LUCARA DIAMOND Reports Q1 FY2023 Earnings Results on May 11th

May 31, 2023

☀️Earnings Overview

On May 11 2023, LUCARA DIAMOND ($TSX:LUC) reported its earnings results for the first quarter of FY2023, which ended on March 31 2023. Total revenue decreased by 37.3%, from the same period in the previous fiscal year, amounting to USD 42.8 million, and net income decreased by 95.0%, amounting to USD 0.95 million.

Share Price

On May 11th, LUCARA DIAMOND reported its Q1 FY2023 earnings results. The company’s stock opened at CA$0.5 and closed at CA$0.5, registering a 1.9% drop from its prior closing price of 0.5. This was a much lower performance than the market had anticipated. The drop in the stock price could be attributed to the company’s lackluster earnings report. Operating results also declined due to the higher-than-anticipated costs related to the company’s research and development projects. In addition, the company announced it would be scaling back its operations in some markets in order to reduce overhead costs and focus on more profitable markets. This move is expected to help improve the company’s overall profitability in the coming quarters. Overall, the results from the first quarter of FY2023 were not encouraging for shareholders.

However, investors remain hopeful that the company can make a strong recovery in the near-term and return to profitability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lucara Diamond. More…

| Total Revenues | Net Income | Net Margin |

| 187.5 | 22.42 | 11.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lucara Diamond. More…

| Operations | Investing | Financing |

| 85.86 | -147.21 | 54.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lucara Diamond. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 530.17 | 263.76 | 0.59 |

Key Ratios Snapshot

Some of the financial key ratios for Lucara Diamond are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | 75.6% | 22.8% |

| FCF Margin | ROE | ROA |

| 35.5% | 10.0% | 5.0% |

Analysis

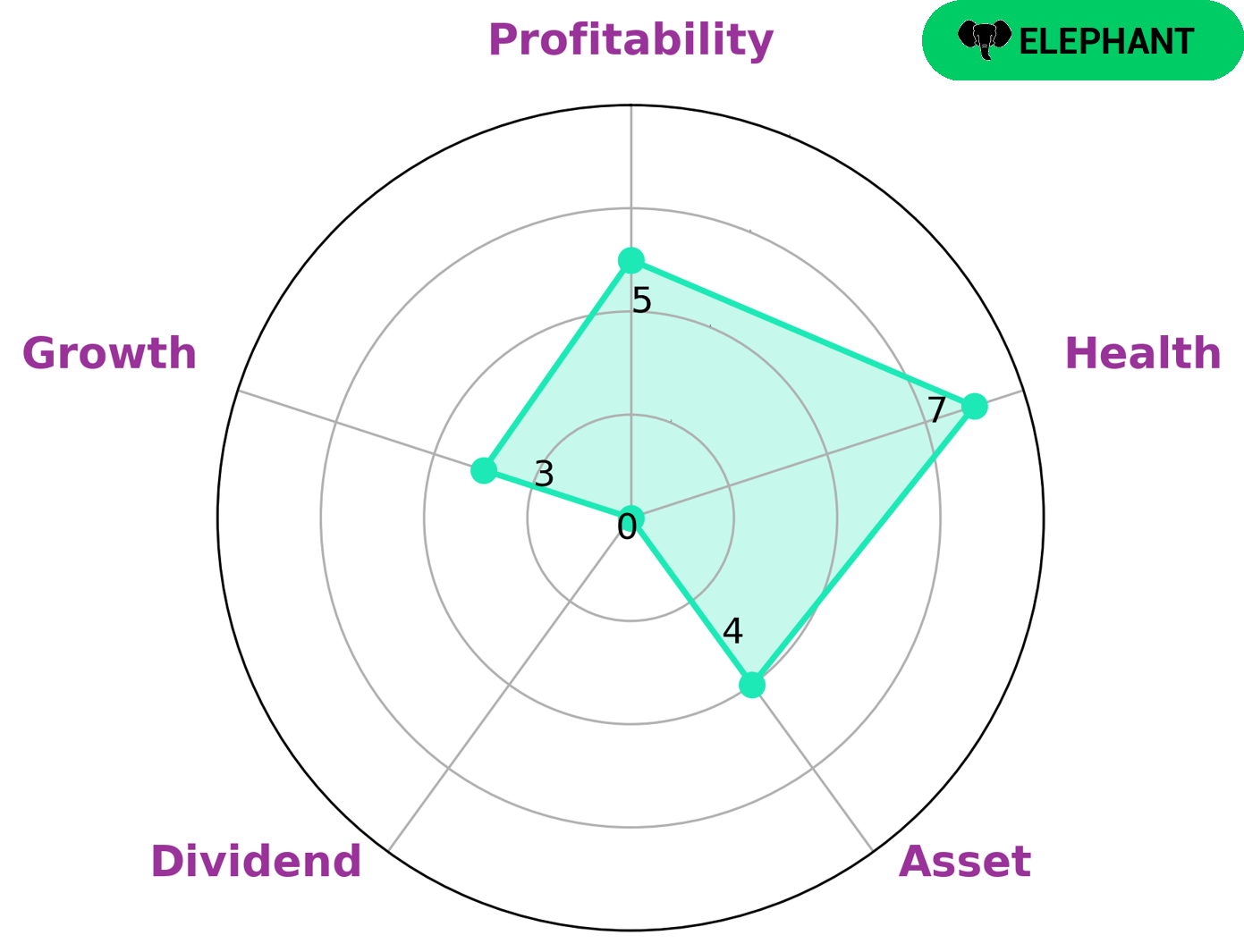

As GoodWhale, we have conducted a comprehensive analysis of LUCARA DIAMOND‘s fundamentals. According to our Star Chart, LUCARA DIAMOND is classified as an ‘elephant’, a type of company that we define as having a strong asset base after deducting off liabilities. As such, this company may be of interest to investors looking for a stable investment. LUCARA DIAMOND is strong in assets, medium in profitability and weak in dividend and growth. Nonetheless, the company has a high health score of 7/10 with respect to its cashflows and debt, indicating that it is capable of sustaining its future operations in times of crisis. More…

Peers

Lucara Diamond Corp is one of the world’s leading diamond producers with operations in Botswana and Canada. The company’s primary competitors are United Paragon Mining Corp, Sylvania Platinum Ltd, and Inception Mining Inc. Lucara Diamond Corp has a market capitalization of $2.3 billion and reported revenue of $1.2 billion in 2020.

– United Paragon Mining Corp ($PSE:UPM)

As of 2022, United Paragon Mining Corp has a market cap of 1.52B and a Return on Equity of 8.78%. The company is engaged in the business of gold and silver mining and processing, and the exploration, development, acquisition and operation of gold and silver properties.

– Sylvania Platinum Ltd ($LSE:SLP)

Sylvania Platinum Ltd is a mining company with a market cap of 253.46M as of 2022. The company has a Return on Equity of 17.89%. Sylvania Platinum Ltd is involved in the mining, processing and sale of platinum group metals (PGMs) and associated minerals.

– Inception Mining Inc ($OTCPK:IMII)

Inception Mining, Inc. is engaged in the business of mining, exploring, and developing mineral properties. The company holds properties in Idaho, Montana, and Nevada in the United States; and in Guatemala and Mexico. Inception Mining, Inc. was founded in 2006 and is headquartered in Coeur d’Alene, Idaho.

Inception Mining has a market capitalization of $342,490 as of 2022 and a return on equity of 0.85%. The company is engaged in mining, exploring, and developing mineral properties in the United States, Guatemala, and Mexico.

Summary

LUCARA DIAMOND, a diamond mining company, recently released its first quarter financial results for FY2023 ending March 31 2023. Revenue decreased by 37.3% year-over-year to USD 42.8 million and net income decreased by 95.0% to USD 0.95 million. This has been a difficult period for the company due to factors such as the global pandemic, global economic crisis, and diamond market uncertainties.

Investors should be aware of the risks related to investing in this sector and should closely monitor the company’s future performance. LUCARA DIAMOND is taking steps to minimize the impact of these headwinds on their operations and investors should be aware of these initiatives when considering investing in the company.

Recent Posts