MOHAWK INDUSTRIES Reports Record-Breaking Q4 Earnings for FY2022

February 22, 2023

Earnings Overview

MOHAWK INDUSTRIES ($NYSE:MHK) revealed their FY2022 Q4 earnings results on February 9 2023 – reporting total revenue of USD 33.5 million and net income of USD 2650.7 million for the quarter ending December 31 2022. Compared to the same period last year, revenue experienced a 82.3% drop and net income saw a 4.0% decrease.

Transcripts Simplified

Mohawk Industries reported 4th quarter sales of just under $2.7 billion, a 4% decrease as reported or 1.3% on a constant basis. The decrease was primarily driven by weakness in the U.S. as residential markets slowed more than expected. Gross margin, as reported, was 20.9%, and excluding one-time items, was 22.4%. SG&A as reported was 18.6% of sales, and excluding one-time items was 17.9%. Operating margin as reported was 2.3%, with restructuring and one-time charges of $58 million. Operating margin, excluding charges, was 4.5%.

Global Ceramics had sales of $988 million, a 4% increase as reported and 5% on a constant basis. Operating income, excluding charges, was $70 million with an operating margin of 7.1%. Flooring North America had sales of $946 million, a 6.8% decrease versus prior year. Earnings per share, as reported, was $0.52 and excluding charges, was $1.32.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mohawk Industries. More…

| Total Revenues | Net Income | Net Margin |

| 11.74k | 25.25 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mohawk Industries. More…

| Operations | Investing | Financing |

| 669.15 | -556.75 | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mohawk Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.12k | 6.1k | 123.06 |

Key Ratios Snapshot

Some of the financial key ratios for Mohawk Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 4.4% | 2.0% |

| FCF Margin | ROE | ROA |

| 5.7% | 1.9% | 1.0% |

Share Price

Market analysts noted that MOHAWK INDUSTRIES stock opened at $122.1 and closed at $121.5, a 0.3% increase from the previous closing price of 121.0. The report detailed that MOHAWK INDUSTRIES saw significant returns in the fourth quarter of fiscal year 2022, surpassing analysts’ expectations. The report revealed that the sales of the company’s carpets and rugs exceeded expectations and grew by 4 percent year-over-year. This was attributed to increased demand from the housing and remodeling industry, as well as increased sales from their e-commerce platform.

Also of note was the growth in flooring solutions such as ceramic and porcelain tiles, laminate, hardwood and vinyl, which saw an increase of 16 percent year-over-year. Overall, MOHAWK INDUSTRIES reported successful fourth-quarter results for Fiscal Year 2022, setting a record for their highest quarterly earnings in their history. The results of this quarter show that the company is in a strong financial position to continue delivering high quality products and excellent customer service in the future. Live Quote…

Analysis

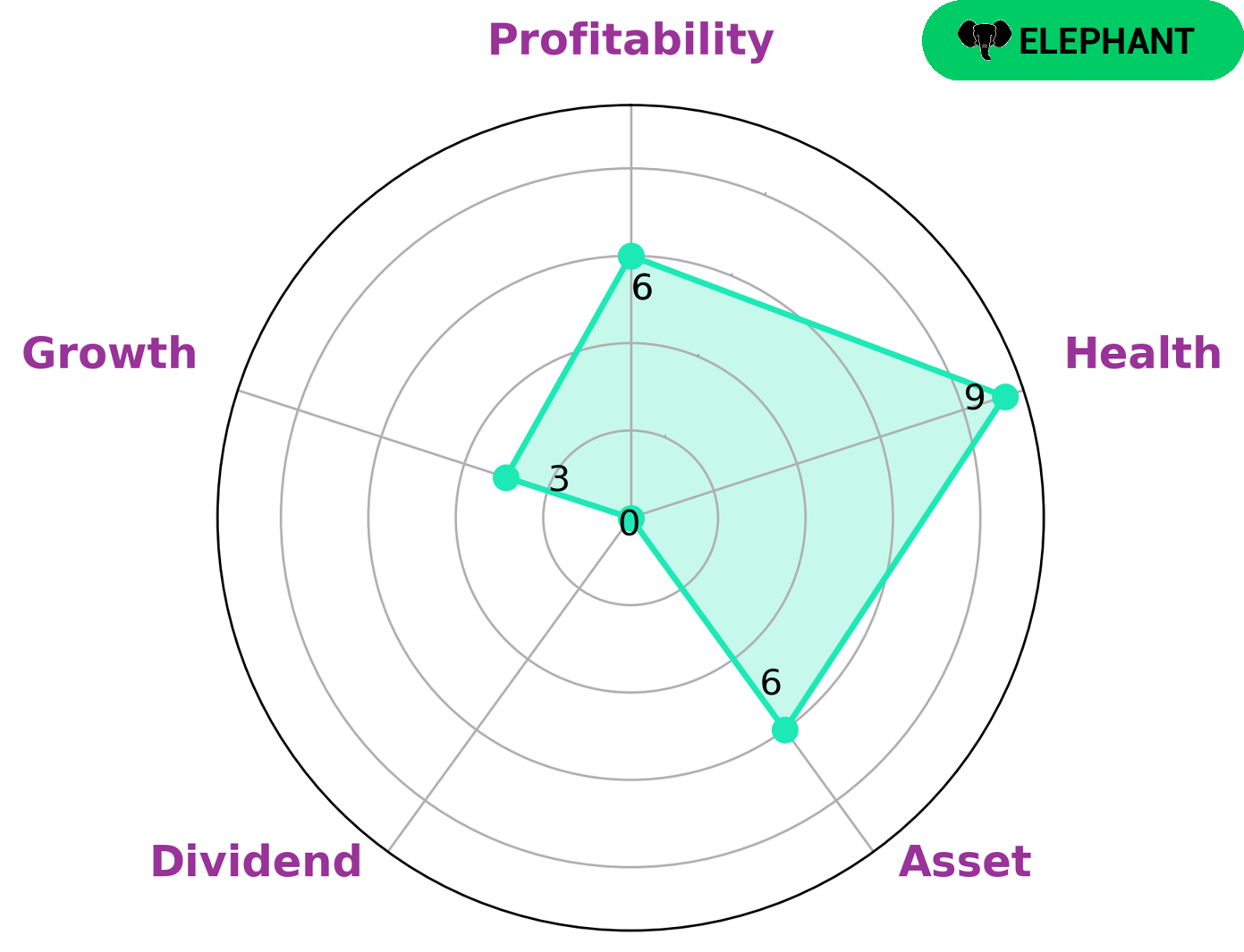

GoodWhale’s analysis of MOHAWK INDUSTRIES fundamentals has revealed a strong performance, with a Health Score of 9/10. This demonstrates that MOHAWK INDUSTRIES has the financial capacity to weather any storms and remain stable despite any inevitable economic turbulence. According to the Star Chart, MOHAWK INDUSTRIES is an ‘elephant’ company, that is, it has a large number of assets in comparison to its liabilities. MOHAWK INDUSTRIES is particularly strong in cashflows and debt management but medium-level in asset management and profitability. Its weak point is its lackluster dividends and growth. Therefore, investors who prioritize stability and financial strength over growth and dividends are likely to find MOHAWK INDUSTRIES an attractive investment option. More…

Peers

Mohawk Industries Inc is one of the largest flooring companies in the world. Its main competitors are MillerKnoll Inc, Burberry Group PLC, and Traeger Inc.

– MillerKnoll Inc ($NASDAQ:MLKN)

Founded in 1893, Miller Knoll is one of the oldest and largest accounting firms in the United States. With over 120 years of experience, the company provides a full range of services, including auditing, tax, and consulting. It has a market cap of 1.35B and a ROE of 6.45%. Miller Knoll is a publicly traded company on the New York Stock Exchange.

– Burberry Group PLC ($LSE:BRBY)

Burberry Group PLC is a British luxury fashion house headquartered in London, England. Its main products are clothing, fragrances, and cosmetics. As of 2022, Burberry Group PLC has a market capitalization of 7.15 billion pounds and a return on equity of 21.58%. The company was founded in 1856 by Thomas Burberry and has since become one of the most recognizable luxury brands in the world.

– Traeger Inc ($NYSE:COOK)

Traeger Inc is a publicly traded company with a market capitalization of 417.38 million as of 2022. The company has a return on equity of -26.37%. Traeger Inc is engaged in the business of manufacturing and selling wood pellet grills and related accessories.

Summary

MOHAWK Industries recently released their financial results for the fourth quarter of FY2022, reporting a total revenue of USD 33.5 million, a significant decrease of 82.3% compared to the same period last year. Net income also experienced a 4.0% decrease year-over-year, to USD 2650.7 million. Investor analysis suggests that the company is currently facing financial difficulty, and that further action may be needed in order to stimulate the company’s domestic and global markets. Shareholders may want to closely monitor the company’s progress in order to make more informed investing decisions.

Recent Posts