ManpowerGroup Reports Subpar Q1 Earnings and Sets Low Q2 Outlook

April 22, 2023

Trending News 🌧️

MANPOWERGROUP ($NYSE:MAN): ManpowerGroup Inc. is a world leader in innovative workforce solutions, connecting human potential to the power of business. Through its four primary lines of business – ManpowerGroup Solutions, Experis, Manpower, and Right Management – the company provides employers with a range of staffing, recruitment and talent management solutions. However, the recent disappointment in earnings has caused its stock price to decline significantly. Investors will be watching the company’s Q2 performance closely to see if it can turn around its performance and regain investor confidence.

Stock Price

This resulted in a 7.2% drop in the company’s stock price from the previous closing price of $79.5, with it opening at $73.0 and closing at $73.8. In light of this, they anticipate that their income will also decrease accordingly. Despite the bleak outlook, MANPOWERGROUP INC remains focused on their strategy to provide quality services to their customers and remain agile in order to respond to changing market conditions.

The company is also investing in technology and innovation in order to remain competitive. The company has also announced that it plans to focus on its core business, which includes providing recruitment, labor assessment and training services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manpowergroup Inc. More…

| Total Revenues | Net Income | Net Margin |

| 19.44k | 360 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manpowergroup Inc. More…

| Operations | Investing | Financing |

| 477.3 | -79.9 | -435.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manpowergroup Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.89k | 6.38k | 48.4 |

Key Ratios Snapshot

Some of the financial key ratios for Manpowergroup Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | -1.6% | 3.0% |

| FCF Margin | ROE | ROA |

| 2.1% | 14.8% | 4.1% |

Analysis

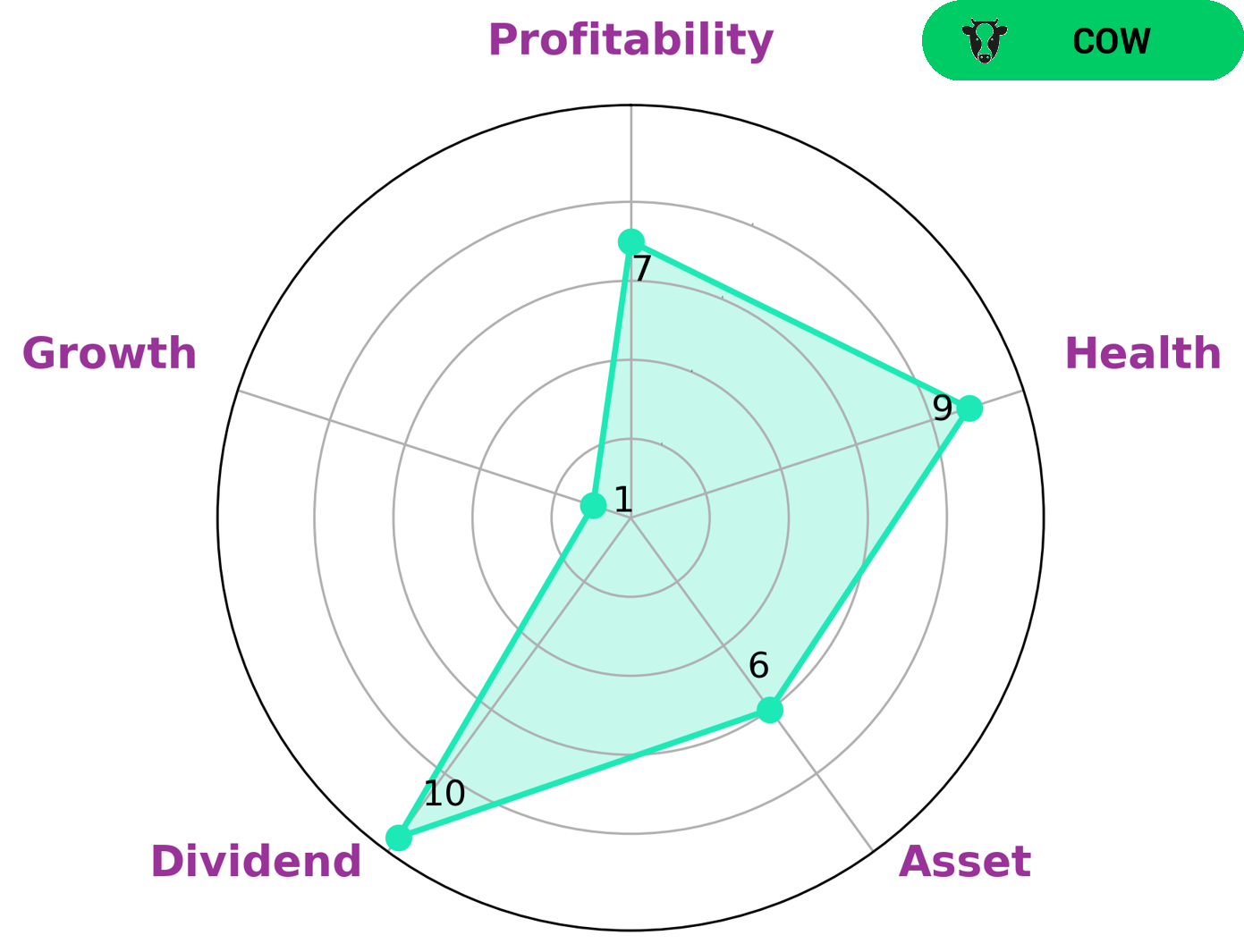

GoodWhale has performed an analysis of MANPOWERGROUP INC‘s fundamentals and based on our Star Chart, the company has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. The classification of MANPOWERGROUP INC as ‘cow’ suggests that the company has a track record of paying out consistent and sustainable dividends. Given that MANPOWERGROUP INC is strong in dividend, profitability, medium in asset and weak in growth, investors who are looking for stability and consistent returns might be interested in such a company. Dividend investors could look to benefit from the regular dividend payments whilst those seeking steady returns that rise over time might be attracted to the stability provided by the investments. Due to the strong cashflows and debt position, MANPOWERGROUP INC is also a suitable option for those looking for growth prospects in future earnings. More…

Peers

Its competitors include Robert Half International Inc, Randstad NV, and Kelly Services Inc.

– Robert Half International Inc ($NYSE:RHI)

Robert Half International Inc. is a provider of professional staffing and consulting services. The company operates through three segments: Accountemps, Robert Half Finance & Accounting, and Robert Half Management Resources. The Accountemps segment provides temporary professional accounting and finance personnel. The Robert Half Finance & Accounting segment provides permanent placement professional accounting and finance personnel. The Robert Half Management Resources segment provides temporary and project professional management personnel. The company was founded in 1948 and is headquartered in Menlo Park, California.

– Randstad NV ($LTS:0NW2)

Randstad is a provider of human resources services. It is headquartered in the Netherlands and has over 4,800 offices in 40 countries. The company offers temporary and permanent staffing, outsourcing, and consulting services. It also provides a range of HR solutions, including payroll, benefits, and training.

– Kelly Services Inc ($NASDAQ:KELYA)

Kelly Services, Inc. is a provider of workforce solutions. The Company offers a range of services, including permanent, temporary and contract placement; outsourcing and consulting; and talent management solutions. It serves customers in a range of industries, including automotive, finance and accounting, healthcare, information technology, life sciences, manufacturing and office. The Company operates through three segments: Americas Staffing, International Staffing and Talent Solutions. The Company’s Americas Staffing segment provides staffing and human resource solutions to a range of customers throughout the United States, Canada and Puerto Rico. The International Staffing segment provides staffing solutions to a range of customers in approximately 30 countries. The Talent Solutions segment provides contract-based professional placement, managed service programs and outplacement services.

Summary

ManpowerGroup Inc. (NYSE: MAN) recently reported mixed Q1 results which missed top and bottom line analyst estimates. This caused its stock price to decline on the same day. Despite this, the company has optimistic outlook for Q2, expecting to achieve higher earnings per share.

Investing analysis remains mixed for ManpowerGroup given that the company has been struggling to meet analyst estimates and its outlook is dependent on the recovery of the labor market from the coronavirus pandemic. Nevertheless, long term investors may be optimistic about the company’s growth prospects, given its strong brand and market position in the staffing and human resources industry.

Recent Posts