MANPOWERGROUP INC Reports Fourth Quarter Earnings Results for FY2022

March 18, 2023

Earnings Overview

On January 31 2023, MANPOWERGROUP INC ($NYSE:MAN) reported their financial results for the fourth quarter of FY2022, ending on December 31 2022. Revenue fell by 56.2% to USD 48.7 million compared to the same period in the previous year, and net income decreased by 10.6% to USD 4809.2 million.

Transcripts Simplified

In the fourth quarter, revenues came in at the low end of the constant currency guidance range, with gross profit margin at the midpoint of the guidance range. As adjusted, EBITA was $167 million, flat in constant currency year-over-year. Foreign currency translation drove a 10% swing between the U.S. dollar reported revenue trend and the constant currency related growth rate. After adjusting for the negative impact of foreign exchange rates, our constant currency revenue decreased 1%. Reported earnings per share was $0.95, which included $1.13 related to restructuring costs, final integration costs from the U.S. Experis acquisition, and other special items consisting of a loss on the sale of our Hungary business and non-cash charges consisting of goodwill impairment and pension settlement costs.

Excluding the restructuring costs and other special items, adjusted EPS was $2.08. Year-over-year on an organic constant currency basis, the Manpower brand reported revenue decline of 1%, the Experis brand was flat, and the Talent Solutions brand reported revenue growth of 7%. Gross margin came in at 18.2%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manpowergroup Inc. More…

| Total Revenues | Net Income | Net Margin |

| 19.83k | 373.8 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manpowergroup Inc. More…

| Operations | Investing | Financing |

| 423.3 | -85.3 | -482.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manpowergroup Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.13k | 6.67k | 48.4 |

Key Ratios Snapshot

Some of the financial key ratios for Manpowergroup Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | -3.8% | 3.0% |

| FCF Margin | ROE | ROA |

| 1.8% | 15.6% | 4.1% |

Share Price

The company’s stock opened at $88.3 and closed at $87.2, representing a 0.3% increase from the previous closing price of $86.9. This is due to their focus on cost-cutting initiatives that have allowed them to improve their operational efficiency and reduce their overall costs. Additionally, the company has seen a rise in new orders and customer acquisition due to their expanding presence in international markets and an increased focus on online customer engagement. This marks the second consecutive year in which the company has declared a dividend payout, further demonstrating their commitment to consistent shareholder returns. Live Quote…

Analysis

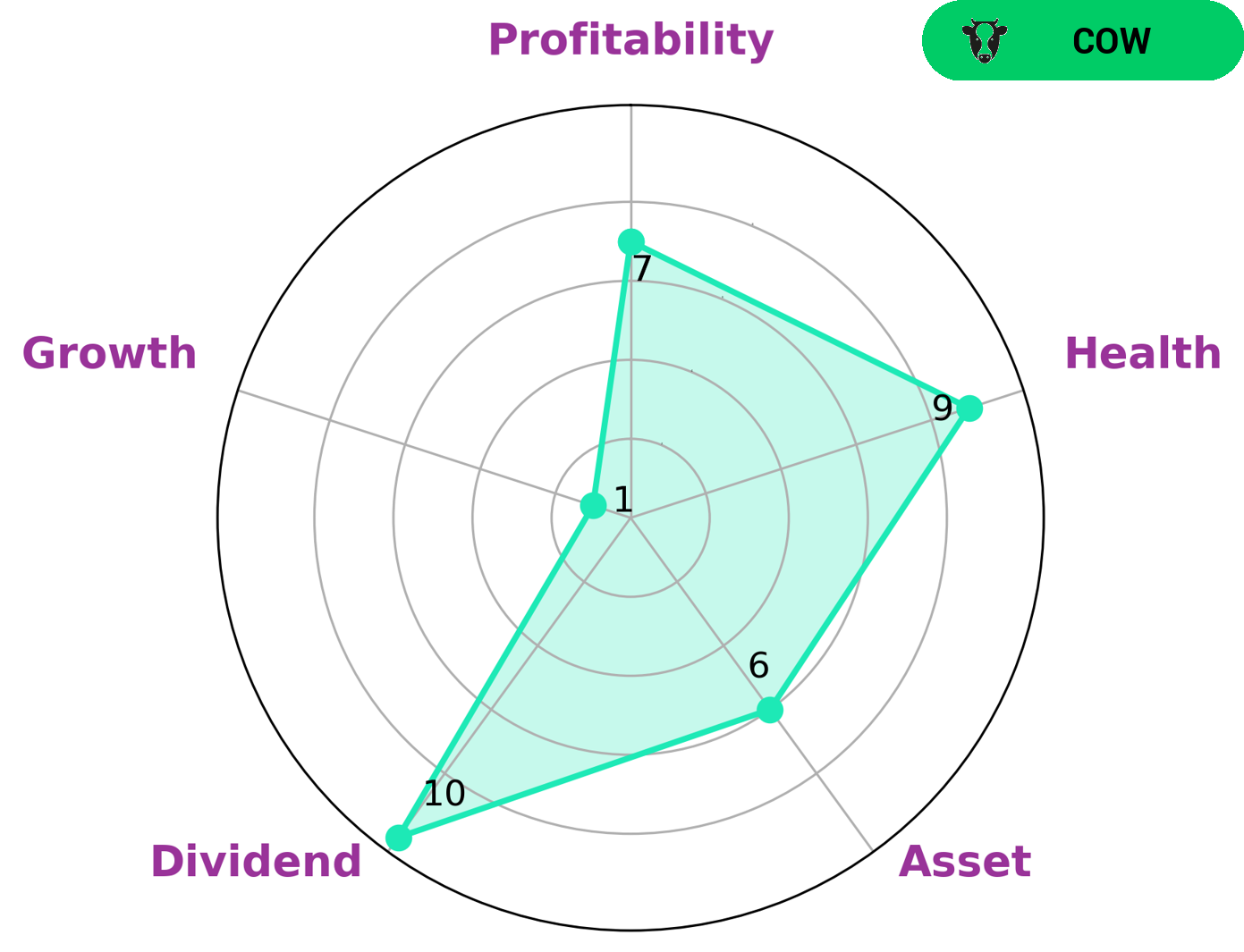

At GoodWhale, we conducted an analysis of MANPOWERGROUP INC‘s financials to determine its strengths, weaknesses, and overall financial health. According to our Star Chart, MANPOWERGROUP INC is strong in dividend and profitability, medium in asset, and weak in growth. We classified MANPOWERGROUP INC as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes MANPOWERGROUP INC attractive to conservative investors who seek stable returns with minimal risk. In addition, MANPOWERGROUP INC has a high health score of 9/10, indicating that it is capable to pay off debt and fund future operations. This makes it a great long-term investment for investors who are looking for a reliable source of income. Therefore, we believe that MANPOWERGROUP INC is an excellent choice for conservative investors seeking to build a diversified portfolio. More…

Peers

Its competitors include Robert Half International Inc, Randstad NV, and Kelly Services Inc.

– Robert Half International Inc ($NYSE:RHI)

Robert Half International Inc. is a provider of professional staffing and consulting services. The company operates through three segments: Accountemps, Robert Half Finance & Accounting, and Robert Half Management Resources. The Accountemps segment provides temporary professional accounting and finance personnel. The Robert Half Finance & Accounting segment provides permanent placement professional accounting and finance personnel. The Robert Half Management Resources segment provides temporary and project professional management personnel. The company was founded in 1948 and is headquartered in Menlo Park, California.

– Randstad NV ($LTS:0NW2)

Randstad is a provider of human resources services. It is headquartered in the Netherlands and has over 4,800 offices in 40 countries. The company offers temporary and permanent staffing, outsourcing, and consulting services. It also provides a range of HR solutions, including payroll, benefits, and training.

– Kelly Services Inc ($NASDAQ:KELYA)

Kelly Services, Inc. is a provider of workforce solutions. The Company offers a range of services, including permanent, temporary and contract placement; outsourcing and consulting; and talent management solutions. It serves customers in a range of industries, including automotive, finance and accounting, healthcare, information technology, life sciences, manufacturing and office. The Company operates through three segments: Americas Staffing, International Staffing and Talent Solutions. The Company’s Americas Staffing segment provides staffing and human resource solutions to a range of customers throughout the United States, Canada and Puerto Rico. The International Staffing segment provides staffing solutions to a range of customers in approximately 30 countries. The Talent Solutions segment provides contract-based professional placement, managed service programs and outplacement services.

Summary

Investors should take note of MANPOWERGROUP INC’s FY2022 fourth quarter report, released on January 31 2023. Revenue experienced a sharp decline of 56.2%, compared to the same quarter the year prior. Net income also showed a decrease of 10.6%.

Given these results, investors should be cautious when considering investing in the company. It is important to monitor future developments to gain a better understanding of how the company will fare in the coming months and quarters.

Recent Posts