MAGNACHIP SEMICONDUCTOR Reports Fourth Quarter FY2022 Earnings Results on February 16, 2023

February 25, 2023

Earnings Overview

On February 16, 2023, MAGNACHIP SEMICONDUCTOR ($NYSE:MX) announced their earnings figures for the fourth quarter of FY2022, ending on December 31, 2022. Revenue totaled USD 3.0 million, representing a decrease of 94.5% year-over-year. Net income decreased by 44.7%, with the company reporting USD 61.0 million for the quarter.

Transcripts Simplified

Revenue from Power business in Q4 was $46.3 million, down 18% sequentially and 20.5% year-over-year. Gross profit margin in Q4 was 26.4%, down from 35% in Q4 2021, but up from 24.2% in Q3 2022. Q4 SG& A was $12.6 million and Q4 R& D was $13.7 million. Q4 operating loss was $10.1 million, compared to an operating loss of $10 million in Q3 and an operating income of $63.9 million in Q4 2021.

On a non-GAAP basis, Q4 adjusted operating loss was $8.6 million compared to adjusted operating loss of $6.6 million in Q3 and adjusted operating income of $14.4 million in Q4 last year. Q4 adjusted EBITDA was negative $4.8 million.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Magnachip Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 337.66 | -8.04 | -1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Magnachip Semiconductor. More…

| Operations | Investing | Financing |

| 5.17 | -24.93 | -12.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Magnachip Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 516.64 | 88.49 | 9.27 |

Key Ratios Snapshot

Some of the financial key ratios for Magnachip Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -24.7% | 1.7% | -0.5% |

| FCF Margin | ROE | ROA |

| -5.5% | -0.3% | -0.2% |

Price History

On Thursday, MAGNACHIP SEMICONDUCTOR stock opened at $10.2 and closed at $10.3, representing a 0.8% increase from the previous day’s close of $10.2. The company’s gross margins have been declining over the past few quarters due to higher production costs, but the company is optimistic that they will return to pre-pandemic levels over time. The company has recently increased its investments in research and development and is also looking to capitalize on the growing demand for semiconductor manufacturing and related services in the global market.

Overall, MAGNACHIP SEMICONDUCTOR has reported solid fourth quarter results, demonstrating the resilience of their business model in the face of market volatility. The company is well positioned to continue to generate strong returns in the coming year as it focuses on expanding its customer base and investing in new technologies. Live Quote…

Analysis

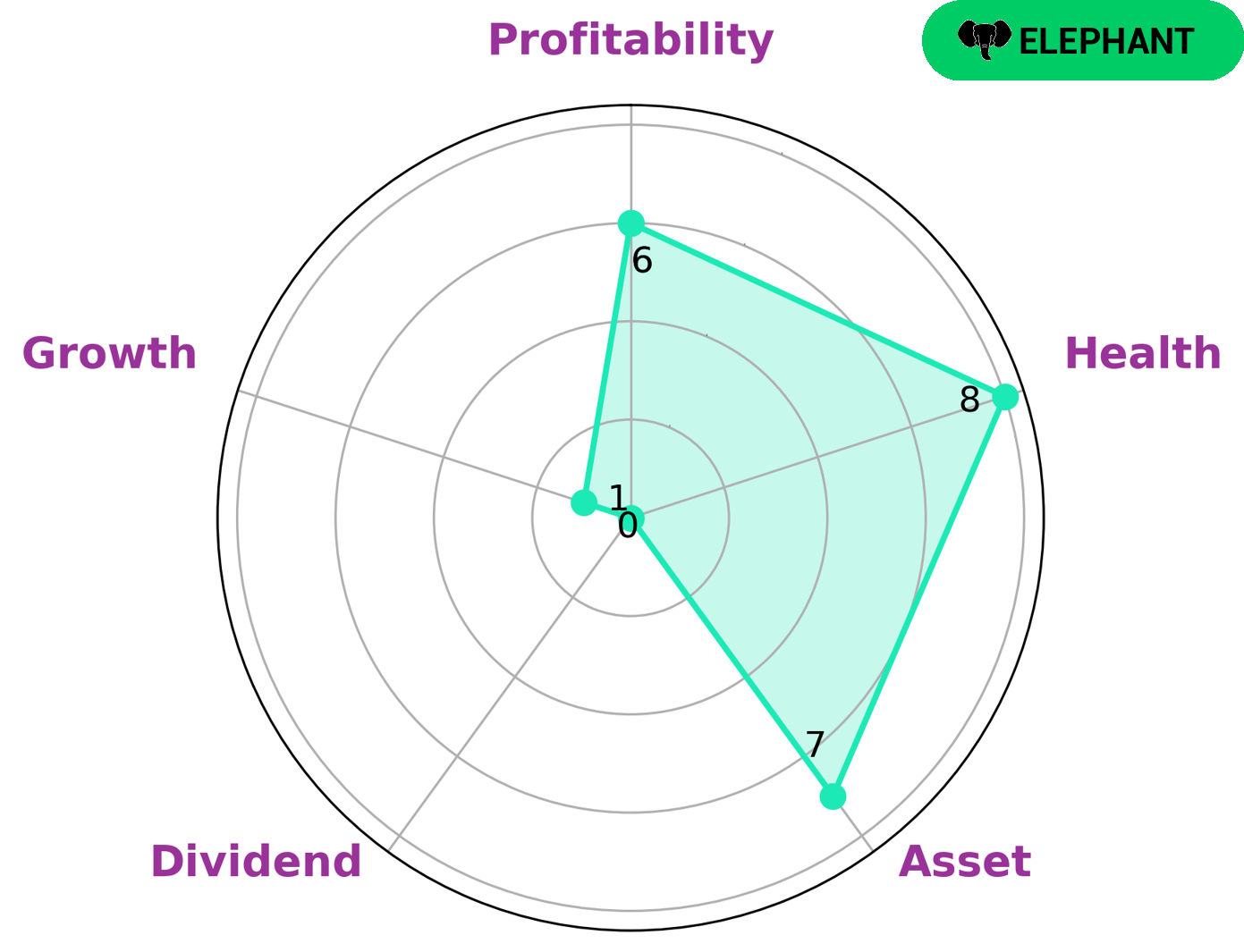

GoodWhale has done an analysis of MAGNACHIP SEMICONDUCTOR‘s financials and the results have been encouraging. According to the Star Chart, MAGNACHIP SEMICONDUCTOR has a very high health score of 8/10. This indicates that the company has a secure cash flow and can weather any crisis, without the risk of bankruptcy. Furthermore, MAGNACHIP SEMICONDUCTOR is classified as an ‘elephant’, which means that its assets outweigh its liabilities. It also scores moderately in terms of profitability and growth, but is weak when it comes to dividends. This type of company could be attractive to a range of investors, especially those looking for secure investments with a strong financial base, as well as those seeking a reliable stream of income in the form of dividends. Its strong asset base also makes it a sound choice for those investors seeking long-term stocks with the potential for growth. More…

Peers

MagnaChip Semiconductor Corp is in the business of designing, manufacturing, and marketing analog and mixed-signal semiconductor products. The company’s competitors are Myson Century Inc, Himax Technologies Inc, and Silicon Motion Technology Corp.

– Myson Century Inc ($TPEX:5314)

MySON Century Inc is a small-cap company with a market cap of 246M as of 2022. The company has a negative ROE of -10.5%. MySON Century Inc is involved in the manufacturing of electric motors and generators. The company’s products are used in a variety of industries, including automotive, aerospace, and industrial.

– Himax Technologies Inc ($NASDAQ:HIMX)

Himax Technologies Inc is a fabless semiconductor company that designs, develops, and markets drivers and other chips for flat panel displays, consumer electronics, and other applications. The company’s market cap is $965.61M and its ROE is 48.79%. Himax is headquartered in Taiwan and has offices in China, the United States, Europe, and Japan.

– Silicon Motion Technology Corp ($NASDAQ:SIMO)

The company’s market cap is 1.92B as of 2022. The company has a ROE of 34.09%. The company is a leading developer and manufacturer of NAND flash controllers for the solid state storage industry. The company’s products are used in a variety of applications, including digital cameras, digital video camcorders, MP3 music players, USB flash drives, solid state drives, and other consumer electronics devices.

Summary

Investors in MAGNACHIP SEMICONDUCTOR should take note of the company’s financial results for their fourth quarter of FY2022. Total revenue was reported as USD 3.0 million for the quarter, a decrease of 94.5% compared to the same quarter of the previous year. Net income for the quarter was reported as USD 61.0 million, a decline of 44.7%.

These results indicate a significant impact on the company’s finances due to the challenging economic environment in the fourth quarter of FY2022. Going forward, investors should monitor the performance of MAGNACHIP SEMICONDUCTOR as the effects of the pandemic remain uncertain.

Recent Posts