Mastercraft Boat Stock Intrinsic Value – MASTERCRAFT BOAT Reports Third Quarter Earnings Results for FY2023

May 31, 2023

🌥️Earnings Overview

For the third quarter of FY2023 ending on March 31 2023, MASTERCRAFT BOAT ($NASDAQ:MCFT) released its earnings results showing total revenue of USD 166.8 million, a drop of 10.7% from the same period last year. Despite this decrease, its net income rose by 7.5%, coming in at USD 22.5 million year over year.

Market Price

The stock opened at $30.5 and closed at $27.5, down by 4.0% from the last closing price of 28.7. This marked the first time in several quarters that the stock price experienced a decline, following several months of steady growth. The quarterly report showed a 3% increase in total revenue for the quarter, driven mainly by sales of new boats, parts and accessories, and earnings from service and repair. Despite this decrease in profitability, the company is still performing well, with strong cash flow and a healthy balance sheet. MASTERCRAFT BOAT remains optimistic about the future, and is committed to continuing to provide excellent customer service and product quality.

They have also been investing heavily in new product development and marketing initiatives, as well as expanding their network of dealers and retailers to reach more customers. As the recreational boating industry continues to grow, MASTERCRAFT BOAT expects to benefit from these investments and continue to deliver strong financial results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mastercraft Boat. More…

| Total Revenues | Net Income | Net Margin |

| 758.95 | 57.75 | 11.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mastercraft Boat. More…

| Operations | Investing | Financing |

| 142.97 | -97.86 | -31.42 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mastercraft Boat. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 338.27 | 162.13 | 10.02 |

Key Ratios Snapshot

Some of the financial key ratios for Mastercraft Boat are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.4% | 31.5% | 12.6% |

| FCF Margin | ROE | ROA |

| 15.3% | 35.7% | 17.7% |

Analysis – Mastercraft Boat Stock Intrinsic Value

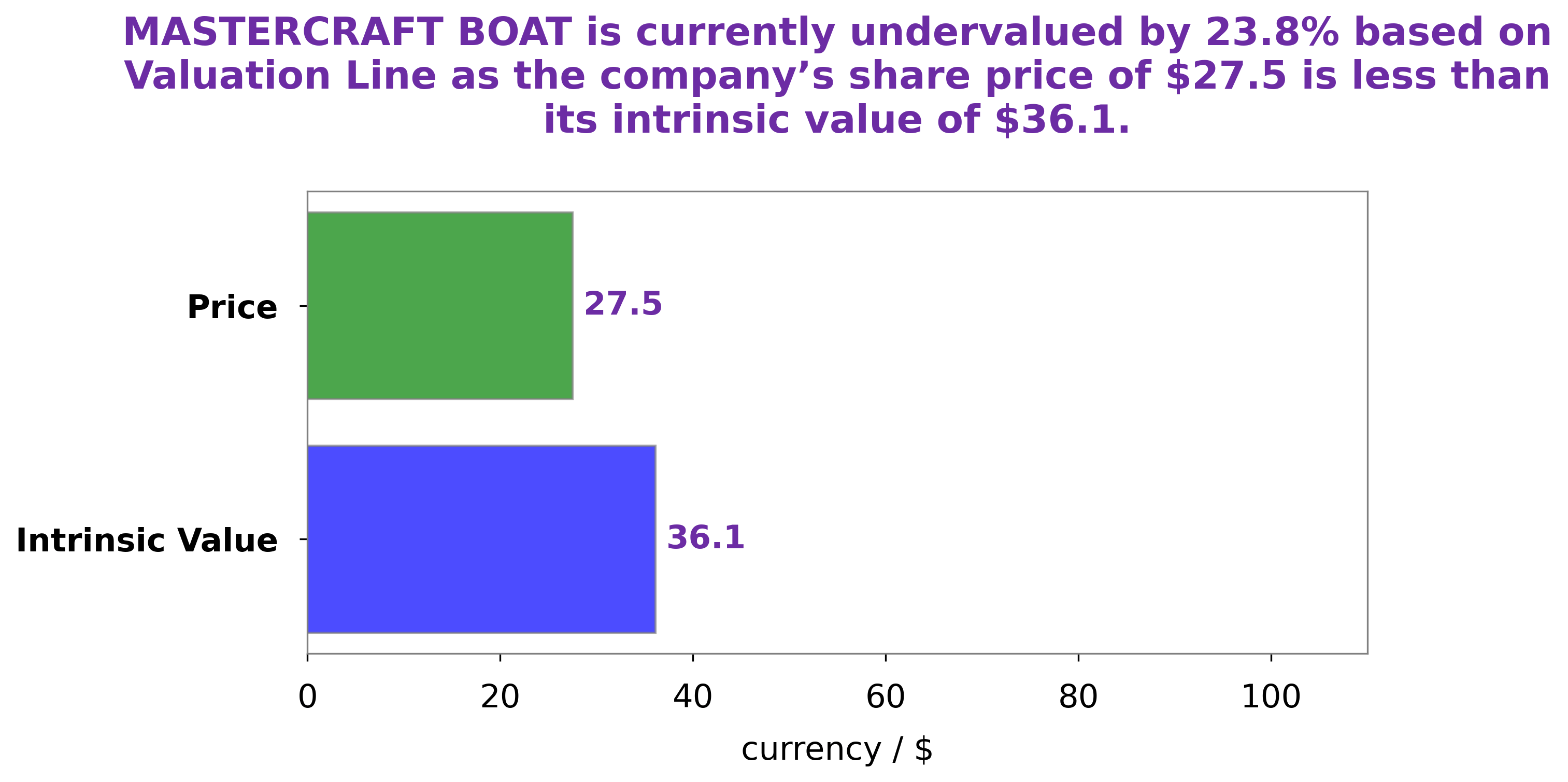

At GoodWhale, we have analyzed the financials of MASTERCRAFT BOAT and believe that the fair value of its share is around $36.1. This valuation was calculated using our proprietary Valuation Line, which looks at a range of factors, including the company’s historical performance and global economic trends. At present, MASTERCRAFT BOAT’s stock is trading at $27.5, which represents an undervaluation of 23.9%. We believe this presents a great opportunity for investors to purchase a quality stock at a discount. More…

Peers

MasterCraft Boat Holdings Inc is a leading designer and manufacturer of premium inboard wakeboard, ski and luxury performance boats. The company’s boats are sold under the MasterCraft brand, as well as under the Nautique, Moomba, Supra, and XStar brands. The company operates in four segments: North America, Europe, Asia, and Other International. The Limestone Boat Co Ltd, Maiden Lane Jewelry Ltd, Malibu Boats Inc are its main competitors.

– The Limestone Boat Co Ltd ($TSXV:BOAT)

The Limestone Boat Co Ltd is a company that manufactures and sells boats. The company has a market cap of 5.38M as of 2022 and a return on equity of 247.14%. The company’s products are sold through its network of dealers and distributors in the United States, Canada, and Europe. The company was founded in 1971 and is headquartered in Kingston, Ontario, Canada.

– Maiden Lane Jewelry Ltd ($OTCPK:MDNL)

Maiden Lane Jewelry Ltd is a jewelry company with a market cap of 5.77M as of 2022. The company has a Return on Equity of -27.96%. The company designs, manufactures, and sells jewelry products.

– Malibu Boats Inc ($NASDAQ:MBUU)

Malibu Boats is a leading manufacturer of recreational boats in the United States. The company has a market cap of 980.44 million as of 2022 and a return on equity of 27.7%. Malibu Boats designs, manufactures, markets, and sells recreational powerboats under the Malibu and Axis brand names. The company offers a range of boat models, including wakeboard boats, ski boats, and performance boats. Malibu Boats also manufactures boats for the US Coast Guard and the US Navy.

Summary

Investors may be disappointed with Mastercraft Boat‘s third quarter financial results for FY2023, as total revenue decreased by 10.7% year over year. However, the company was able to report a 7.5% increase in net income year over year, reaching USD 22.5 million. Despite this, the stock price moved down the same day, indicating that investors may be expecting more from the boat maker in the future. Investors should keep an eye on the performance of the company in the following quarters for further insight into its long-term sustainability.

Recent Posts