showing their progress over the last year. Their continuous growth gives them a strong foothold in the market and provides them with a strong foundation for an even more successful future. It is clear that through their hard work and dedication, N-ABLE is on track for long-term success.

Market Price

This was a welcome sign of improvement following a challenging period. Analysts have noted that the stock has been able to hold its ground despite volatile market conditions. Investors are hopeful that N-ABLE’s strong performance will continue into the next quarter and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for N-able. More…

| Total Revenues | Net Income | Net Margin |

| 371.77 | 16.71 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for N-able. More…

| Operations | Investing | Financing |

| 71.41 | -30.21 | -10.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for N-able. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 436.79 | 3.55 |

Key Ratios Snapshot

Some of the financial key ratios for N-able are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | 9.0% | 13.3% |

| FCF Margin | ROE | ROA |

| 13.6% | 5.0% | 2.9% |

Analysis

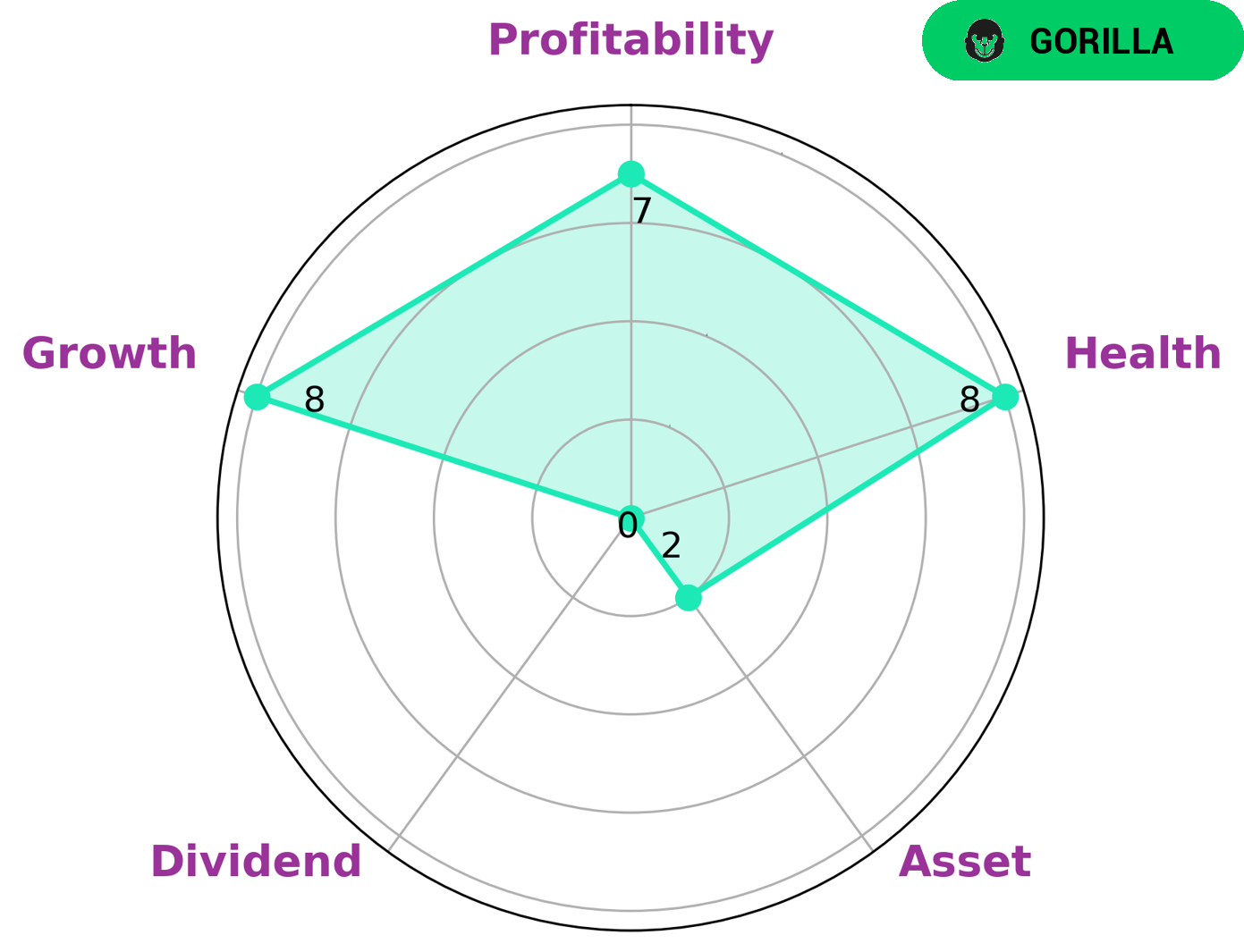

GoodWhale has conducted an analysis of N-ABLE‘s finances and found that they are classified as a ‘gorilla’ company according to Star Chart. This suggests that they have achieved stable and high revenue or earning growth due to their strong competitive advantage. When considering what type of investors may be interested in such a company, it is important to look at their growth, profitability, and asset and dividend strengths. N-ABLE has a high health score of 8/10 with regard to its cashflows and debt, which demonstrates its capability in paying off debt and funding future operations. This puts the company in a good position to attract high-value investors, such as venture capitalists or private equity firms that are looking for companies that have the potential for high returns. Additionally, N-ABLE’s strong competitive advantage means that it can provide a safe investment for any investor looking for steady long-term returns. More…

Peers

In the market for customer relations management (CRM) software, N-able Inc faces stiff competition from Coveo Solutions Inc, BigBear.ai Holdings Inc, and Pushpay Holdings Ltd. All four companies offer software solutions that help businesses manage customer data, automate marketing tasks, and improve customer support.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc is a software company that specializes in search and analytics. The company has a market cap of 561.87M as of 2022 and a return on equity of 59.41%. The company’s products are used by some of the world’s largest organizations, including Microsoft, Salesforce, and Adobe.

– BigBear.ai Holdings Inc ($NYSE:BBAI)

BigBear.ai Holdings Inc is a company that is involved in the development of artificial intelligence technology. The company has a market capitalization of 140.15 million as of 2022. The company’s return on equity is -405.49%.

– Pushpay Holdings Ltd ($NZSE:PPH)

With a market cap of $1.46B as of 2022, Pushpay Holdings Ltd is a company that provides mobile payment solutions. Its Return on Equity (ROE) is 18.56%.

Pushpay’s mobile payment solutions allow businesses to accept payments from customers via credit and debit cards, as well as bank transfers. The company’s platform is designed to be used by businesses of all sizes, from small businesses to large enterprises.

Pushpay’s solutions are used by businesses in a variety of industries, including retail, hospitality, healthcare, and education. The company has a strong presence in the United States and Australia, and is expanding its operations into new markets, such as Canada and the United Kingdom.

Summary

N-ABLE has seen a significant increase in their financials in the past year, reported at $7.0 million in total revenue, a 238.8% increase, with a net income of $95.8 million, a 7.0% increase from the prior year. These positive results have been reflected in their stock price, which moved up the same day. Investors should take note of N-ABLE’s consistent improvements and consider taking advantage of any potential opportunities.

Recent Posts