MAXEON SOLAR TECHNOLOGIES Reports First Quarter of FY2023 Earnings Results

May 27, 2023

Earnings Overview

MAXEON SOLAR TECHNOLOGIES ($BER:5QJ) released their financial results for the first quarter of FY2023, ending March 31 2023, on May 16 2023. Their total revenue amounted to USD 318.3 million, a 42.7% increase compared to the same period in FY2022. Furthermore, net income was up 134.3%, reaching USD 20.3 million, from the previous year.

Share Price

The company’s stock opened at €29.6 and closed at the same price, taking a plunge of 17.1% from its prior closing price of 35.7. This was the second consecutive day of losses for the company as investors reacted to the news of MAXEON SOLAR TECHNOLOGIES’ financial results.

Additionally, the company reported net income of €17 million, a decrease of 17% from the previous year. Despite these disappointing results, MAXEON SOLAR TECHNOLOGIES’s CEO and Chairman, William Wang, remained optimistic about the company’s outlook for the future. “We are confident that our core business strategies are on track to deliver long-term value for our shareholders,” said Wang. “We remain committed to further strengthening our leadership position in the renewable energy industry and delivering industry-leading products to our customers.” Despite the company’s disappointing first quarter performance, there may be some positive news on the horizon for MAXEON SOLAR TECHNOLOGIES. The company recently announced a new partnership with leading energy provider EDF to bring its innovative solar technologies to France. This should help to bolster MAXEON SOLAR TECHNOLOGIES’s revenues in the coming quarters and provide investors with hope for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 5QJ. More…

| Total Revenues | Net Income | Net Margin |

| 1.16k | -188.04 | -16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 5QJ. More…

| Operations | Investing | Financing |

| -34.7 | -58.24 | 188.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 5QJ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.27k | 1.19k | 1.51 |

Key Ratios Snapshot

Some of the financial key ratios for 5QJ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.2% | – | -9.6% |

| FCF Margin | ROE | ROA |

| -8.1% | -125.7% | -5.5% |

Analysis

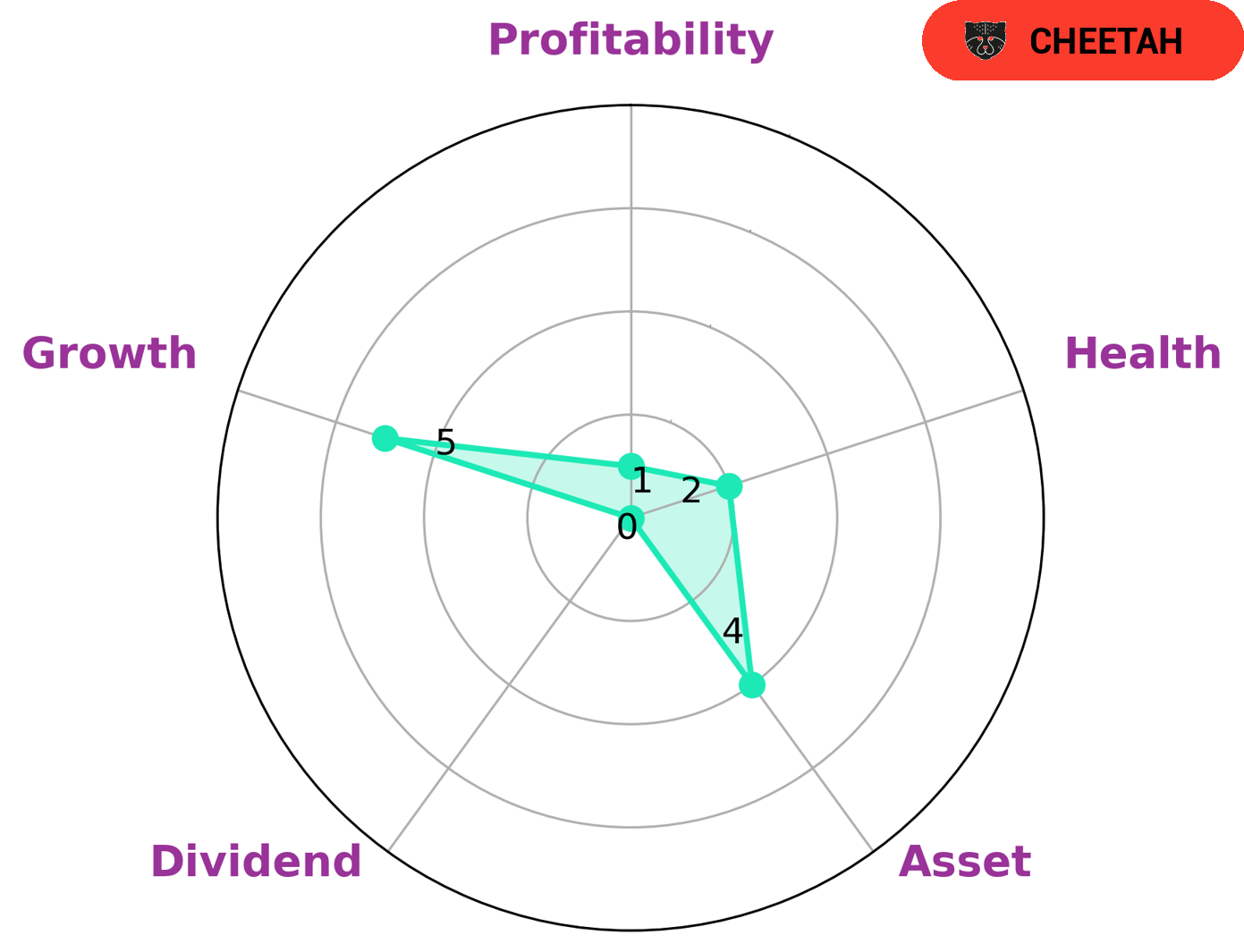

As GoodWhale, we have conducted an analysis of MAXEON SOLAR TECHNOLOGIES’ fundamentals. According to our Star Chart, the company has a low health score of 2/10 when it comes to its cashflows and debt. This suggests that MAXEON SOLAR TECHNOLOGIES is less likely to sustain future operations in times of crisis. Additionally, MAXEON SOLAR TECHNOLOGIES is strong in medium in asset, growth and weak in dividend, profitability. Given this information, we can conclude that MAXEON SOLAR TECHNOLOGIES is classified as a ‘cheetah’, meaning they have achieved high revenue or earnings growth but may be considered less stable due to lower profitability. Given its cheetah classification, investors who are likely to be interested in such a company include those who are actively seeking high returns and are willing to take a higher level of risk. Those with a higher risk tolerance may find MAXEON SOLAR TECHNOLOGIES to be an interesting investment option. More…

Summary

MAXEON SOLAR TECHNOLOGIES reported strong financial results for the first quarter of FY2023. Total revenue increased by 42.7% year-over-year, reaching USD 318.3 million, while net income was up 134.3%, reaching USD 20.3 million. Despite these impressive figures, investors reacted negatively and the stock price dropped on the same day. The results suggest that investors may have expected even higher performance for the company, and a further analysis of the results could shed more light on the underlying reasons behind the sudden change in sentiment.

Recent Posts