LINDE PLC Reports 29.1% Increase in Total Revenue for Q4 2022 with USD 1.3B Earnings.

February 22, 2023

Earnings Overview

On February 7 2023, LINDE PLC ($NYSE:LIN) reported its quarterly earnings results for the fourth quarter of fiscal year 2022, totaling USD 1.3 billion in revenue, a 29.1% increase from the same period in the previous year. Net income for the quarter, however, dropped by 4.8% year over year, to USD 7.9 billion.

Transcripts Simplified

Linde achieved record financial performance in 2022, including operating margin, EPS, and ROC all reaching record highs. $7 billion was returned to owners in the form of dividends and share repurchases. Linde also implemented environmental initiatives that included 50 additional zero-waste sites, reducing greenhouse gas emissions by 1 million tons of CO2, and investing in energy transition. On the human capital front, they achieved double-digit improvements in safety performance and developed programs to increase gender diversity to 30% by 2030. They also supported 500 community engagement projects and donated over $10 million to charitable and STEM programs.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Linde Plc. More…

| Total Revenues | Net Income | Net Margin |

| 33.36k | 4.15k | 12.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Linde Plc. More…

| Operations | Investing | Financing |

| 8.86k | -3.09k | -3.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Linde Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 79.66k | 38.27k | 81.27 |

Key Ratios Snapshot

Some of the financial key ratios for Linde Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.7% | 25.5% | 16.8% |

| FCF Margin | ROE | ROA |

| 17.1% | 9.0% | 4.4% |

Price History

On Tuesday, LINDE PLC reported its fourth quarter results for 2022 and the results are impressive. The company reported a total revenue of $1.3 billion, up 29.1% from the same period last year. This was achieved despite the challenging global economic environment in which most companies have been struggling. The stock price of LINDE PLC also saw a surge on Tuesday. It opened at $318.9 and closed at $337.1, up by 4.4% from the previous closing price of $322.9. This indicates that investors are optimistic about the company’s future performance.

LINDE PLC has seen significant growth over the past year, driven by an increase in demand for its products and services. The company has also been able to reduce costs, which has added to its bottom line. The strong financial performance of LINDE PLC underscores its ability to deliver consistent and sustainable growth in the future. The company will be looking to capitalize on this momentum in order to grow further and become one of the leading players in its industry. Live Quote…

Analysis

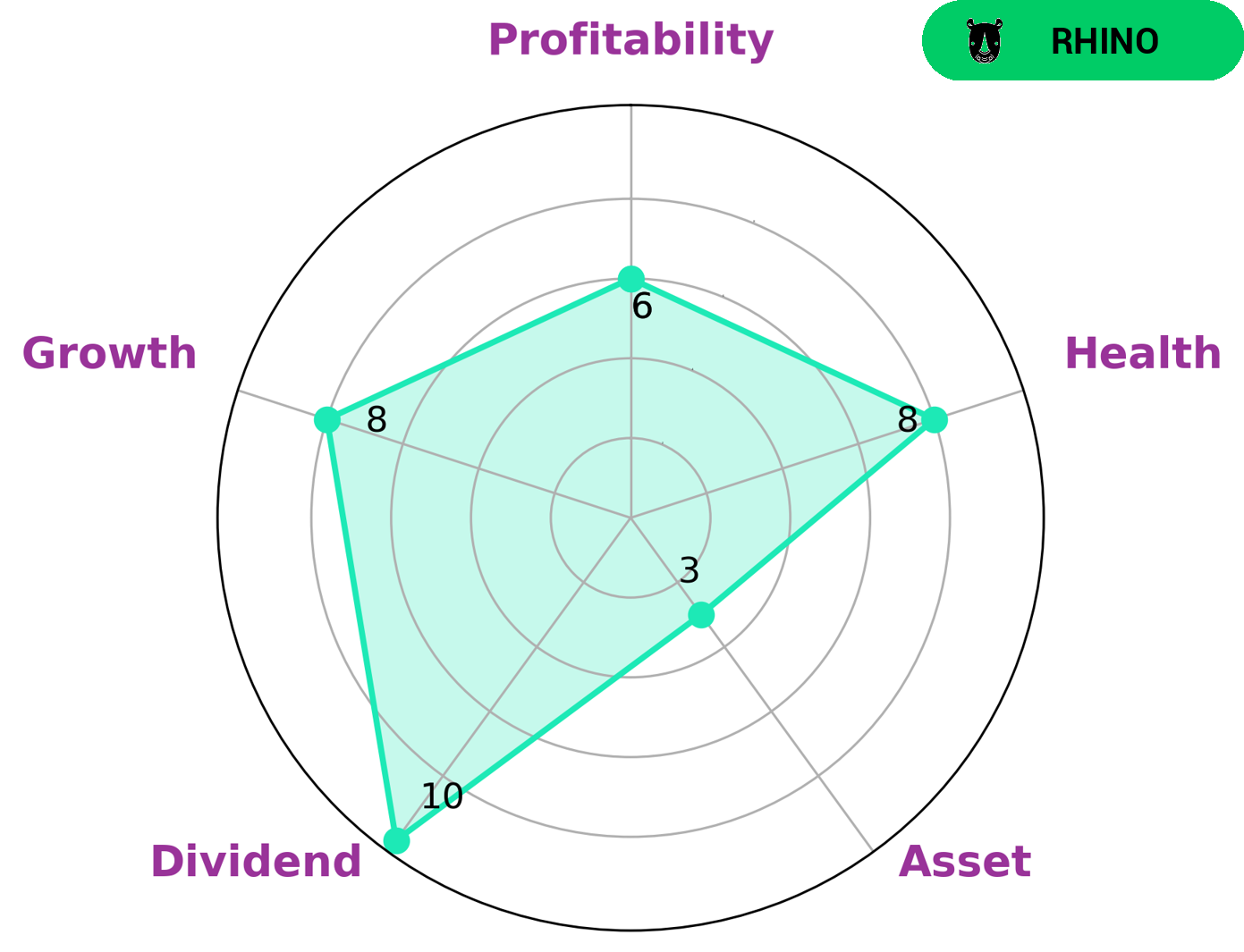

GoodWhale has conducted an analysis of LINDE PLC‘s wellbeing. We used our Star Chart system to measure their health score, rating them 8 out of 10, indicating a strong cash flow and no risk of bankruptcy. Based on this score, LINDE PLC is classified as a ‘rhino’, which is a company that has achieved moderate revenue or earnings growth. We believe that an investor looking for a solid dividend will find LINDE PLC a promising option. The company also shows some potential for growth, although the profitability is only average. The assets of LINDE PLC, however, are deemed as weak. Despite this, investors who are looking for growth and dividends may find LINDE PLC promising. More…

Peers

The company operates in more than 100 countries and serves customers in a wide range of industries, from food and beverage to healthcare and chemical manufacturing. Linde’s main competitors are Air Products & Chemicals Inc, Air Liquide SA, and Southern Gas Ltd.

– Air Products & Chemicals Inc ($NYSE:APD)

Air Products & Chemicals Inc is an international industrial gases company. Headquartered in Allentown, Pennsylvania, in the United States, the company has operations in over 50 countries, and serves customers in a wide range of industries including chemicals, energy, electronics, food and beverage, healthcare, manufacturing, metals, and others.

The company has a market capitalization of $53.55 billion as of 2022 and a return on equity of 12.98%. Air Products & Chemicals Inc is a leading supplier of industrial gases and related equipment, and is one of the world’s leading producers of hydrogen. The company also produces a variety of other gases, including nitrogen, oxygen, and argon. In addition to gas production, Air Products & Chemicals Inc also provides engineering and construction services for a variety of industries.

– Air Liquide SA ($OTCPK:AIQUF)

Air Liquide SA is a French multinational company that supplies industrial gases and services to various industries. The company has a market cap of 62.29B as of 2022 and a Return on Equity of 11.4%. The company’s products and services include oxygen, nitrogen, hydrogen, carbon dioxide, and other gases. Air Liquide SA also offers welding, medical, and food-grade gases.

– Southern Gas Ltd ($BSE:509910)

Southern Gas Ltd is a gas distribution company that serves the southern United States. The company has a market capitalization of $2.66 million and a return on equity of 4.12%. Southern Gas is a publicly traded company listed on the New York Stock Exchange.

Summary

The latest earnings report from LINDE PLC showed that the company achieved total revenue of USD 1.3 billion for the fourth quarter of FY 2022, a notable increase of 29.1% year-over-year. Net income declined slightly by 4.8% to USD 7.9 billion, a less significant decrease than the revenue gains. The stock price reacted positively to the news, moving up on the same day.

From an investment perspective, these results suggest that LINDE PLC is performing well and may be an attractive option for investors. The company appears to have a strong outlook for the future, with potential for further growth.

Recent Posts