METLIFE Reports Impressive FY2022 Q4 Earnings Results Ahead of Schedule

March 26, 2023

Earnings Overview

METLIFE ($NYSE:MET) released their FY2022 Q4 earnings results on December 31 2022 for the period ending February 1 2023. Total revenue for the fourth quarter was USD 1.3 billion, an 11.7% increase from the preceding year. Unfortunately, the reported net income was USD 16.3 billion, dropping 18.8% compared to the same quarter the previous year.

Transcripts Simplified

MetLife reported fourth quarter adjusted earnings of $1.2 billion, down 28% from the same period a year ago. This was primarily due to lower variable investment income, partially offset by higher recurring interest margins and favorable underwriting. Fourth quarter net investment gains were driven by real estate sales and net derivative gains, primarily due to the weakening of the U.S. dollar. Group Benefits adjusted earnings were $400 million versus $20 million in the fourth quarter of 2021, primarily due to significant improvement in underwriting margins and higher volume growth.

Retirement and Income Solutions adjusted earnings were down 40% year-over-year due to lower variable investment income. Credit losses in the portfolio remain modest.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Metlife. More…

| Total Revenues | Net Income | Net Margin |

| 68.95k | 2.35k | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Metlife. More…

| Operations | Investing | Financing |

| 13.2k | -2.62k | -10.11k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Metlife. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 666.61k | 639.32k | 34.71 |

Key Ratios Snapshot

Some of the financial key ratios for Metlife are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | – | 5.5% |

| FCF Margin | ROE | ROA |

| 19.2% | 9.1% | 0.4% |

Price History

On Wednesday, METLIFE reported impressive earnings results for the fourth quarter of its fiscal year 2022, arriving ahead of the company’s projected schedule. The news sent shockwaves throughout the market, pushing METLIFE stock to open at 72.4, a 0.5% drop from the prior closing price of 73.0.

However, by the end of the day, METLIFE stock had closed at 72.7, a minor decrease from the start of the day. The impressive results paint a positive picture for METLIFE moving forward, with the company beating expectations and indicating a successful quarter overall. Investors remain optimistic in their outlook on the stock, with many expecting METLIFE to continue to reach new highs and maintain its place as a leader in the insurance industry. METLIFE’s success is a testament to the company’s hard work and dedication in providing top-notch service and products to its customers. As one of the largest global insurers, the company has long been a leader in the insurance space and is expected to continue to outperform its competitors in the coming quarters. Overall, METLIFE has set itself up for a successful future with its impressive Q4 earnings results. With investors remaining bullish on the stock and customers continuing to be satisfied with the company’s services, METLIFE looks primed to continue in its success and increase its market share as one of the world’s top insurers. Live Quote…

Analysis

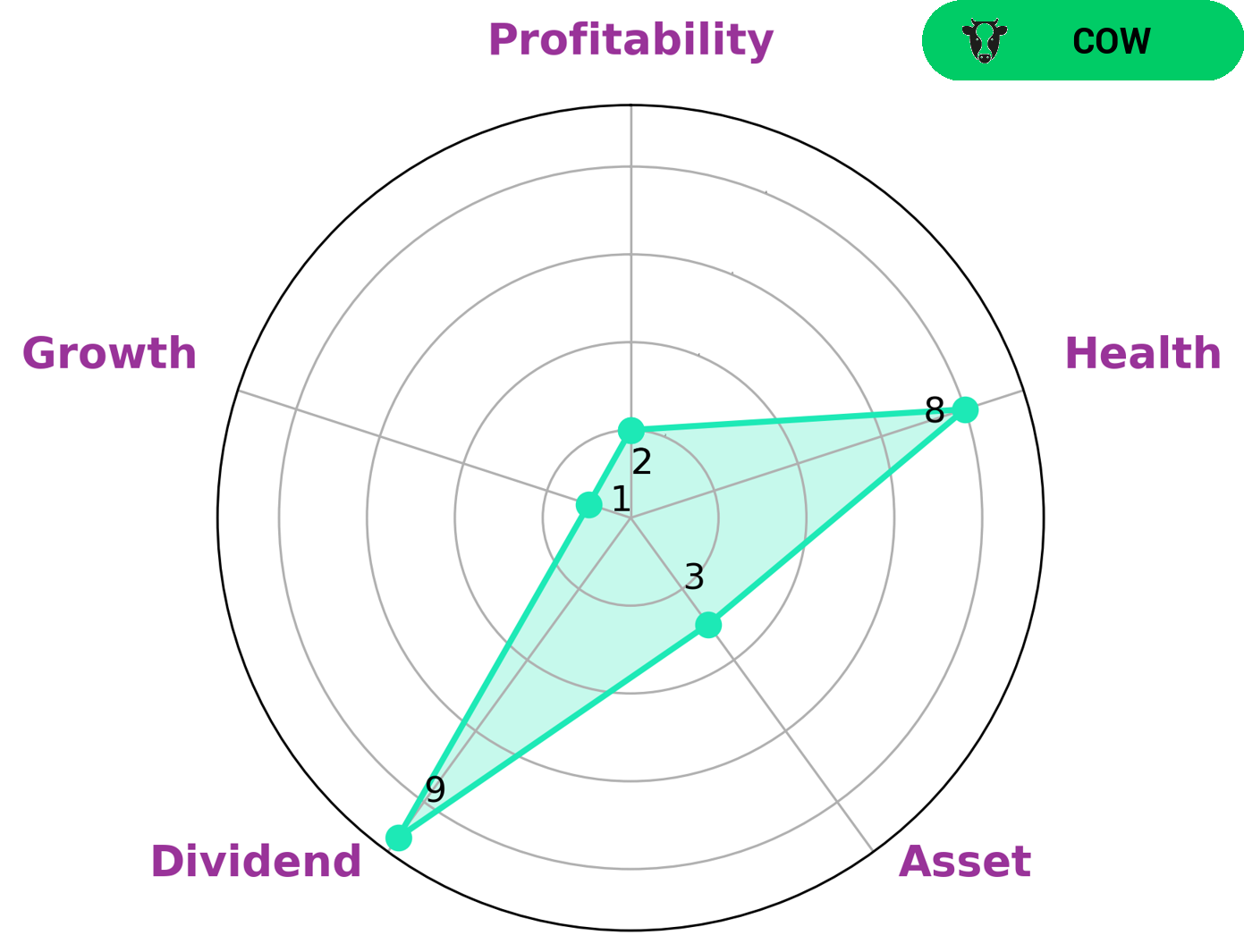

GoodWhale conducted an analysis of METLIFE‘s fundamentals, for which the Star Chart showed that the company was strong in dividend and weak in asset, growth, and profitability. METLIFE’s health score of 8/10 with regards to cashflows and debt indicates that the company is able to pay off debt and fund future operations. We classified METLIFE as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for steady dividend income over long-term capital appreciation may be interested in such a company. More…

Peers

In the insurance industry, MetLife Inc faces competition from Prudential Financial Inc, Great-West Lifeco Inc, Reinsurance Group of America Inc. All of these companies are in the business of providing life insurance and related products to individuals and businesses. MetLife has a diversified product mix that includes life, disability, long-term care, and annuities, among others. Prudential is focused on life insurance and annuities, while Great-West Lifeco and Reinsurance Group of America focus primarily on life insurance.

– Prudential Financial Inc ($NYSE:PRU)

Prudential Financial Inc. is an American multinational financial services company. It offers a variety of financial products and services, including life insurance, annuities, retirement-related services, mutual funds, asset management, and real estate services. As of 2022, it has a market cap of $35.87 billion.

Prudential was founded in 1875 and is headquartered in Newark, New Jersey. It has operations in the United States, Asia, Europe, and Latin America. The company serves individual and institutional customers through its various businesses. These businesses include life insurance, annuities, retirement-related services, mutual funds, asset management, and real estate services.

– Great-West Lifeco Inc ($TSX:GWO)

Great-West Lifeco Inc is a financial services holding company with operations in the United States, Canada, Europe and Asia. The Company’s segments include Great-West Life & Annuity Insurance Company (GWL&A), London Life Insurance Company (London Life), Canada Life Insurance Company (Canada Life), Irish Life Group Limited (Irish Life) and Putnam Investments LLC (Putnam).

– Reinsurance Group of America Inc ($NYSE:RGA)

Reinsurance Group of America, Incorporated is a holding company, which engages in the provision of life reinsurance, financial services, and asset management solutions. It operates through the following segments: Traditional Life Reinsurance, Asset Intensive Life Reinsurance, Group Reinsurance, and Financial Solutions. The company was founded in 1973 and is headquartered in Chesterfield, MO.

Summary

METLIFE recently released their FY2022 Q4 earnings results for the period ending February 1 2023, showing total revenue reaching USD 1.3 billion, a 11.7% increase from the same period last year. Net income, however, was down 18.8% year over year, reaching USD 16.3 billion. Investors should consider the overall financial performance of METLIFE and analyze their performance in relation to the industry.

They should focus on the company’s future prospects, looking at factors such as the competitive landscape, potential growth areas, and the current macroeconomic environment. Long-term investors should review the company’s fundamentals and decide whether they believe METLIFE is a good investment opportunity.

Recent Posts