MUELLER INDUSTRIES Reports Q4 Earnings Results for Fiscal Year 2022

February 20, 2023

Earnings report

MUELLER INDUSTRIES ($NYSE:MLI) recently reported their earnings results from the fourth quarter of their fiscal year 2022, as of December 31 2022. The company reported a year-over-year increase in total revenue of 10.6%, amounting to USD 138.9 million. Unfortunately, this was not paired with increased net income for the quarter, which decreased by 8.2% to an amount of USD 877.6 million. These results were reported on February 7 2023. The company’s fourth quarter performance was less successful than previous quarters in the fiscal year, and the company has been focused on finding new ways to increase revenue and improve profits moving forward. They are also looking at ways to reduce costs associated with running the business in order to minimize the impact of decreased net income on their overall growth.

They have a wide range of industries in which they operate, including plumbing, HVAC, and industrial products. Despite their fourth quarter earnings, they remain committed to providing quality products and services that benefit their customers across the globe. Despite the decrease in net income for MUELLER INDUSTRIES in Q4 of fiscal year 2022, the company is still in a healthy position, with their total revenue increasing significantly from the previous fiscal year. It remains to be seen how the company will adjust their strategy to improve profits moving forward, but with their long-standing presence and commitment to providing top quality products and services, there is no doubt that they will be able to propel themselves forward into a successful future.

Share Price

MUELLER INDUSTRIES reported their earnings results for the fourth quarter of fiscal year 2022 on Tuesday, with stock opening at $70.3 and closing at $75.7, rising by 9.4% from the prior closing price of $69.2. This increase in share price reflects a positive outlook on the company’s financial results for the quarter. Overall, investors were pleased with MUELLER INDUSTRIES’ Q4 earnings results, with the stock rallying on the news. Moving forward, the company will focus on driving growth in its core business segments and continuing to optimize its operations in order to drive improved financial performance in future quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mueller Industries. More…

| Total Revenues | Net Income | Net Margin |

| 3.98k | 658.32 | 16.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mueller Industries. More…

| Operations | Investing | Financing |

| 723.94 | -242 | -102.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mueller Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.24k | 428.44 | 28.58 |

Key Ratios Snapshot

Some of the financial key ratios for Mueller Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 66.4% | 22.0% |

| FCF Margin | ROE | ROA |

| 17.2% | 32.1% | 24.4% |

Analysis

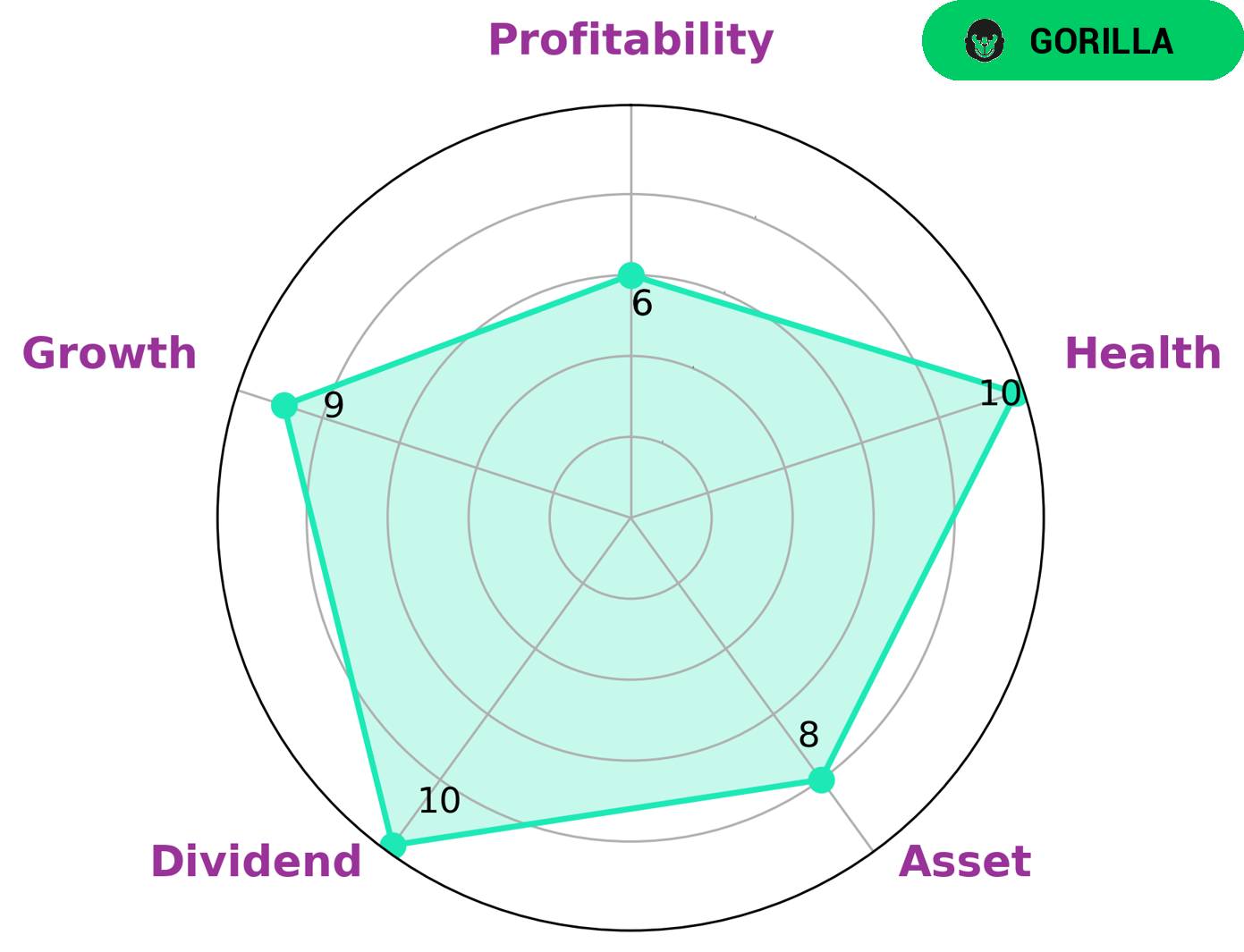

After performing an analysis of Mueller Industries‘ wellbeing, GoodWhale was able to classify it as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Looking at the Star Chart, Mueller Industries has strong assets, dividend, and growth, as well as medium profitability. Additionally, it has a high health score of 10/10 with regard to its cashflows and debt, proving that it is capable of sustaining future operations in times of crisis. Given these traits, Mueller Industries is attractive to many types of investors. It may be attractive to value investors, who are looking for strong assets and dividends. Growth investors may also be interested in the company due to its potential for future growth and income. Finally, institutional investors may be interested in its health score, which could provide them with a sense of security in times of market downturns. More…

Peers

Its competitors include Franklin Electric Co Inc, Furukawa Electric Co Ltd, PT Tembaga Mulia Semanan Tbk.

– Franklin Electric Co Inc ($NASDAQ:FELE)

Franklin Electric Co Inc is a manufacturer of submersible motors, pumps, and related parts and equipment. The company has a market capitalization of $3.95 billion as of 2022 and a return on equity of 18.79%. The company’s products are used in a variety of applications including residential, agricultural, commercial, and industrial water pumping.

– Furukawa Electric Co Ltd ($TSE:5801)

Furukawa Electric Co., Ltd. engages in the manufacture and sale of electric and electronic materials, products, and systems. It operates through the following segments: Electronic Devices, Optics, and Communication; Materials; Automotive; and Energy. The Electronic Devices, Optics, and Communication segment offers copper clad laminates, printed wiring boards, lead frames, optical fibers, optical fiber cables, and optical connectors. The Materials segment provides aluminum wire rods, aluminum alloys, aluminum foils, rare metals, and chemical products. The Automotive segment supplies automotive parts such as electric wires and cables, connectors, and battery terminals. The Energy segment offers power cables and power distribution equipment. The company was founded by Masaru Furukawa on June 8, 1949 and is headquartered in Tokyo, Japan.

– PT Tembaga Mulia Semanan Tbk ($IDX:TBMS)

PT Tembaga Mulia Semanan Tbk is one of the largest mining companies in Indonesia with a market cap of 593.25B as of 2022. The company is engaged in the exploration, mining, and smelting of copper and gold.

Summary

Mueller Industries, Inc. reported a net income of 877.6 million US dollars on February 7th, 2023, representing a decrease of 8.2% year-over-year. Despite the lower earnings, the company’s stock price saw an uptick on the same day. Investors may be encouraged by the positive reaction to earnings, however any further investment decisions should be made with careful consideration of the overall financial performance.

Recent Posts