MERITAGE HOMES Releases Financial Results for Q4 of FY2022 on February 1 2023.

February 13, 2023

Earnings report

On February 1 2023, MERITAGE HOMES ($NYSE:MTH) released their financial results for Q4 of FY2022, which ended on December 31 2022. MERITAGE HOMES is a leading U.S. homebuilder with operations in Arizona, California, Colorado, Florida, Georgia, New Mexico and Texas. The company is a publicly traded stock on the New York Stock Exchange under the symbol MTH. For the quarter, MERITAGE HOMES reported a 10.5% year-over-year increase in total revenue to USD 262.4 million and a 32.8% year-over-year rise in reported net income to USD 2000.7 million. The company’s strong performance was mainly driven by the continued strong demand for new homes along with cost-cutting initiatives that enhanced their operating efficiency.

This margin expansion was mainly due to higher average selling prices and increased leverage of purchasing and construction costs. Overall, MERITAGE HOMES had a very successful Q4 of FY2022, reporting strong revenue growth and improved profitability compared to the previous year. This is a good sign that the company is well-positioned to continue its growth trajectory in the coming quarters.

Price History

The company’s stock opened Wednesday at $107.3 and closed at $109.5, a 1.7% increase from the prior closing price of 107.7. The news was welcome news to investors, as the financial results of MERITAGE HOMES showed positive results for the fourth quarter. This increase was driven by increases in both residential and commercial sales, as well as higher rents from tenants in MERITAGE HOMES’ rental properties. This was due to higher margins on residential sales, as well as higher margin on commercial sales and rental income streams.

This action further strengthened the company’s financial position going forward and provided peace of mind to investors and shareholders alike. All in all, it was a positive quarter for MERITAGE HOMES, with strong financial results across all metrics, and investors have responded positively to the news. The stock closed Wednesday at $109.5, up 1.7% from the previous close and continuing a steady upward trend that has been seen over the past few months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Meritage Homes. More…

| Total Revenues | Net Income | Net Margin |

| 6.3k | 992.19 | 15.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Meritage Homes. More…

| Operations | Investing | Financing |

| 405.27 | -32.29 | -129.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Meritage Homes. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 1.82k | 100.67 |

Key Ratios Snapshot

Some of the financial key ratios for Meritage Homes are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.6% | 61.2% | 20.5% |

| FCF Margin | ROE | ROA |

| 6.0% | 21.1% | 14.0% |

Analysis

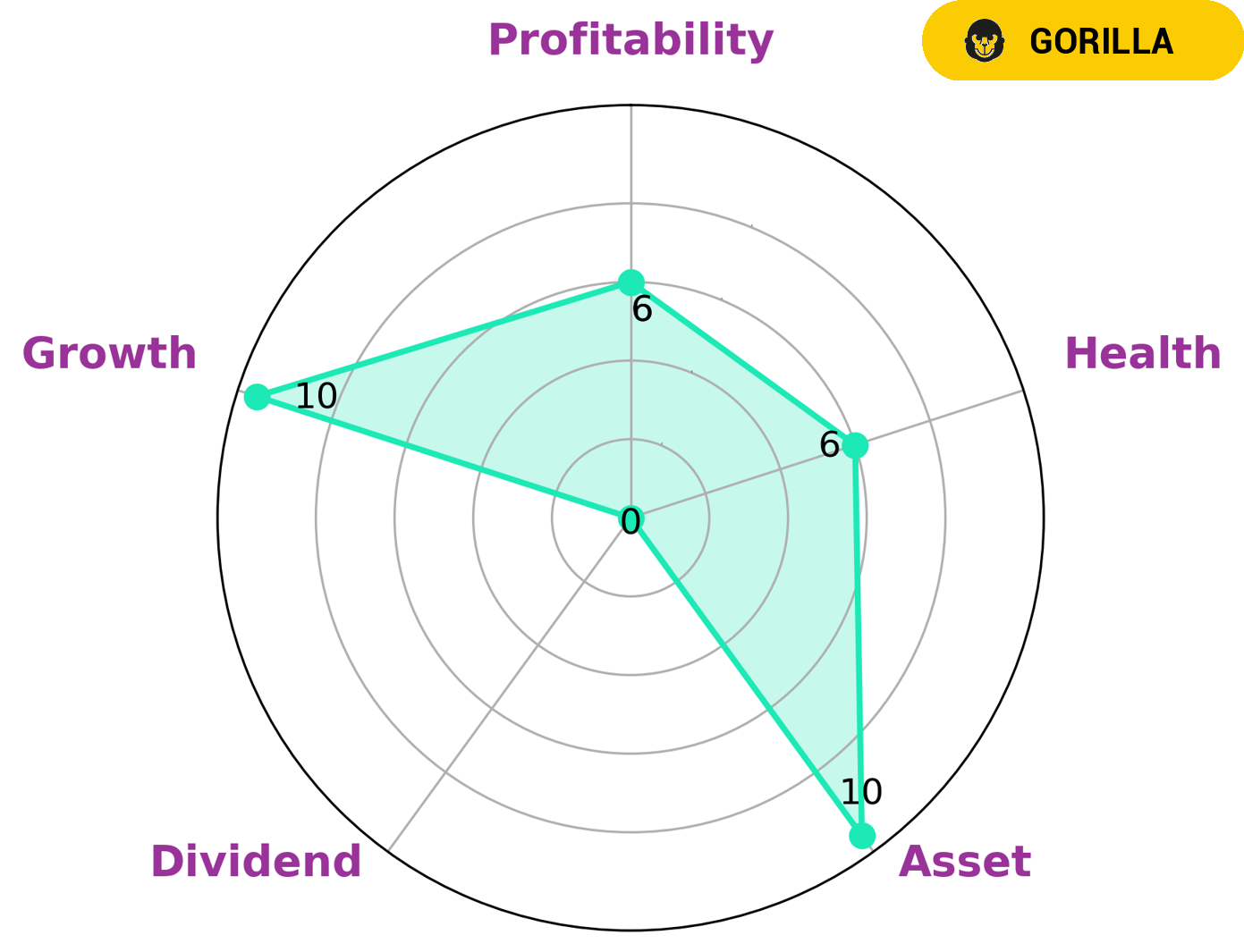

GoodWhale has conducted a comprehensive analysis of MERITAGE HOMES‘ wellbeing. The Star Chart revealed that MERITAGE HOMES has an intermediate health score of 6/10, taking into consideration its cashflows and liabilities, demonstrating its capability to sustain operations during economic downturns. MERITAGE HOMES is strong in asset and growth, moderate in profitability and weak in dividend. This suggests that the company has achieved a good level of financial stability, but may not be providing attractive returns to shareholders. It is classified as a ‘gorilla’, a term given to companies that achieved sustainable and high revenue or earnings growth due to its strong competitive advantage. Due to its ability to continue its operations during difficult economic times, MERITAGE HOMES is likely to be interesting to a variety of investors. Long-term value investors may be interested in its potential for growth, given the strength of its competitive advantage. Dividend investors may also find its intermediate health score appealing, as it provides a good balance between safety and income. Finally, those who are looking for value-oriented investments may consider MERITAGE HOMES due to its strong asset and growth figures. Overall, MERITAGE HOMES shows promise in terms of its financial health and prospects for the future. As such, it could be an attractive option for a range of investors. More…

Peers

Beazer Homes USA Inc is a privately held company that is the tenth largest homebuilder in the United States. Skyline Champion Corp is a publicly traded company and the fifth largest builder in the United States. Taylor Morrison Home Corp is a publicly traded company and is the seventh largest homebuilder in the United States.

– Beazer Homes USA Inc ($NYSE:BZH)

Beazer Homes USA Inc is one of the largest homebuilders in the United States. The company has a market cap of 311.19M as of 2022 and a return on equity of 15.8%. Beazer Homes builds and sells single-family homes, townhomes, and condominiums in the United States. The company was founded in 1985 and is headquartered in Atlanta, Georgia.

– Skyline Champion Corp ($NYSE:SKY)

Skyline Champion Corporation is an American publicly traded company and one of the largest manufacturers of manufactured homes, modular homes, and park model RVs in North America. The company is headquartered in Elkhart, Indiana.

As of 2022, Skyline Champion Corporation has a market capitalization of 3.08 billion and a return on equity of 30.7%. The company’s primary business is the design, production, and sale of manufactured homes, modular homes, and park model RVs. Skyline Champion Corporation operates in three segments: Factory-Built Housing, Modular Buildings, and Park Models.

– Taylor Morrison Home Corp ($NYSE:TMHC)

Taylor Morrison Home Corporation is a homebuilder and land developer in the United States. The Company’s segments include Homebuilding and Financial Services. The Homebuilding segment builds and sells single-family detached and attached homes designed primarily for the entry-level and first move-up markets. This segment also provides mortgage banking and title services to homebuyers in its communities. The Financial Services segment provides mortgage banking and title services to third-party homebuyers in communities where it does not build homes, as well as to homebuyers of Taylor Morrison homes. The Company operates in Arizona, California, Colorado, Florida, Georgia, Illinois, North Carolina and Texas.

Summary

Investing in Meritage Homes looks to be a lucrative option, as the company reported strong financial results for Q4 of FY2022. Meritage Homes saw a 10.5% year-over-year increase in total revenue to USD 262.4 million and a 32.8% year-over-year rise in reported net income to USD 2000.7 million. This indicates that the company has experienced a high level of growth on a year-on-year basis and that it may be able to continue this trend of growth in the future. Investors should take note of Meritage Homes’ strong financials and consider investing in the company, which could potentially yield a high return on investment over the long-term.

Recent Posts