MSC Industrial Direct Reports Record Quarter Revenues and Earnings for Q1 of FY2023

January 18, 2023

Earnings report

MSC Industrial Direct Co., Inc., a leading distributor of industrial supplies and related products, recently reported record quarterly revenues and earnings for the first quarter of fiscal year 2023, ending on November 30, 2022. The total revenue for the first quarter was USD 81.3 million, a year-over-year increase of 23.1%. The reported net income was USD 957.7 million, a year-over-year increase of 12.9%. These results were announced on January 5, 2023. MSC INDUSTRIAL DIRECT ($NYSE:MSM) serves a wide range of customers in the manufacturing, construction, and government sectors. The company has a strong presence in the United States, Canada, and the United Kingdom. The record results for the first quarter of FY2023 reflect the company’s focus on providing customers with high-quality products and services at competitive prices.

Additionally, the company’s strategic investments in e-commerce have enabled them to better serve customers and expand their reach. These investments have also enabled the company to benefit from increased demand in the industrial supplies sector due to the ongoing pandemic. With a diversified portfolio of products, services, and solutions, the company is well-positioned to capitalize on growth opportunities in the industrial supplies sector going forward. With a sound financial position, the company is expected to continue to deliver strong results in the coming quarters.

Stock Price

MSC Industrial Direct Co., Inc. recently reported its quarterly financial results for the first quarter of fiscal year 2023. This marks the company’s sixth consecutive quarter of record revenue and earnings.

However, despite the positive financial results, MSC Industrial Direct stock opened on Thursday at $81.2, but closed at $77.0, a drop of 5.5% from its last closing price of 81.5. This drop can be attributed to the volatile market conditions and the uncertainty surrounding global economic growth. Investors may have been expecting even better results from the company and were disappointed when the actual numbers came in slightly lower than expected. The company demonstrated its ability to adapt and grow in spite of headwinds, and this is likely to bode well for its future prospects. With continued focus on innovation and cost-saving measures, MSC Industrial Direct is well-positioned for future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MSM. More…

| Total Revenues | Net Income | Net Margin |

| 3.8k | 355.03 | 9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MSM. More…

| Operations | Investing | Financing |

| 264.4 | -104.82 | -196.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MSM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.75k | 1.35k | 24.77 |

Key Ratios Snapshot

Some of the financial key ratios for MSM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | 8.6% | 13.0% |

| FCF Margin | ROE | ROA |

| 5.1% | 22.5% | 11.2% |

VI Analysis

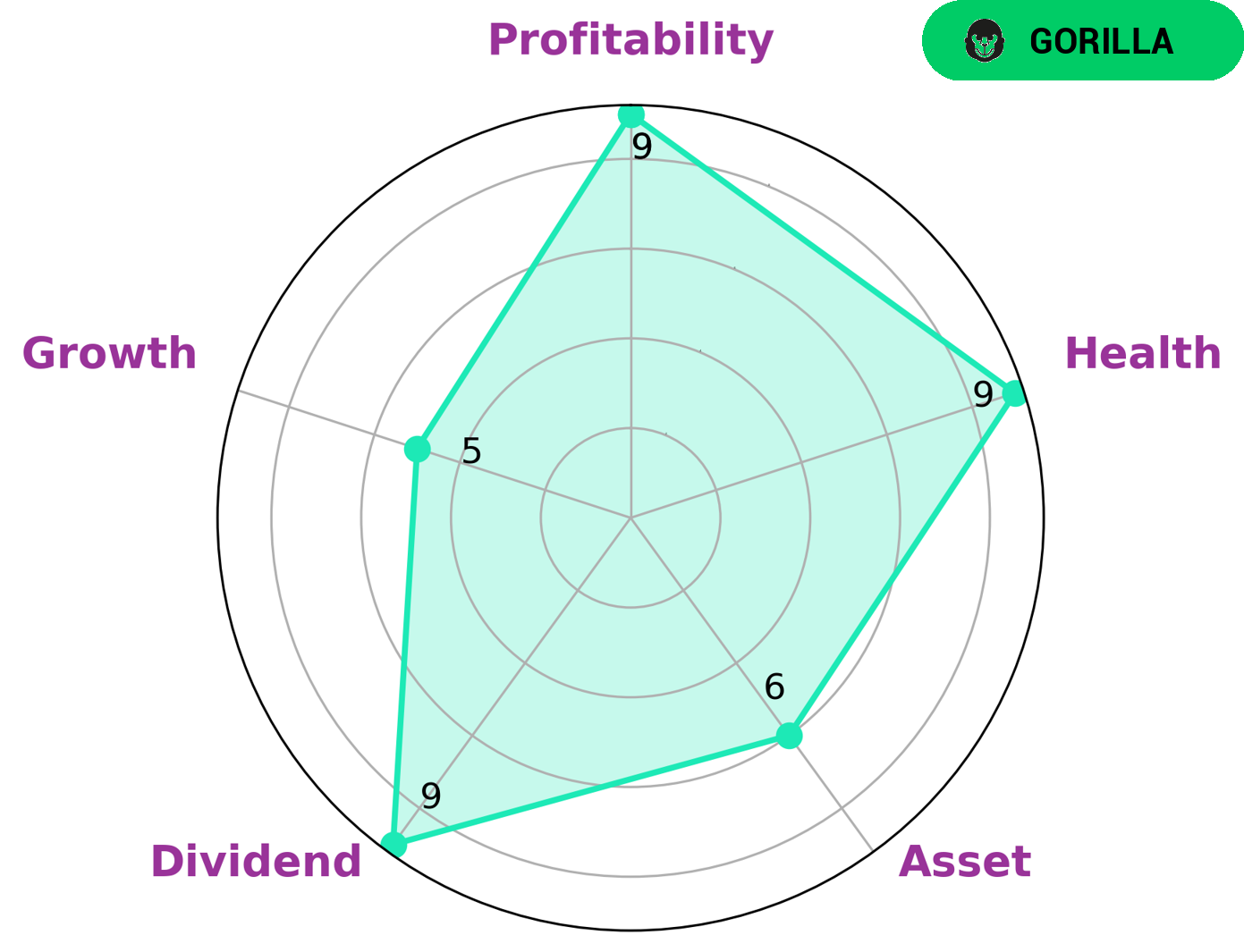

MSC INDUSTRIAL DIRECT is classified as a ‘gorilla’ company, representing a strong competitive advantage and stable, high revenue or earning growth. Investors interested in such a company should be aware of its fundamentals, which can easily be made simple using the VI app. According to the VI Star Chart, MSC INDUSTRIAL DIRECT is strong in dividend and profitability, and medium in asset and growth. It also has a high health score of 9/10 due to its good cashflows and debt management, making it capable of safely riding out any crisis without the risk of bankruptcy. MSC INDUSTRIAL DIRECT’s financial performance and stability make it an attractive option for investors looking for long-term potential. The company has solid fundamentals and is well-positioned to weather any market downturns. With a solid health score, dividend yield, and profitability, it is likely to remain attractive to investors for many years to come. Furthermore, its strong competitive advantage ensures that it will continue to produce high returns for investors. More…

VI Peers

The company has a wide range of products and services that it offers to its clients. The company has a strong presence in the market and is one of the leading companies in this sector. The company has a good reputation in the market and is known for its quality products and services. The company has a strong competition from other companies such as Hardwoods Distribution Inc, Watsco Inc, WESCO International Inc.

– Hardwoods Distribution Inc ($TSX:HDI)

As of 2022, Hardwoods Distribution Inc has a market cap of 534.86M and a ROE of 29.08%. The company is a wholesale distributor of hardwood lumber and related products in North America, with a network of over 60 locations in the United States and Canada. Products include hardwood lumber, softwood lumber, plywood, veneers, decking, flooring, and other millwork products. The company has a long history dating back to 1925, and is a publicly traded company on the Toronto Stock Exchange.

– Watsco Inc ($NYSE:WSO)

Watsco Inc is a provider of air conditioning, heating and refrigeration solutions. It has a market cap of 9.62B as of 2022 and a return on equity of 27.67%. The company serves the residential, commercial and industrial markets in the United States, Canada, Mexico and the Caribbean.

– WESCO International Inc ($NYSE:WCC)

Wesco International Inc is a holding company that, through its subsidiaries, engages in the distribution of electrical, industrial, and communications products and services in the United States, Canada, and Mexico. The company operates through three segments: Electrical, Industrial, and Communications. The Electrical segment offers products and services to customers in the construction, industrial, commercial, and utility end-markets. The Industrial segment provides products and services to customers in the mining, oil and gas, transportation, and infrastructure end-markets. The Communications segment offers products and services to customers in the communications, data center, and enterprise end-markets.

As of 2022, Wesco International Inc had a market cap of 6.45B and a Return on Equity of 16.97%.

Summary

MSC Industrial Direct is a publicly traded company that reported strong earnings results for the first quarter of fiscal 2023, ending November 30 2022. Total revenue for the quarter was USD 81.3 million, a 23.1% increase from the same period in the previous year, and reported net income was USD 957.7 million, a year-over-year increase of 12.9%. These results were announced on January 5 2023 and the stock price moved down the same day. Given these strong results, investors should consider MSC Industrial Direct as an attractive investment option due to its consistent and impressive growth.

Additionally, the strong net income figure indicates that the company is able to generate substantial profits with its current operating model. Furthermore, the company has a history of paying consistent dividends, which should also be taken into account when considering MSC Industrial Direct as an investment option. Overall, MSC Industrial Direct appears to be a solid investment option for investors looking for consistent, long-term growth. The strong revenue and net income figures, as well as the consistent dividend payouts, demonstrate that the company is well-positioned to continue its impressive growth in the years to come.

Recent Posts