Markel Corporation Reports Q4 FY2022 Earnings of USD 689.7 Million with 8.9% Increase in Net Income Year Over Year

February 14, 2023

Earnings report

Markel Corporation ($NYSE:MKL), a publicly traded financial services company, recently reported their Q4 FY2022 earnings results as of December 31 2022 on February 1 2023. Markel Corporation provides insurance products to a diverse range of customers across the world, with a focus on specialty lines and general insurance. The company reported total revenue for the quarter at USD 689.7 million, a decrease of 20.8% compared to the same period last year. This was mainly due to the decrease in premiums as a result of the pandemic and its impact on the insurance industry.

However, despite the decrease in revenue, Markel Corporation was able to report an 8.9% increase in net income year over year to USD 4105.6 million. The increase in net income was mainly due to the company’s focus on cost-saving initiatives and efficiencies, as well as their ability to leverage their diverse portfolio of products across different industries. The company also saw an increase in their investments portfolio for the quarter, as well as an increase in operating income. Overall, it appears that Markel Corporation has been able to weather the storm of the pandemic, and is now beginning to reap the rewards of their investments and cost-saving efforts. The company’s strong performance in the fourth quarter of FY2022 bodes well for the future, and investors should watch closely for any further updates from Markel Corporation.

Stock Price

On Wednesday, Markel Corporation reported its fourth quarter earnings of FY2022, with net income of USD 689.7 million, a 8.9% increase year over year. At the end of the day, Markel Corporation stock opened at $1396.4 and closed at $1401.2, down 0.6% from its last closing price of $1409.0. Markel Corporation is a global holding company offering insurance, reinsurance, and investment products through its subsidiaries and affiliates. The company’s property and casualty operations include specialty insurance and reinsurance products for clients in a variety of industries, including healthcare, workers’ compensation, cyber, energy, and marine. The company’s investment operations include equity investments and venture capital investments, as well as participating in private equity and venture capital funds. Markel also has a banking business that offers secured loans to fund acquisitions, as well as other corporate purposes.

The company’s fourth quarter results showed that its net income was driven by strong performance across many of its operating segments. In particular, Markel’s property and casualty operations saw a double-digit growth in premium income, across all lines of business. Markel Corporation’s strong fourth quarter results have underscored its focus on delivering value to shareholders. As the company continues to build on its success in the current market environment, investors can expect to see further growth in the company’s financial performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Markel Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 11.82k | -320.02 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Markel Corporation. More…

| Operations | Investing | Financing |

| 2.53k | -2.94k | 369.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Markel Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.79k | 49.79k | 973.37 |

Key Ratios Snapshot

Some of the financial key ratios for Markel Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | – | 0.4% |

| FCF Margin | ROE | ROA |

| 19.1% | 0.2% | 0.1% |

Analysis

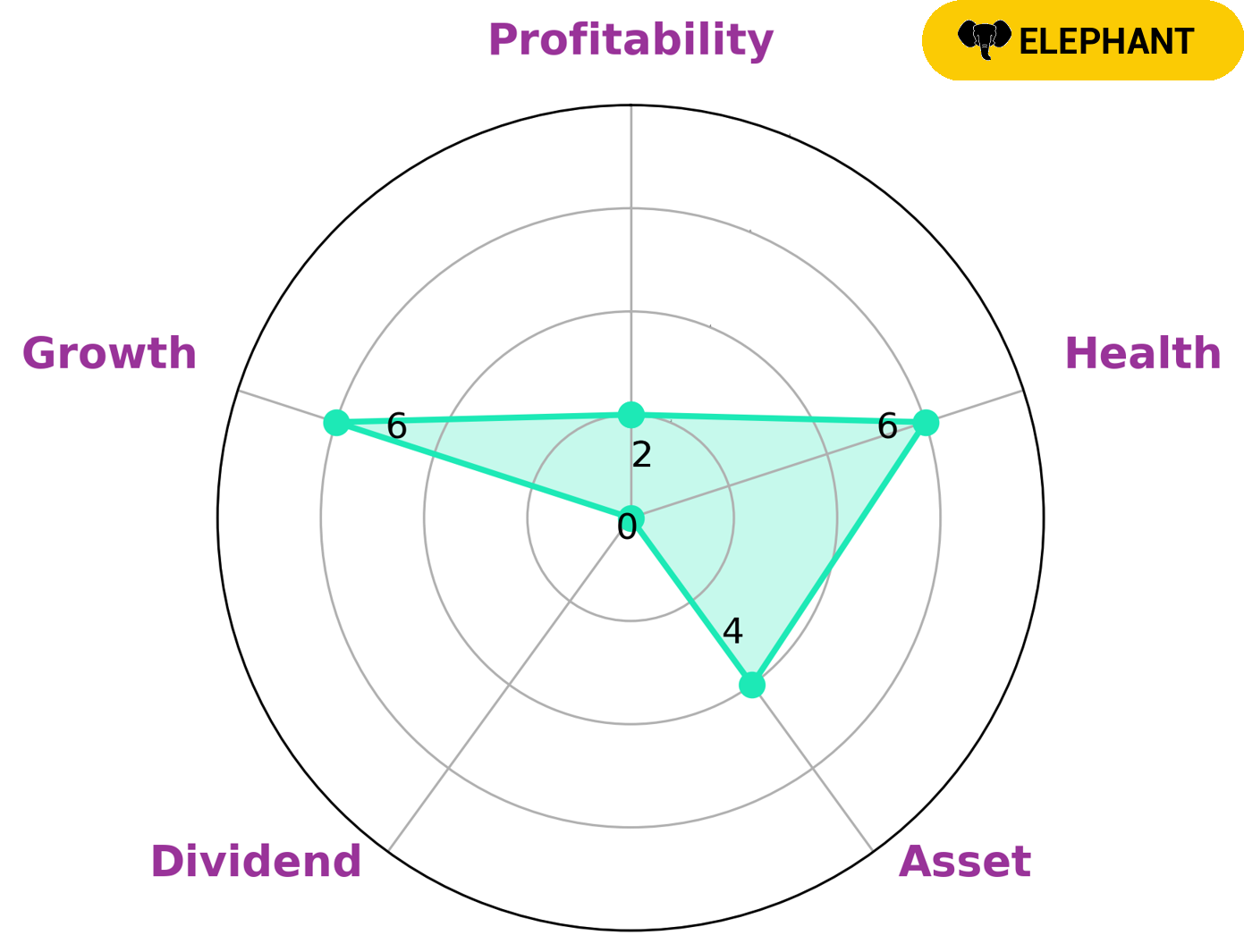

MARKEL CORPORATION‘s wellbeing has been analysed by GoodWhale, with a Star Chart rating of 6/10. This indicates that the company has an intermediate health score with regards to cashflows and debt, allowing it to safely ride out any crisis without the risk of bankruptcy. MARKEL CORPORATION is particularly strong in asset holdings, which allows it to remain in a secure financial position. It is also medium in terms of growth, though it is weak in dividend yield and profitability. MARKEL CORPORATION is classified as an ‘elephant’ and is rich in assets after liabilities have been deducted. Such companies are attractive to investors who are looking for a steady source of income and capital appreciation, as well as those who are looking for a safe haven for their money. Furthermore, investors may be interested in MARKEL CORPORATION due to its strong asset base and long-term growth prospects. In conclusion, MARKEL CORPORATION has an intermediate health score of 6/10 with regards to its cashflows and debt, and is likely to safely ride out any crisis without the risk of bankruptcy. The company is classified as an ‘elephant’ and is strong in asset holdings, medium in growth, and weak in dividend yield and profitability. Such companies are attractive to investors who are looking for a steady source of income and capital appreciation, as well as those who are looking for a safe haven for their money. More…

Peers

Some of its competitors are Unico American Corp, Chubb Ltd, and White Mountains Insurance Group Ltd.

– Unico American Corp ($NASDAQ:UNAM)

Unico American Corporation is a holding company that operates through its subsidiaries engaged in a number of diversified business activities including life and health insurance, property and casualty insurance, real estate investment, commercial lending, and other investments.

As of 2022, Unico American Corporation had a market cap of 7.05 million. The company’s subsidiary, Unico American Insurance Company, is a provider of life and health insurance products to policyholders in the United States. Unico American also has a property and casualty insurance subsidiary that offers insurance products to individuals and businesses in the United States. In addition, the company’s real estate investment subsidiary owns and operates a portfolio of income-producing properties. Finally, Unico American’s commercial lending subsidiary provides financing to small businesses in the United States.

– Chubb Ltd ($NYSE:CB)

Chubb is a large insurance company with a market capitalization of over $81 billion. The company has a strong return on equity of 10.32%. Chubb provides insurance products and services for individuals, families, and businesses around the world. The company has a long history dating back to 1882 and is headquartered in Zurich, Switzerland.

– White Mountains Insurance Group Ltd ($NYSE:WTM)

The company’s market cap is 3.52B as of 2022 and its ROE is -10.11%. The company is an insurance group that provides a range of insurance products and services.

Summary

Markel Corporation reported their FY2022 Q4 earnings as of December 31, 2022 on February 1, 2023. Total revenue for the quarter was USD 689.7 million, a decrease of 20.8% compared to the same period last year. Net income, however, increased 8.9% year over year to USD 4105.6 million. For investors, these results indicate that Markel Corporation has been able to remain profitable despite the pandemic’s effects on their revenue. The increase in net income demonstrates their ability to effectively manage their costs and maximize profits. This may indicate that the company’s current strategies are working and that they have solidified their position in the market. Furthermore, since Markel Corporation’s revenues have decreased year-over-year, it is likely that they are now more cost-efficient. This could be an advantage for investors, as the company may now be able to better manage their expenses and generate higher profits.

Additionally, the company’s financial position is likely to remain stable and resilient, given their continued profitability. Overall, Markel Corporation’s FY2022 Q4 earnings report indicates that the company is performing well despite the pandemic’s impact on the market. This could be a good sign for investors considering buying or holding Markel Corporation stock. The report also suggests that the company is successfully managing costs and maximizing profits.

Recent Posts