Kogeneracja Sa Stock Fair Value Calculation – KOGENERACJA SA Reports Q1 FY2023 Earnings Results for Quarter Ending March 31 2023

May 30, 2023

🌥️Earnings Overview

On May 23 2023, KOGENERACJA SA ($LTS:0LV4) announced their FY2023 Q1 financial results for the quarter ending on March 31 2023. Their total revenue for the quarter was PLN 1112.5 million, marking an 88.8% increase compared to the previous year’s quarter. Net income also posted an impressive growth rate of 184.8%, reaching PLN 213.6 million.

Stock Price

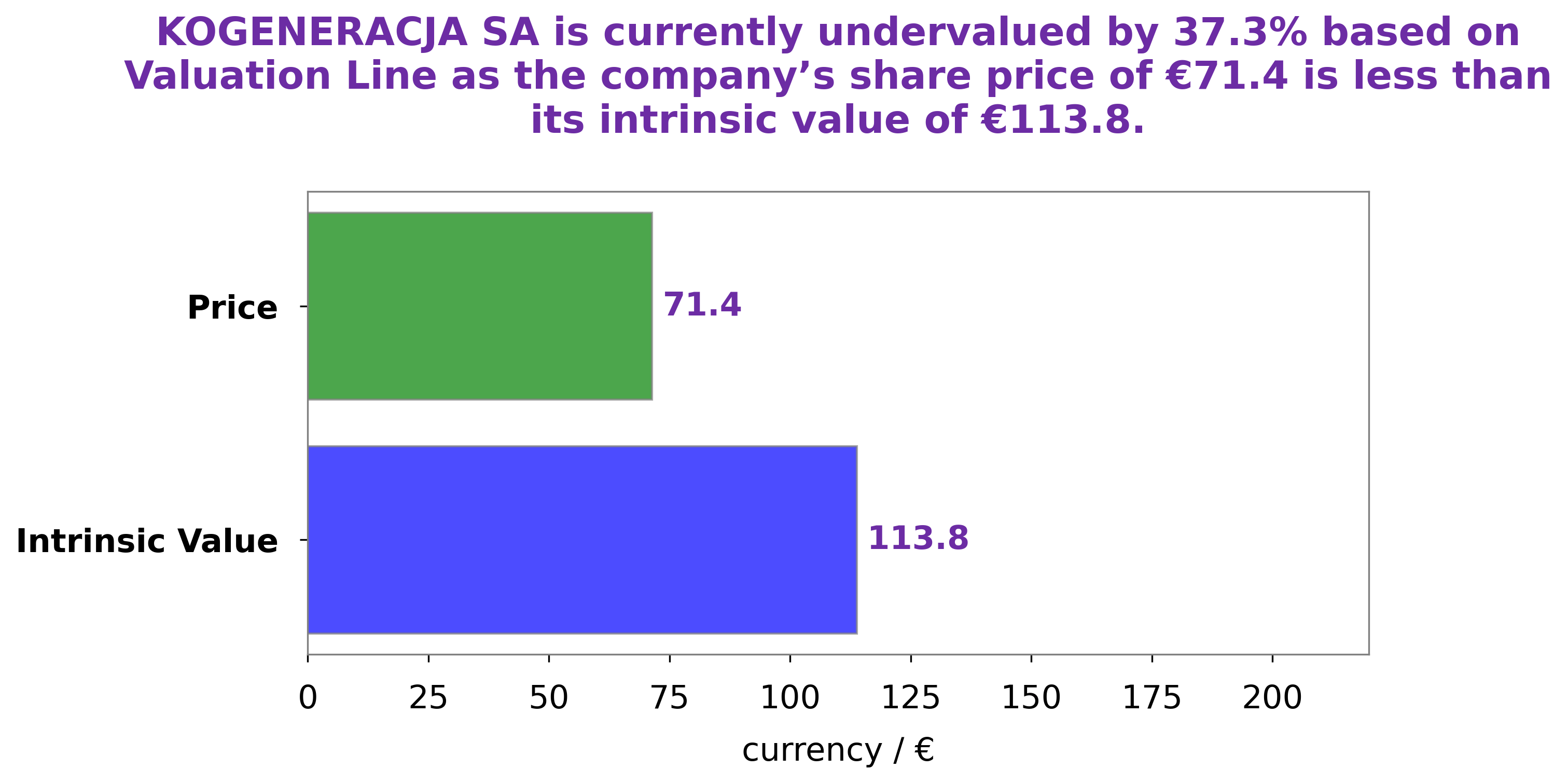

The stock opened at €71.4 and closed at the same price, showing no change on the day. This reduction in operating expenses helped to boost the company’s overall profitability and boost earnings for the quarter. Overall, KOGENERACJA SA reported solid results for the quarter ended March 31, 2023, indicating a strong start to the fiscal year and a positive outlook for the rest of the year. The company’s stock price closed at €71.4, indicating investor confidence in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kogeneracja Sa. More…

| Total Revenues | Net Income | Net Margin |

| 2.34k | 288.13 | 12.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kogeneracja Sa. More…

| Operations | Investing | Financing |

| 727 | -859.34 | 156.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kogeneracja Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.17k | 2.07k | 126.36 |

Key Ratios Snapshot

Some of the financial key ratios for Kogeneracja Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.8% | 23.7% | 15.7% |

| FCF Margin | ROE | ROA |

| 7.9% | 11.5% | 5.5% |

Analysis – Kogeneracja Sa Stock Fair Value Calculation

At GoodWhale, we recently conducted an analysis of KOGENERACJA SA‘s wellbeing. After thorough analysis, we calculated their intrinsic value of KOGENERACJA SA share to be around €113.8 using our proprietary Valuation Line. We found that the stock is currently being traded at €71.4, meaning that it is undervalued by 37.3%. We believe that this could be a great opportunity for investors to purchase the stock at a discounted rate. More…

Peers

All four companies are vying for market share in an increasingly competitive landscape, and are constantly looking for ways to outshine their rivals. Despite the fierce competition among them, Kogeneracja SA remains focused on providing high-quality services and products at competitive prices.

– SRM Energy Ltd ($BSE:523222)

SRM Energy Ltd is a leading India-based energy company that specializes in power generation, transmission, and distribution. SRM Energy Ltd has a market capitalization of 27.9M as of 2023, which reflects the company’s position as one of the most reliable energy companies in the region. SRM Energy Ltd has also exhibited a Return on Equity of 3.18%, indicating that the company is making efficient use of its equity capital to generate significant returns. The company is focused on expanding its operations to new markets in order to become a major player in the energy industry.

– NZ Windfarms Ltd ($NZSE:NWF)

NZ Windfarms Ltd. is a leading provider of wind energy solutions in New Zealand. With a market cap of 38.31M as of 2023, the company has established a strong presence in the energy industry. The company’s Return on Equity (ROE) is 6.07%, indicating a significant return on their investments. NZ Windfarms Ltd. is committed to providing renewable energy solutions that can be used to power homes and businesses across the country. Their focus on sustainability and clean energy makes them an attractive option for investors.

– Energa SA ($BER:EN2)

Energa SA is a power group in Poland which produces, distributes, and trades electricity and heat. As of 2023, the company has a market cap of 726M, indicating the firm’s estimated value calculated by multiplying the number of issued shares by their current market price. This market cap is relatively high in comparison to other companies in the same industry. Additionally, Energa SA has a Return on Equity of 14.55%, which is a measure of profitability and indicates that the company is generating more profits than it is putting into shareholders’ investments. This is an indication that the company is managing its resources efficiently and is providing a good return to shareholders.

Summary

KOGENERACJA SA has reported impressive financial results for the first quarter of FY2023. Total revenue has increased by 88.8% year-on-year, while net income has seen an even more remarkable growth rate of 184.8%. This impressive performance is likely to attract the attention of potential investors.

Analysts are likely to be bullish on KOGENERACJA SA going forward, given the impressive growth trajectories and solid financial footing the company is currently on. Investors should consider KOGENERACJA SA as a potential investment opportunity in the near future, given its promising performance.

Recent Posts