MKS INSTRUMENTS Reports Financial Results for Fourth Quarter of 2022.

March 21, 2023

Earnings Overview

MKS INSTRUMENTS ($NASDAQ:MKSI) revealed its financial results for the fourth quarter of the 2022 fiscal year (ending December 31, 2022) on February 27, 2023. The company’s total revenue for the period decreased by 64.0% to USD 54.0 million, compared to the same quarter in the preceding year. In contrast, reported net income increased by 42.0%, amounting to USD 1085.0 million.

Transcripts Simplified

MKS Instruments reported fourth quarter revenue of $1.09 billion above the high end of their guidance range, down 6% year-over-year. Revenue from semiconductor, electronics and packaging and specialty industrial markets made up 27%, 25%, and 29% of total revenue respectively. Consumables and service revenue across the 3 end market categories comprised 37% of total revenue, up 3% year-over-year on a combined company basis, excluding the impact of foreign exchange in palladium pass-through.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mks Instruments. More…

| Total Revenues | Net Income | Net Margin |

| 3.55k | 333 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mks Instruments. More…

| Operations | Investing | Financing |

| 529 | -4.55k | 3.97k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mks Instruments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.49k | 7.01k | 67.31 |

Key Ratios Snapshot

Some of the financial key ratios for Mks Instruments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.1% | 35.8% | 17.2% |

| FCF Margin | ROE | ROA |

| 10.3% | 8.8% | 3.3% |

Price History

The stock opened at $92.9 and closed at $92.2, representing a 0.7% increase from the prior closing price of 91.5. This slight uptick in the stock price demonstrated the company’s successful performance during the three month period. This was a result of the company’s cost cutting measures, which it had implemented to offset rising costs of goods. These cost efficiency initiatives enabled MKS INSTRUMENTS to achieve profitability despite the challenging economic environment.

Going forward, MKS INSTRUMENTS is looking to capitalize on its strong financial performance in the fourth quarter of 2022 and continue to expand its operations in order to drive revenue growth and shareholder value. The company has stated its commitment to investing in research and development and exploring new opportunities for growth. With its strong financial results this quarter, investors are optimistic about MKS INSTRUMENTS’ outlook for the future. Live Quote…

Analysis

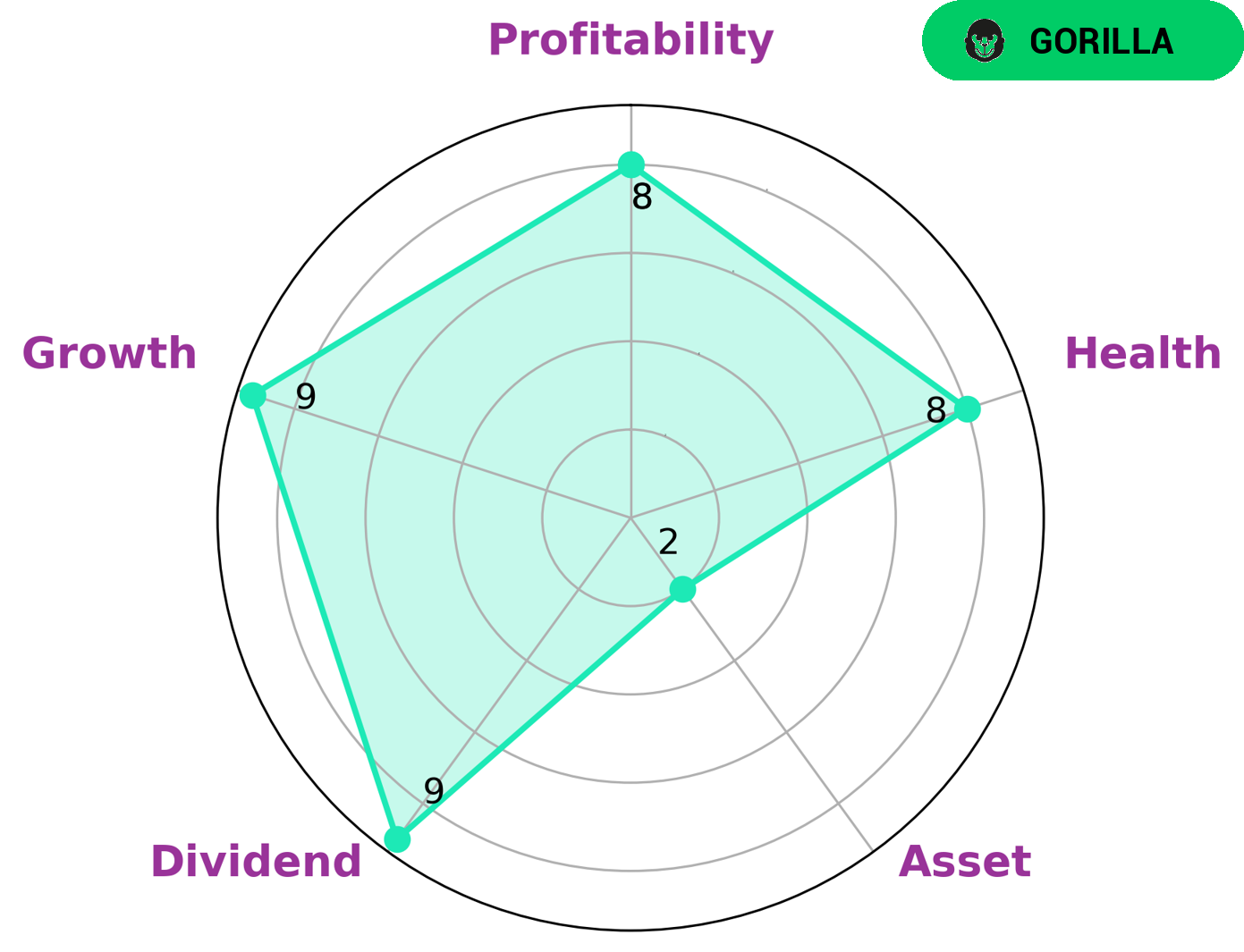

At GoodWhale, we specialize in analyzing financials of companies, and MKS Instruments is no exception. According to our Star Chart, MKS Instruments is classified as a “gorilla,” meaning that the company has achieved a strong and stable revenue or earnings growth due to its competitive advantage. These types of companies are likely to be attractive to investors that are looking for steady and consistent growth. Not only that, but MKS Instruments has an impressive Health Score of 8 out of 10. This score is based on cash flows and debt, indicating that the company is capable of paying off its debt and funding future operations. In addition, MKS Instruments is strong in dividends, growth and profitability, but weaker in asset management. All in all, this company looks to be a strong choice for interested investors. More…

Peers

The company’s products are used in semiconductor, flat panel display, industrial, and scientific research applications. MKS Instruments is a publicly traded company with annual revenues of over $1 billion, and is headquartered in Andover, MA. MKS Instruments’ primary competitors are Coherent, Inc., Teledyne Technologies, Inc., and Horiba, Ltd. These companies are all much larger than MKS Instruments, with Coherent and Teledyne each having over $2 billion in annual revenue, and Horiba having over $3 billion. All three of these companies are much more diversified than MKS Instruments, with each having a significant presence in a variety of industries beyond just the semiconductor and flat panel display industries.

– Coherent Inc ($NYSE:TDY)

Teledyne Technologies Inc is a provider of advanced electronics and communication products. Its products are used in a variety of industries including aerospace, defense, medical, and industrial. The company has a market cap of 16.43B as of 2022 and a return on equity of 6.93%. Teledyne Technologies is a diversified company with a strong history of innovation and growth.

– Teledyne Technologies Inc ($TSE:6856)

As of 2022, Horiba Ltd has a market capitalization of 246.85 billion and a return on equity of 9.91%. The company is a leading provider of scientific instruments and analytical and measurement solutions. Its products are used in a variety of fields, including automotive, environmental, life science, semiconductor, and chemical.

Summary

Investors in MKS Instruments saw a 64.0% decrease in total revenue for the fourth quarter of fiscal year 2022 compared to the same period in the previous year. However, the net income rose by 42.0%, amounting to USD 1085.0 million, showing promising potential in the company’s future performance. Going forward, investors should consider MKS Instruments as a viable option, as its increasing net income demonstrates strong fundamentals. Investors should monitor the company’s upcoming financial results to ensure that it is meeting its objectives.

Recent Posts