JOYY INC Reports FY2022 Q4 Earnings Results for Period Ending December 31, 2022

March 30, 2023

Earnings Overview

On March 16 2023, JOYY INC ($NASDAQ:YY) reported its FY2022 Q4 earnings results for the period ending December 31 2022. Total revenue for the quarter was USD -377.5 million, showing a decrease of 615.4% compared to the same period in the prior year. Net income decreased 8.9%, amounting to USD 604.9 million.

Transcripts Simplified

We continued to make investments in our platform and products, which resulted in an increase in our research and development expenses. Sales and marketing expenses increased due to our efforts to further expand our user base and increase user engagement. We also saw an increase in our share-based compensation expenses as part of our strategy to align management and employees with the long-term interests of the company and its shareholders. Looking ahead, we remain focused on driving the top line growth of our existing businesses, while making investments in new products and services, so that we can continue to deliver long-term value for our shareholders.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.41k | 119.47 | -13.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.07k | 3.57k | 74.36 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.9% | -22.5% | 26.8% |

| FCF Margin | ROE | ROA |

| 1.0% | 7.5% | 4.5% |

Share Price

The company’s stock opened for the day at $27.7 and closed at $28.0, up by 3.4% from its prior closing price of $27.1. Looking ahead, JOYY INC‘s management has provided an upbeat outlook despite the current challenging economic environment. The company projects that its revenues for fiscal year 2023 will grow by at least 10% compared to fiscal year 2022. Management also expects continued strong free cash flow and margin expansion over the coming quarters. Live Quote…

Analysis

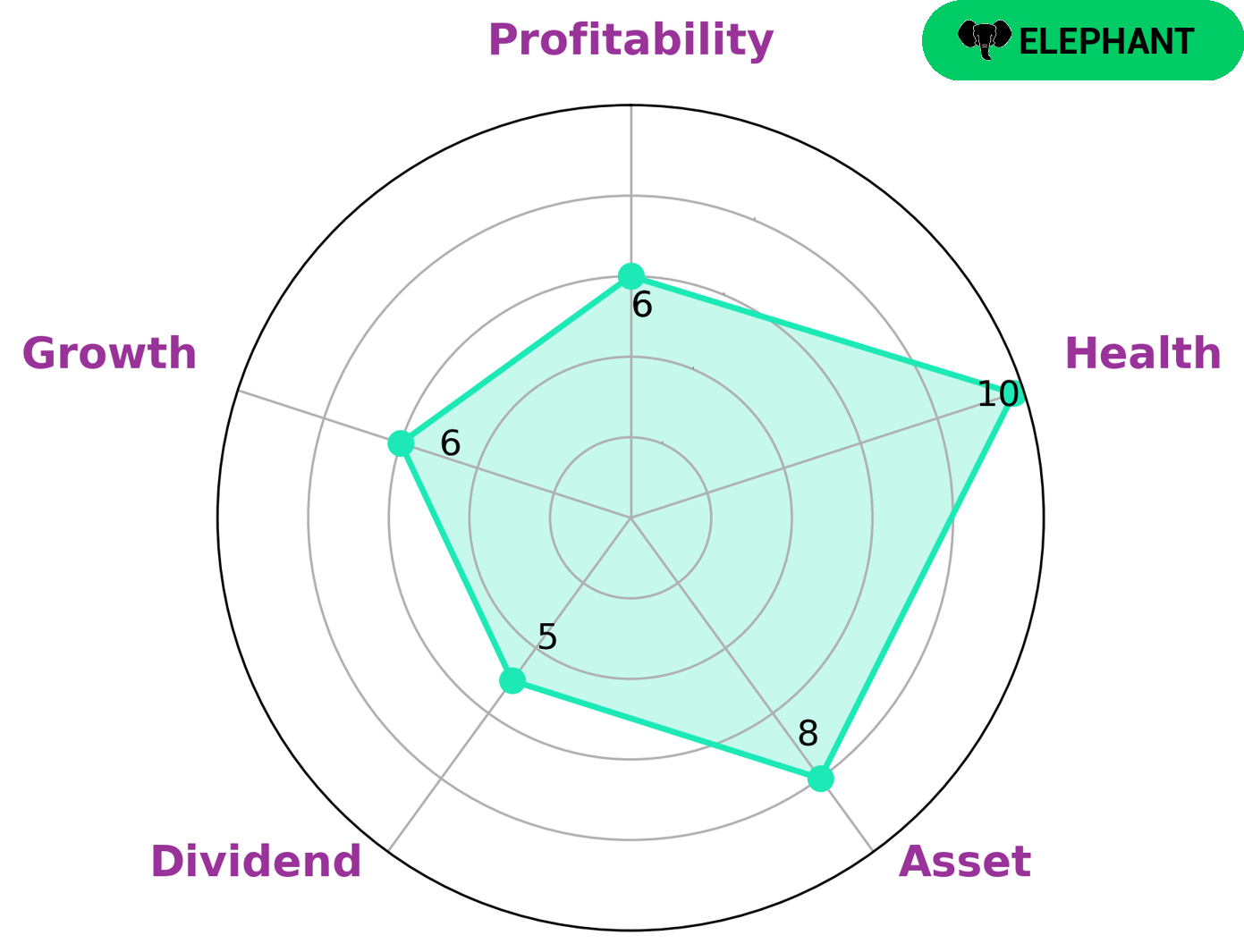

At GoodWhale, we conducted an analysis of JOYY INC‘s fundamentals, based on our Star Chart. From this, we concluded that JOYY INC is strong in asset, and medium in dividend, growth, profitability. Furthermore, we rated their health score as 10/10, indicating that they are in a financially safe position and are capable to safely ride out any crisis without the risk of bankruptcy. We have classified JOYY INC as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. We believe this type of company may be of particular interest to investors looking for reliable returns with a low risk of loss. Additionally, those seeking long-term investments may also benefit from the stable cash flows that JOYY INC offers. More…

Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

JOYY INC recently released its Q4 2022 financial results for the period ending December 31 2022. Revenues decreased 615.4% compared to the same period in the prior year, while net income decreased 8.9%. Despite the lower than expected figures, the company’s stock price surged the same day. Analysts suggest that investors may be betting on a potential rebound in the company’s fortunes.

Despite the uncertainty surrounding the future of the company, long-term investors may find value in its current price. The company’s ability to contain costs and return to profitability will be key to its success in the coming quarters.

Recent Posts