Kite Realty Reports Impressive Earnings, Guidance Raised

May 2, 2023

Trending News ☀️

Kite Realty ($NYSE:KRG) Group Trust recently reported very impressive earnings, blowing past analyst expectations. The company reported adjusted funds from operations (FFO) of $0.51 per share, exceeding analyst estimates by $0.04 per share. On top of this, Kite reported revenue of $206.75M, far exceeding analyst expectations of $6.91M. The strong results led Kite to raise its earnings guidance for the year.

Kite Realty Group Trust is a publicly traded real estate investment trust (REIT) based in Indianapolis, Indiana. The company owns, develops and manages shopping centers, office buildings, and other properties across the United States.

Share Price

Kite Realty Group Trust (KITE REALTY) has recently reported impressive financial results and raised its guidance for the coming quarter. On Monday, KITE REALTY stock opened at $20.6 and closed at $20.5, down by 0.9% from last closing price of 20.7. In light of these positive numbers, KITE REALTY has increased their guidance for the upcoming quarter, expecting a further increase in sales and net income compared to their previous guidance. This news has been welcomed by investors, as it indicates the increasing strength of the company’s financial position and their ability to continue to increase value for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kite Realty. More…

| Total Revenues | Net Income | Net Margin |

| 802 | -12.64 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kite Realty. More…

| Operations | Investing | Financing |

| 379.28 | -45.15 | -312.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kite Realty. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.34k | 3.52k | 17.18 |

Key Ratios Snapshot

Some of the financial key ratios for Kite Realty are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 8.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

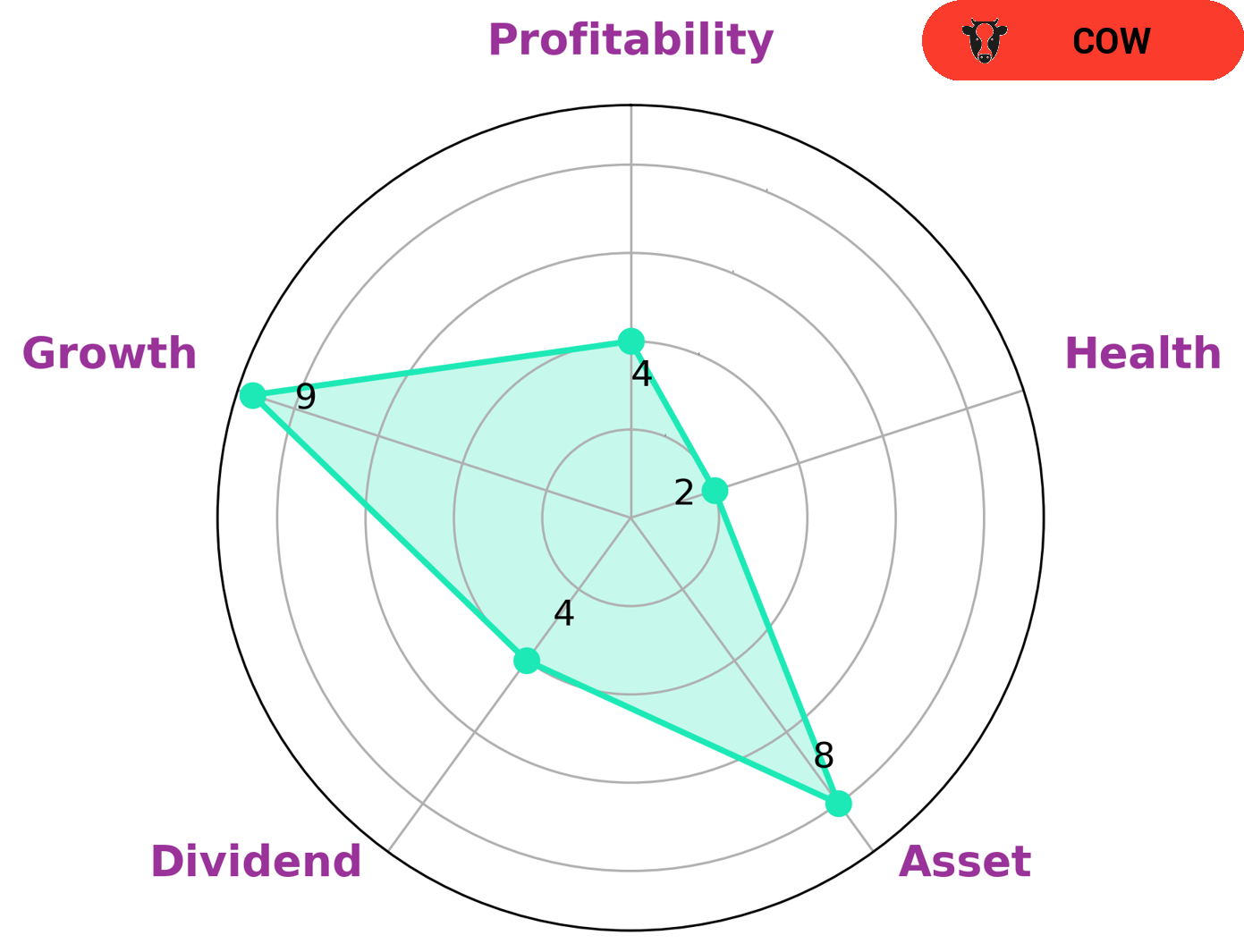

GoodWhale has conducted an analysis of KITE REALTY‘s financials and our Star Chart indicates that the company has a low health score of 2/10 with regards to its cashflows and debt. This suggests that KITE REALTY is less likely to sustain future operations in times of crisis. On the other hand, KITE REALTY is strong in asset and growth, and medium in dividend and profitability. We have classified KITE REALTY as ‘cow’, a type of company which has the track record of paying out consistent and sustainable dividends. Given this information, investors who are looking for stable and consistent returns may be interested in investing in KITE REALTY. These may include those looking for long-term capital growth, income seekers who want regular and reliable dividend payments, or those looking for a balance of capital appreciation and income. More…

Peers

The real estate industry is very competitive, with many companies vying for the same customers. Kite Realty Group Trust is no exception, and must compete against other companies such as Realty Income Corp, Primaris REIT, and Choice Properties Real Estate Investment Trust. While each company has its own strengths and weaknesses, Kite Realty Group Trust strives to provide the best possible service and products to its customers. In doing so, Kite Realty Group Trust hopes to gain a larger share of the market and become the leading real estate company in the industry.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust that owns and operates commercial real estate properties in the United States. The company has a market cap of $40.95 billion as of 2022. Realty Income Corporation is headquartered in San Diego, California.

– Primaris REIT ($TSX:PMZ.UN)

Primaris REIT is a large Canadian real estate investment trust that owns and operates a portfolio of over 40 office, retail, and industrial properties across Canada. The company has a market capitalization of over $1.5 billion as of early 2021. Primaris REIT is headquartered in Toronto, Ontario.

– Choice Properties Real Estate Investment Trust ($TSX:CHP.UN)

Choice Properties Real Estate Investment Trust has a market cap of 4.79B as of 2022. The company focuses on owning, operating, and developing retail and commercial real estate properties in Canada. As of December 31, 2020, the company’s portfolio consisted of 772 properties, including 656 retail properties, 97 office properties, and 19 industrial properties.

Summary

Kite Realty Group Trust (KRG) recently reported an impressive quarter with their FFO beating estimates by 4 cents at $0.51 per share and revenue exceeding expectations by $6.91 million at $206.75 million. The positive results have prompted the company to raise its guidance for the remainder of the year. KRG’s share price has been on a steady rise since last year and its financial metrics indicate a sound investment opportunity.

The company has seen its sales growth while maintaining a balance sheet with low debt and high liquidity. Investors should consider KRG as a safe bet in the REIT space.

Recent Posts