JOYY INC Reports Fourth Quarter Earnings Results for 2022 on March 16, 2023

March 23, 2023

Earnings Overview

On March 16, 2023, JOYY INC ($NASDAQ:YY) released its earnings report for the fourth quarter of the fiscal year ending December 31, 2022. Total revenue for the quarter was USD -377.5 million, a decrease of 615.4% compared to the same period in FY2022. The company’s net income was USD 604.9 million, representing an 8.9% decrease from the same period in FY2022.

Transcripts Simplified

Joining me on this call are Ms. Carrie Smith, our Chief Financial Officer, and Mr. Joe Davis, our Chief Operating Officer. This increase was driven by our growing user base and increased activity on our platform as well as additional advertising revenue from our social media channels. This increase was primarily due to higher revenue and lower operating expenses. We continued to invest in research and development to improve our customer experience and deepen user engagement in our core products, as well as focus on expanding our customer base through marketing and promotions. We have also taken steps to strengthen our operations by streamlining processes and increasing efficiency.

We remain focused on delivering long-term shareholder value by continuing to optimize our core products and expanding into new areas. We will continue to focus on growing and engaging our user base, launching new products and services, and increasing advertising revenues through strategic partnerships and acquisitions. We look forward to continuing our strong performance in the coming quarters and remain confident about the future of Joyy Inc. Thank you for your time today.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.41k | 119.47 | -13.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.07k | 3.57k | 74.36 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.9% | -22.5% | 26.8% |

| FCF Margin | ROE | ROA |

| 1.0% | 7.5% | 4.5% |

Stock Price

The stock opened at $27.7 and closed at $28.0, showing a 3.4% increase from the prior closing price of 27.1. The company’s cash and cash equivalents also increased significantly to $12 billion as compared to $10 billion during the same period last year. JOYY INC is optimistic about the future and expects to continue to grow in the coming quarters. The company plans to focus on expanding its customer base and launching new products and services to further increase its market share and revenue. Live Quote…

Analysis

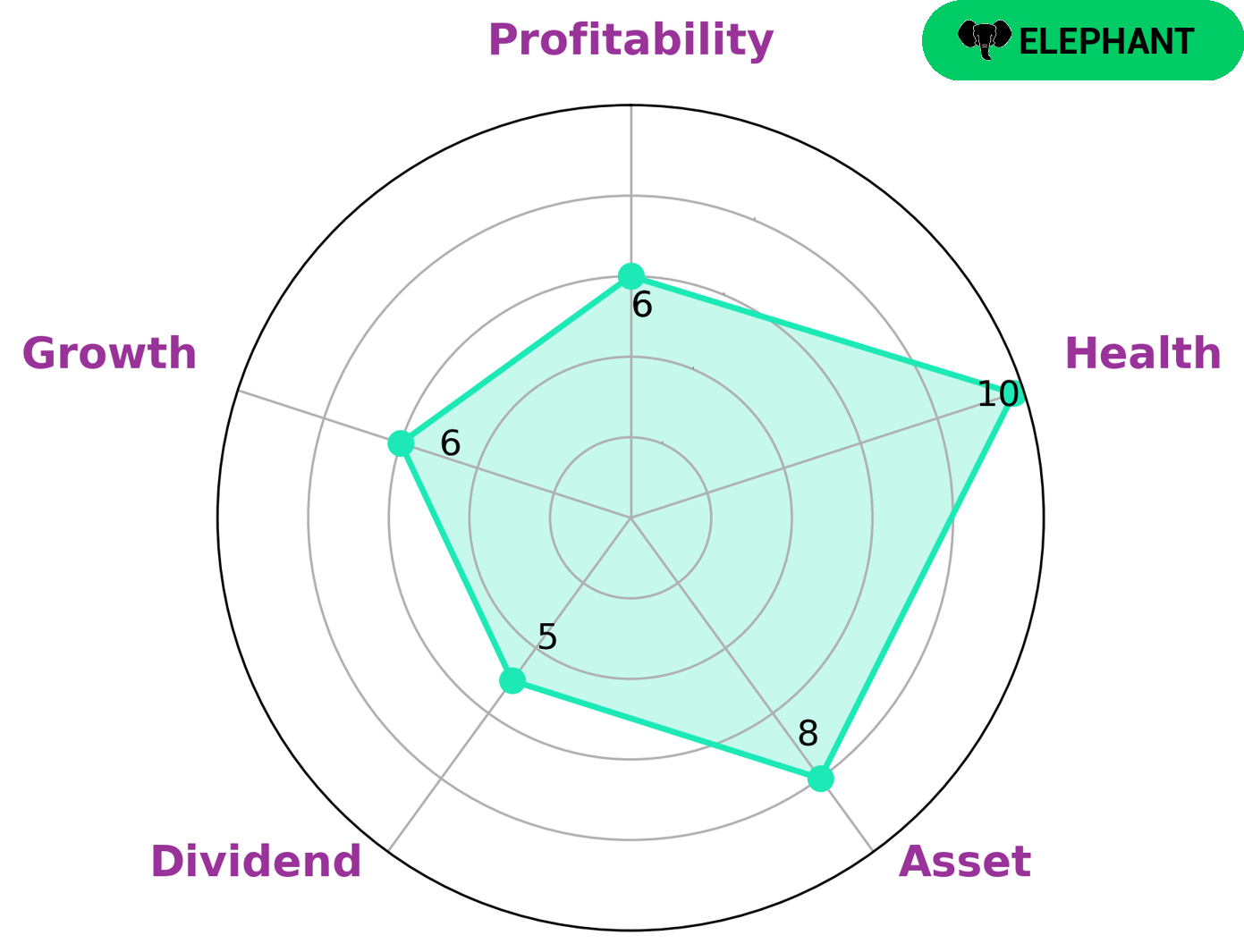

GoodWhale conducted an analysis of JOYY INC‘s wellbeing and according to Star Chart, JOYY INC has a high health score of 10/10. This indicates the company is in a strong financial position and will be able to safely ride out any crisis without the risk of bankruptcy. Further to our analysis, JOYY INC is classified as an ‘elephant’ which is a type of company that is rich in assets when liabilities are deducted. This makes the company attractive to investors who are looking for a company with strong assets and medium dividend, growth and profitability. Overall, JOYY INC is an attractive proposition for investors who are looking for a financially sound and stable company. The company has a high level of security and has strong potential for future growth. More…

Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investors should consider the recent financial results of JOYY INC, reported on March 16, 2023. Total revenue for the fourth quarter was USD -377.5 million, a decrease of 615.4% from the same period in FY2022, while net income dropped 8.9% year-over-year to USD 604.9 million. Despite the significant revenue dip, the stock price moved up on the same day, which may indicate that investors are looking at other factors such as the company’s long-term prospects. Investors should conduct further research and due diligence to determine if JOYY INC is a suitable investment for their portfolio.

Recent Posts