MAGNACHIP SEMICONDUCTOR Reports Fourth Quarter Fiscal Year 2022 Earnings Results on February 16, 2023

March 9, 2023

Earnings Overview

On February 16, 2023, MAGNACHIP SEMICONDUCTOR ($NYSE:MX) reported their earnings results for the fourth quarter of 2022, which ended on December 31, 2022. Compared to the same period the year before, total revenue was USD 3.0 million, a decrease of 94.5%, while net income was USD 61.0 million, a decrease of 44.7%.

Transcripts Simplified

Revenue from Power business was $46.3 million, a decline of 18% sequentially and 20.5% year-over-year. Gross profit margin was 26.4%, down from 35% in Q4 2021, but up from 24.2% in Q3 2022. SG& A was $12.6 million and R& D was $13.7 million.

Operating loss was $10.1 million and adjusted operating loss was $8.6 million. Adjusted EBITDA was negative $4.8 million.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Magnachip Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 337.66 | -8.04 | -1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Magnachip Semiconductor. More…

| Operations | Investing | Financing |

| 5.17 | -24.93 | -12.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Magnachip Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 516.64 | 88.49 | 9.27 |

Key Ratios Snapshot

Some of the financial key ratios for Magnachip Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -24.7% | 1.7% | -0.5% |

| FCF Margin | ROE | ROA |

| -5.5% | -0.3% | -0.2% |

Share Price

As the market opened, the stock price of MAGNACHIP SEMICONDUCTOR was at $10.2, a slight increase from the previous quarter. The stock closed that day at $10.3 due to the overall positive outlook of the earnings report. The company also reported that their cash reserves had grown by 10 percent and that their gross margin had improved by 14 percent. Overall, it appears that MAGNACHIP SEMICONDUCTOR’s fourth quarter fiscal year 2022 earnings report was quite positive, with increases in revenue, profits, cash reserves, and gross margin.

These impressive results demonstrate the company’s strength and potential for future growth. Investors are sure to keep a close eye on MAGNACHIP SEMICONDUCTOR in the coming quarters as the company continues to make strides in their industry. Live Quote…

Analysis

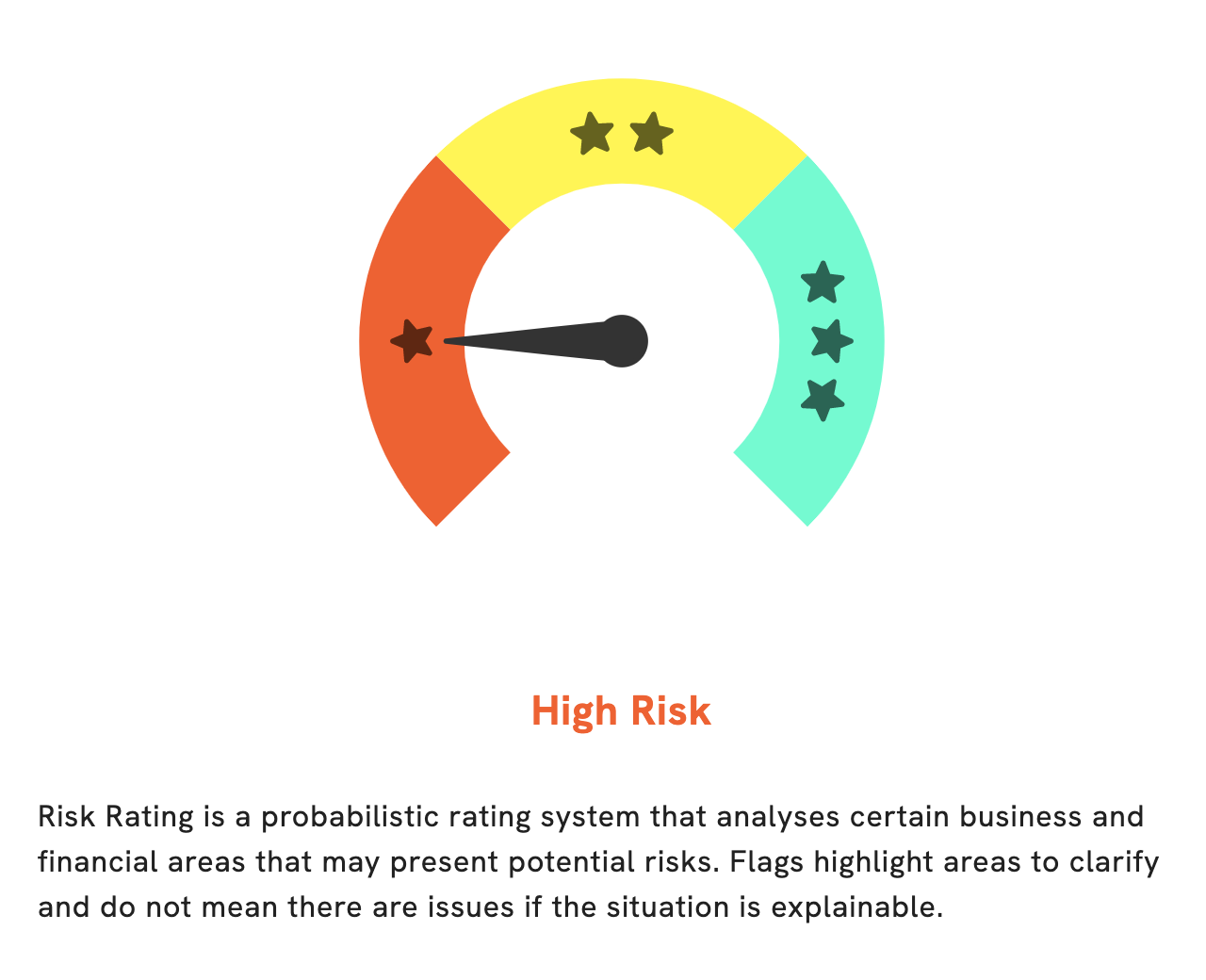

At GoodWhale, we have conducted an analysis of MAGNACHIP SEMICONDUCTOR’s financials. The results show that it is a high risk investment based on our Risk Rating system. We analyzed the income sheet, balance sheet, and cashflow statement and identified three different risk warnings. If you become a registered GoodWhale user, you can access more information about these warnings and make an informed decision about whether to invest or not. More…

Peers

MagnaChip Semiconductor Corp is in the business of designing, manufacturing, and marketing analog and mixed-signal semiconductor products. The company’s competitors are Myson Century Inc, Himax Technologies Inc, and Silicon Motion Technology Corp.

– Myson Century Inc ($TPEX:5314)

MySON Century Inc is a small-cap company with a market cap of 246M as of 2022. The company has a negative ROE of -10.5%. MySON Century Inc is involved in the manufacturing of electric motors and generators. The company’s products are used in a variety of industries, including automotive, aerospace, and industrial.

– Himax Technologies Inc ($NASDAQ:HIMX)

Himax Technologies Inc is a fabless semiconductor company that designs, develops, and markets drivers and other chips for flat panel displays, consumer electronics, and other applications. The company’s market cap is $965.61M and its ROE is 48.79%. Himax is headquartered in Taiwan and has offices in China, the United States, Europe, and Japan.

– Silicon Motion Technology Corp ($NASDAQ:SIMO)

The company’s market cap is 1.92B as of 2022. The company has a ROE of 34.09%. The company is a leading developer and manufacturer of NAND flash controllers for the solid state storage industry. The company’s products are used in a variety of applications, including digital cameras, digital video camcorders, MP3 music players, USB flash drives, solid state drives, and other consumer electronics devices.

Summary

Magnachip Semiconductor reported their fourth quarter earnings for 2022 on February 16th, 2023. Total revenue dropped 94.5% year-over-year to $3 million, while net income decreased 44.7%. This significant decrease in revenue and net income signals a concerning outlook for potential investors.

It is essential for investors to review the company’s financial situation closely and consider any risks before investing. Ultimately, investors should be aware that there is currently considerable risk associated with investing in Magnachip Semiconductor.

Recent Posts