MPLX LP Reports Fourth Quarter FY2022 Earnings Results.

February 21, 2023

Earnings Overview

MPLX LP ($NYSE:MPLX) reported its financial results for the fourth quarter of FY2022, which concluded on December 31, 2022. Revenue for the quarter totaled USD 816.0 million, representing a 1.7% decrease year-over-year. Net income for the period was USD 2501.0 million, a 3.6% decrease from the same quarter of the prior fiscal year.

Transcripts Simplified

MPLX LP‘s fourth quarter operational and financial performance highlights include an increase in adjusted EBITDA for the Logistics and Storage segment of $45 million and a decrease in adjusted EBITDA for the Gathering and Processing segment of $36 million. Total adjusted EBITDA was roughly flat when compared to the same period in the prior year, while distributable cash flow increased 5%. MPLX ended the year with total debt of around $20 billion and a debt to EBITDA ratio of 3.5x. The company also announced its intent to redeem the $600 million of outstanding Series B preferred units in mid-February and refinance these units into long-term debt.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mplx Lp. More…

| Total Revenues | Net Income | Net Margin |

| 10.54k | 3.81k | 37.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mplx Lp. More…

| Operations | Investing | Financing |

| 5.02k | -956 | -3.84k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mplx Lp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 35.66k | 23.12k | 13.33 |

Key Ratios Snapshot

Some of the financial key ratios for Mplx Lp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 10.5% | 46.6% |

| FCF Margin | ROE | ROA |

| 47.6% | 22.9% | 8.6% |

Price History

MPLX LP, a leading master limited partnership, reported its financial results for the fourth quarter of fiscal year 2022 on Tuesday. The stock opened at $34.8 and closed at $34.9, representing an increase of 0.7% from its prior closing price of $34.7. This ties into the positive performance that MPLX LP has experienced throughout FY2022. This revenue growth was driven by strong performance in the company’s refining and logistics operations, along with improved pricing and volumes in the retail fuels sector.

This increase was supported by improved operating results, as well as higher net income resulting from lower costs and positive contributions from recent acquisitions. Overall, MPLX LP continues to perform well and is well-positioned to capitalize on growth opportunities in its industries. Shareholders can expect the company to continue to show strong returns in the coming years. Live Quote…

Analysis

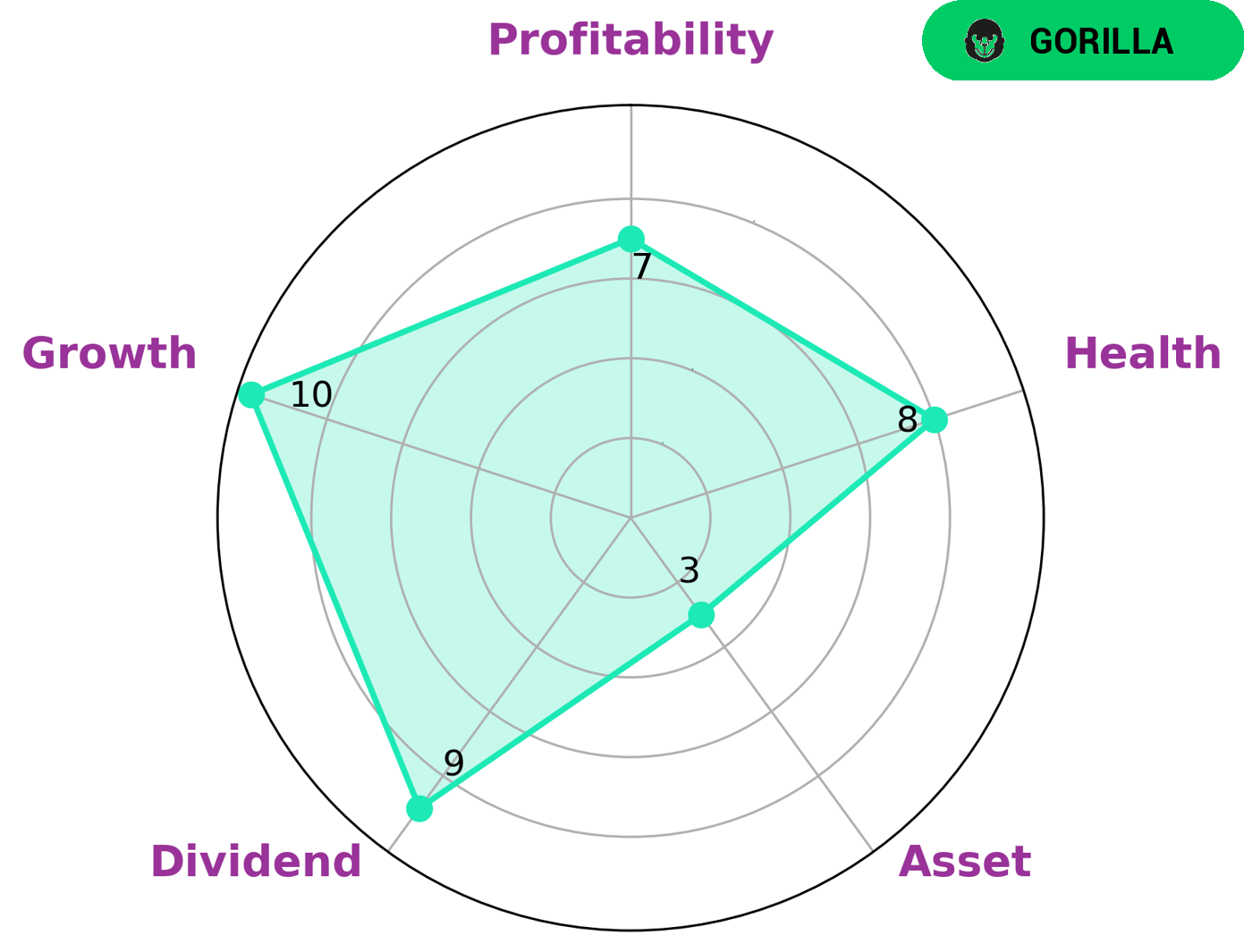

As GoodWhale, I have conducted an analysis of MPLX LP‘s fundamentals. The star chart revealed that MPLX LP is strong in terms of dividend and growth, as well as profitability. However, the asset remains its weak point. MPLX LP is classified as a “gorilla” – a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This means that investors who seek to maximize returns associated with such companies may be interested in investing in MPLX LP. Additionally, MPLX LP has a high health score of 8/10 with regard to its cash flows and debt-related metrics, providing assurance that it is capable of paying off debt and funding future operations. More…

Peers

MPLX LP is a publicly traded master limited partnership that owns, operates, develops, and acquires midstream energy infrastructure assets. The company’s asset portfolio includes approximately 11,800 miles of crude oil and light product pipelines, approximately 8,200 miles of natural gas pipelines, approximately 36 natural gas processing plants, and approximately 50 crude oil and light product storage facilities. MPLX LP is headquartered in Findlay, Ohio.

MPLX LP’s primary competitors are Marathon Petroleum Corp, Energy Transfer LP, and Magellan Midstream Partners LP. All three companies are engaged in the business of transporting, storing, and processing petroleum products.

– Marathon Petroleum Corp ($NYSE:MPC)

Marathon Petroleum Corp is an oil refining and marketing company with a market cap of $54.29B as of 2022. The company has a return on equity of 32.4%. Marathon Petroleum Corp is engaged in the refining, marketing, retailing and transportation of petroleum products and crude oil. The company operates through three segments: Refining & Marketing, Retail, and Midstream. Marathon Petroleum Corp was founded in 1887 and is headquartered in Findlay, Ohio.

– Energy Transfer LP ($NYSE:ET)

Energy Transfer LP is a master limited partnership that owns and operates energy infrastructure assets in the United States. The company’s assets include natural gas pipelines, natural gas storage facilities, and crude oil pipelines. Energy Transfer’s natural gas pipelines transport natural gas from production areas to market centers. The company’s crude oil pipelines transport crude oil from production areas to refineries and market centers. Energy Transfer’s natural gas storage facilities provide storage capacity for natural gas. The company also owns and operates natural gas gathering and processing facilities.

Energy Transfer’s market cap as of 2022 is 36.67B. The company has a Return on Equity of 14.71%. Energy Transfer’s business is focused on the transportation, storage, and gathering of natural gas and crude oil. The company’s pipelines transport natural gas and crude oil from production areas to market centers. Energy Transfer’s natural gas storage facilities provide storage capacity for natural gas. The company also owns and operates natural gas gathering and processing facilities.

– Magellan Midstream Partners LP ($NYSE:MMP)

Magellan Midstream Partners LP is a publicly traded partnership that owns, operates, and leases a diversified portfolio of energy infrastructure assets in the United States. The company’s assets include approximately 8,400 miles of pipelines, 80 terminals, and six product storage facilities. Magellan Midstream Partners LP is headquartered in Tulsa, Oklahoma.

Summary

MPLX LP released its fourth quarter earnings results for FY2022 and showed a slight decrease in total revenue compared to the same period the previous year. Net income also decreased by 3.6%. As such, investors may want to take a closer look at this stock.

Recent Posts