MGM RESORTS INTERNATIONAL Reports Fourth Quarter FY2022 Earnings on February 8, 2023

March 6, 2023

Earnings report

On February 8, 2023, MGM RESORTS INTERNATIONAL ($NYSE:MGM) reported their fourth quarter FY2022 earnings results. The company reported total revenue of USD 284.0 million for the quarter ended December 31, 2022, indicating a 116.8% increase from the same period last year. Net income for the quarter amounted to USD 3592.2 million, a 17.5% rise from the same quarter a year prior. The company’s stock price rose in response to the news, as investors viewed the results in a positive light.

MGM RESORTS INTERNATIONAL’s financial performance was driven by its strong performance in the hospitality segment, which saw an increase in demand and occupancy during the quarter. The company’s management team is pleased with its results and believes they successfully managed their operations despite the challenging circumstances associated with the global pandemic. They remain optimistic regarding the future performance of MGM RESORTS INTERNATIONAL and are confident that their resilient business model and strategies will continue to pay off in the long term.

Price History

Before the earnings report, the stock opened at $41.7 and closed at $41.4, down 1.3% from its prior closing price of $42.0. Results of the financial performance will be closely watched by investors to gauge the health and outlook of the company after a tumultuous past year. Analysts will be looking for any positive signs that indicate the company is on a pathway to recovery. Investors are expecting to see an improvement in the earning report compared to the same period last year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MGM. More…

| Total Revenues | Net Income | Net Margin |

| 13.13k | 1.47k | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MGM. More…

| Operations | Investing | Financing |

| 1.82k | 1.54k | -2.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MGM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.69k | 40.32k | 12.75 |

Key Ratios Snapshot

Some of the financial key ratios for MGM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -24.9% | 11.4% |

| FCF Margin | ROE | ROA |

| 9.1% | 19.4% | 2.1% |

Analysis

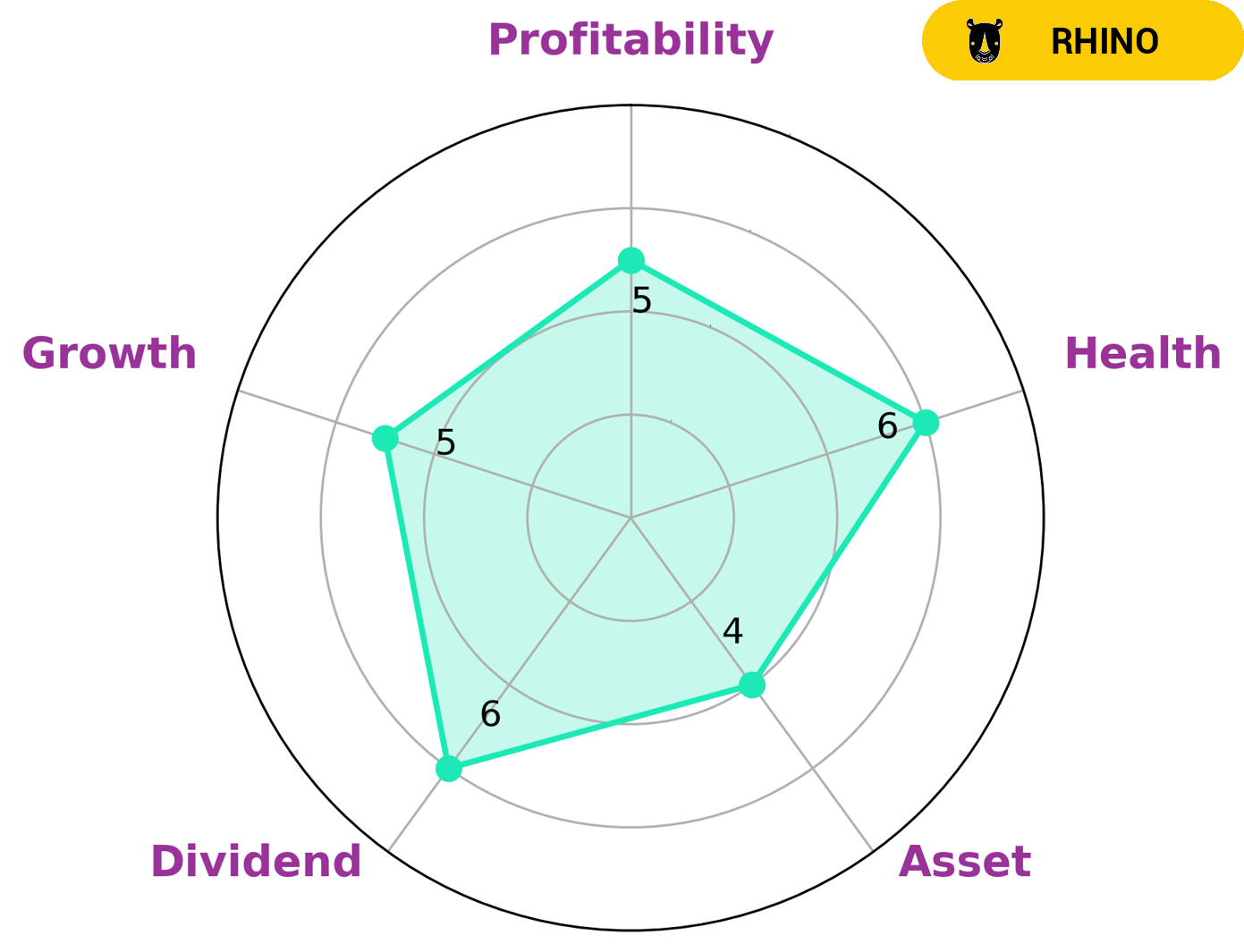

At GoodWhale, we analyzed MGM RESORTS INTERNATIONAL’s financials and found it to be classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. MGM RESORTS INTERNATIONAL’s Star Chart showed that it is strong in asset quality, dividend yield, growth potential, and profitability. However, its intermediate health score of 6/10 with regard to its cashflows and debt indicates that it might be able to pay off debt and fund future operations. Given the moderate growth potential and good financial health, MGM RESORTS INTERNATIONAL could be a decent option for investors looking for steady returns over the long term. Investors with a low risk appetite should find MGM RESORTS INTERNATIONAL to be an attractive investment option. Investors looking for higher returns should look to other options. More…

Peers

MGM Resorts International is one of the world’s leading global hospitality companies, operating a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, and more. The company’s competitors include SkyCity Entertainment Group Ltd, Wyndham Hotels & Resorts Inc, and Cruzani Inc.

– SkyCity Entertainment Group Ltd ($NZSE:SKC)

SkyCity Entertainment Group Ltd is a casino and hospitality company based in New Zealand. The company has a market cap of 2B as of 2022 and a Return on Equity of 3.48%. SkyCity operates four casinos in New Zealand, two in Australia, and one in Chile. The company also has a number of hotels, restaurants, and bars.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts, Inc. is one of the largest hotel companies in the world, with over 9,000 hotels across more than 80 countries. The company offers a variety of hotel brands, including Wyndham, Ramada, Days Inn, Super 8, and Howard Johnson. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey. The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

Summary

MGM Resorts International, a leading global hospitality and entertainment company, has released its financial results for the fourth quarter ended December 31, 2022. The company reported an impressive 116.8% year-over-year increase in total revenue to USD 284.0 million. Net income for the quarter was USD 3592.2 million, up 17.5% from the same period last year.

The strong results and promising outlook reinforce MGM’s position as an attractive investment opportunity in the hospitality industry. Growth prospects and sound management have made MGM Resorts International a compelling choice for investors seeking value and stability.

Recent Posts