KANZHUN LIMITED Announces Fourth Quarter 2022 Earnings Results for Fiscal Year 2022 on March 20 2023

April 8, 2023

Earnings Overview

KANZHUN LIMITED ($NASDAQ:BZ) reported its financial performance for the fourth quarter of the fiscal year 2022, which ended on December 31, 2022, on March 20, 2023. Total revenue for this quarter was CNY -184.8 million, a decrease of 179.3% compared to the same period in the previous year.

Transcripts Simplified

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kanzhun Limited. More…

| Total Revenues | Net Income | Net Margin |

| 4.51k | 107.25 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kanzhun Limited. More…

| Operations | Investing | Financing |

| 1k | -2.82k | -669.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kanzhun Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.83k | 3.19k | 26.94 |

Key Ratios Snapshot

Some of the financial key ratios for Kanzhun Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 65.3% | – | -2.9% |

| FCF Margin | ROE | ROA |

| 22.2% | -0.7% | -0.5% |

Share Price

The stock opened at $18.5 and closed at $17.8, up by 0.1% from its last closing price of $17.8. This increase in the stock price reflects the positive sentiment of investors towards KANZHUN LIMITED’s overall performance. Analysts are projecting a positive outlook for KANZHUN LIMITED based on the company’s impressive results in the previous quarters and its commitment to growth. As the company continues to invest in research and development, it is anticipated that its fourth quarter earnings report will be even more impressive. KANZHUN LIMITED’s strong showing in the stock market is a result of its strategic business decisions which have enabled the company to stay ahead of industry trends and capitalize on emerging markets.

The company’s focus on innovation and customer satisfaction has made it an attractive investment for shareholders. With a strong outlook for the future, KANZHUN LIMITED’s fourth quarter 2022 earnings results are expected to be an indicator of the company’s long-term success. As the markets continue to fluctuate, investors are likely to keep a close eye on KANZHUN LIMITED’s performance as they seek to maximize their returns. Live Quote…

Analysis

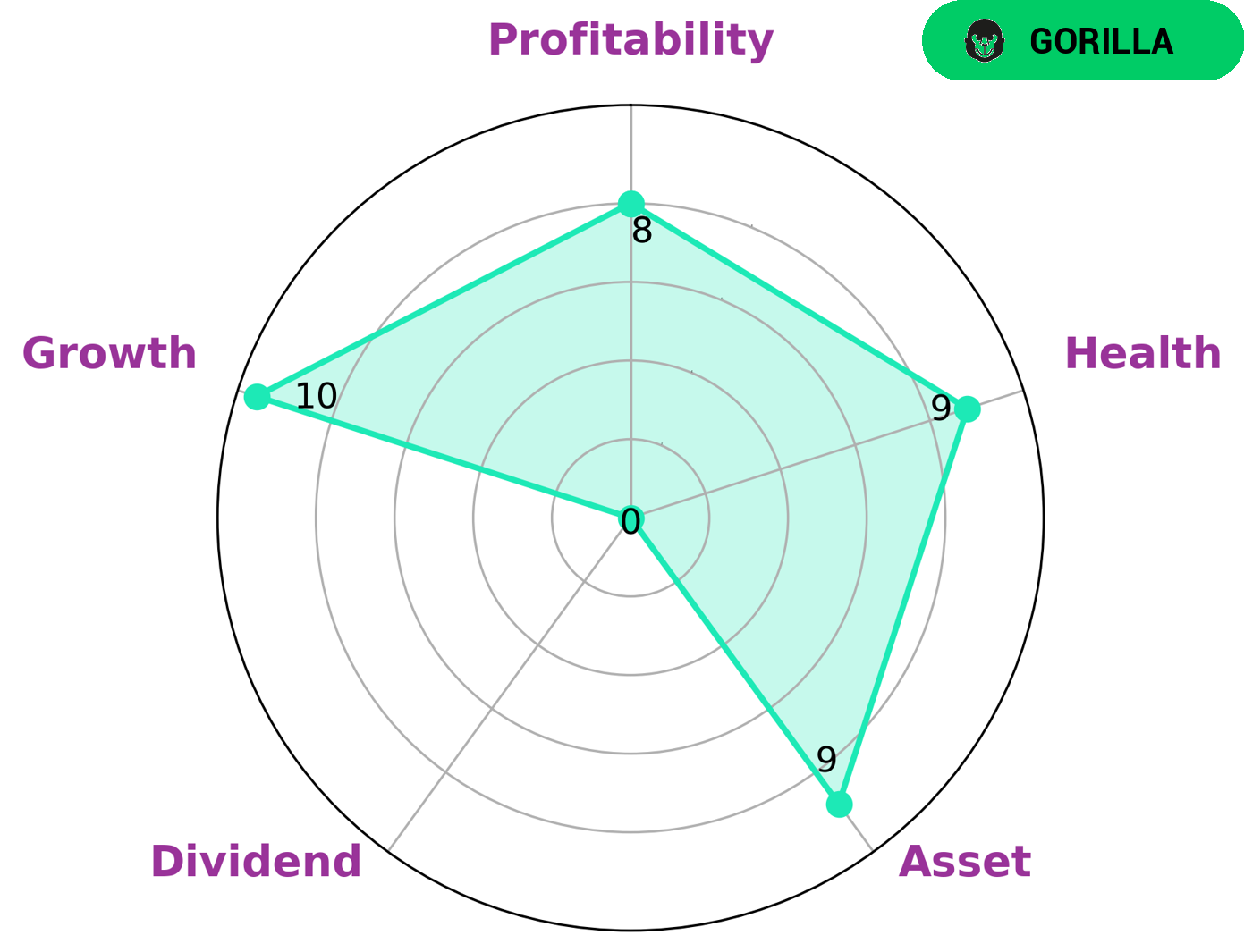

GoodWhale has analyzed KANZHUN LIMITED‘s financials and found that the company has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations in times of crisis. We have classified it as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. KANZHUN LIMITED is strong in asset, growth, and profitability, and weak in dividend. As such, investors who value growth potential and stability would be attracted to this company. Those looking for regular income through dividends may not find KANZHUN LIMITED to be the best fit. However, long-term investors looking to benefit from the aforementioned features may still find themselves interested in investing in this company. More…

Peers

The competition between Kanzhun Ltd and its competitors, such as ZTO Express (Cayman) Inc, Frontier Group Holdings Inc, and JetBlue Airways Corp, is fierce in the current market. All companies are competing to offer the most competitive prices and the best services to their customers in order to gain a larger market share. As a result, the competition between these companies is expected to continue to be intense going forward.

– ZTO Express (Cayman) Inc ($SEHK:02057)

ZTO Express (Cayman) Inc is a leading express delivery company in China, providing express delivery and other value-added logistics services. The company has a market cap of 175.39B as of 2023, and a Return on Equity (ROE) of 9.7%. This market cap and ROE indicate that the company has seen significant growth over the past few years, indicating a positive outlook for its future. ZTO Express has a comprehensive network of express delivery services across China, with over 35,000 courier stations and over 500 million customers. The company has also diversified its business operations to include e-commerce and warehouse services. In addition, it has also invested in various technologies such as big data, cloud computing, and artificial intelligence to provide better customer experience.

– Frontier Group Holdings Inc ($NASDAQ:ULCC)

Frontier Group Holdings Inc is a publicly-traded telecommunications and media company that operates in the United States. The company’s current market capitalization stands at 2.2 billion dollars as of 2023. Frontier Group Holdings Inc’s Return on Equity (ROE) has been a negative 23.77%, which is reflective of their overall financial performance. This is indicative of a decrease in their shareholder’s equity due to greater losses and lower profitability. Frontier Group Holdings Inc is focused on providing integrated communications services for residential and business customers as well as delivering high-speed internet, television, and phone services.

– JetBlue Airways Corp ($NASDAQ:JBLU)

JetBlue Airways Corp is a US-based airline company that offers air travel services to over 100 destinations in the US, Caribbean, Central America, and South America. The company has a market cap of 2.1B as of 2023, indicating that it is a relatively large and established company. JetBlue’s Return on Equity (ROE) stands at -8.81%, which suggests a lack of profitability. This could be caused by a number of factors, including the airline industry’s susceptibility to economic downturns and changes in fuel prices. However, despite this, JetBlue has remained a successful airline with an extensive network of destinations.

Summary

KANZHUN LIMITED reported its earnings results for the fourth quarter of 2022, which ended December 31 2022, on March 20 2023. Total revenue decreased significantly year-over-year by 179.3%, totaling CNY -184.8 million. Net income was lower than the same period a year ago by 0.8%, at CNY 1082.3 million.

For investors, this quarter’s results suggest that KANZHUN LIMITED may not be a particularly good investment option currently, as both top and bottom line declines are cause for caution. As such, investors should take a closer look at the company before making any decisions.

Recent Posts