LINTEC CORPORATION Reports Third Quarter FY2023 Earnings Results for Period Ending February 13 2023

March 25, 2023

Earnings Overview

LINTEC CORPORATION ($TSE:7966) announced their earnings results for the third quarter of FY2023 on December 31 2022, which ended on February 13 2023. Compared to the same period in the previous year, total revenue decreased by 50.2%, whereas net income increased by 10.0%.

Market Price

The company’s shares opened at JP¥2197.0 and closed at JP¥2147.0, down by 2.5% from the prior closing price of 2202.0. LINTEC CORPORATION‘s management expressed optimism about the outlook for the fourth quarter. They noted that strong demand in the automotive industry is expected to help drive growth, along with new product launches and initiatives to improve cost structure. Overall, investors seemed to be generally pleased with LINTEC CORPORATION’s third quarter performance, though there were some concerns about future earnings prospects given the company’s current financial position. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lintec Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 282.14k | 14.34k | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lintec Corporation. More…

| Operations | Investing | Financing |

| 10.46k | -16.05k | -16.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lintec Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 323.34k | 94.82k | 3.29k |

Key Ratios Snapshot

Some of the financial key ratios for Lintec Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | 4.1% | 7.0% |

| FCF Margin | ROE | ROA |

| -0.4% | 5.4% | 3.8% |

Analysis

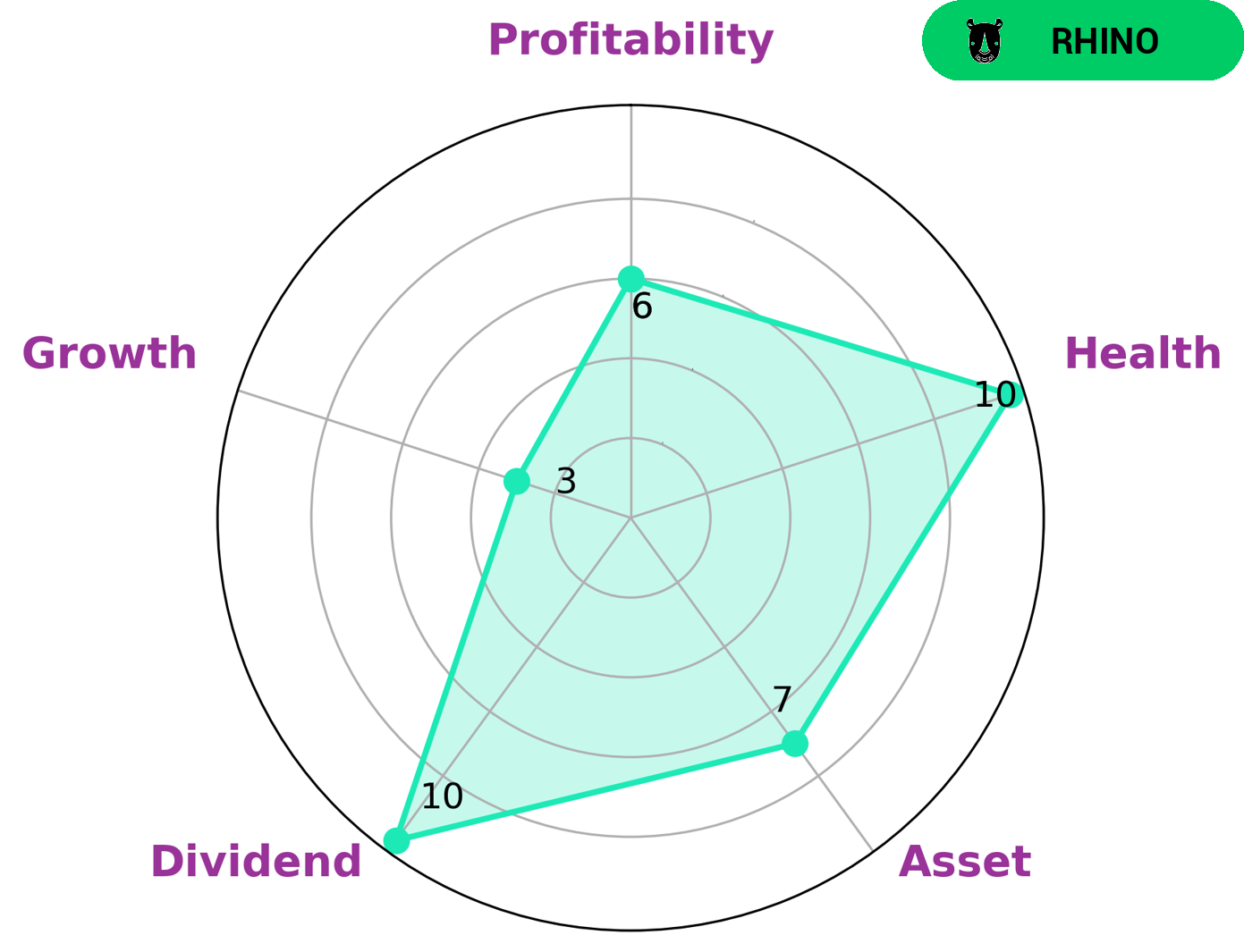

At GoodWhale, we’ve been analyzing the financials of LINTEC CORPORATION and have determined that they are classified as a ‘rhino’. This means that they have achieved moderate revenue or earnings growth and are a good candidate for investors looking for stability. LINTEC CORPORATION is an attractive company, with strengths in asset, dividend and medium profitability. Although they may be weak in terms of growth, they have a high health score of 10/10, indicating that they are capable to safely ride out any crisis without the risk of bankruptcy. Overall, LINTEC CORPORATION is an attractive company for investors who prioritize stability and financial health, and who are willing to accept moderate growth in exchange. More…

Peers

The competition between LINTEC Corp and its competitors, Arakawa Chemical Industries Ltd, Central Global Bhd, and Shanghai Smith Adhesive New Material Co Ltd, is heating up as each company strives to secure the upper hand in the market. With new innovations and cutting-edge technology, each of these companies is pushing the boundaries of what’s possible and providing customers with the best possible products and services.

– Arakawa Chemical Industries Ltd ($TSE:4968)

Arakawa Chemical Industries Ltd is a multinational chemical and pharmaceuticals company headquartered in Japan. It is one of the largest chemical companies in the country. As of 2023, the company has a market capitalization of 19.48 billion dollars, indicating its size and significance in the industry. Additionally, the company has a negative return on equity of -0.29%, which suggests that the company is not generating sufficient profits to cover its shareholders’ investments. Arakawa Chemical Industries Ltd produces a range of chemical products, including agricultural chemicals, petrochemicals, and specialty chemicals. They also produce pharmaceuticals and have a wide range of research projects.

– Central Global Bhd ($KLSE:8052)

Central Global Bhd is a Malaysian-based company that provides financial services, including banking and insurance. The company has a market capitalization of 151.48 million Malaysian Ringgit as of 2023, which reflects the total value of its outstanding shares. Central Global’s Return on Equity (ROE) is 11.49%, which is a measure of the company’s profitability. This indicates that the company is able to generate an above-average return on its shareholders’ investments. The company has managed to maintain a consistent ROE despite the competitive environment in the financial services industry, indicating strong competitive advantages.

– Shanghai Smith Adhesive New Material Co Ltd ($SHSE:603683)

Shanghai Smith Adhesive New Material Co Ltd is a leading Chinese manufacturer and supplier of adhesives and sealants, specializing in the production of a wide range of products. As of 2023, the company has a market cap of 1.96B and a Return on Equity (ROE) of 2.46%. The company’s market cap is indicative of its strong competitive position in the Chinese adhesive market, and its ROE suggests that the company is able to generate a healthy return on investments.

Summary

Investors considering LINTEC CORPORATION should note that the company reported a decrease in revenue of 50.2% for the third quarter of FY2023 compared to the same period in the previous year. However, the company’s net income increased by 10.0% over the same time period, indicating that it has been able to create profits despite the challenging market conditions. Additionally, LINTEC CORPORATION has taken measures to strengthen its operations, which indicates potential for improved financial performance in the future. Taking all this into account, investors may find that LINTEC CORPORATION is a worthy investment.

Recent Posts