Joyy Inc Intrinsic Value Calculator – JOYY INC Reports Record Earnings for FY2023 Q2

October 21, 2023

🌥️Earnings Overview

On August 30, 2023, JOYY INC ($NASDAQ:YY) announced its earnings results for the second quarter of FY2023, ending June 30, 2023. The company reported total revenue of USD 547.3 million, an 8.2% decrease from the same quarter last year. Additionally, net income was USD 155.1 million, compared to the 18.6 million recorded in the same period the previous year.

Stock Price

On Wednesday, JOYY INC reported record earnings for the second quarter of its FY2023 fiscal year. The company’s stock opened at $33.9 and closed at $34.1, up 0.4% from the previous closing price of 34.0. This marks a new high for the company’s share price over the past year, and a notable increase from the previous quarter’s earnings. This is the highest revenue growth that the company has seen over the past three years.

The company attributed its success to the growth in its LivU video streaming service and YY Live broadcast platform. Overall, JOYY INC’s stellar performance has been welcomed by investors and analysts alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.32k | 310.75 | -10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 316.49 | -510.28 | -321.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.42k | 3.22k | 80.2 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.0% | -30.4% | 32.6% |

| FCF Margin | ROE | ROA |

| 10.6% | 9.3% | 5.6% |

Analysis – Joyy Inc Intrinsic Value Calculator

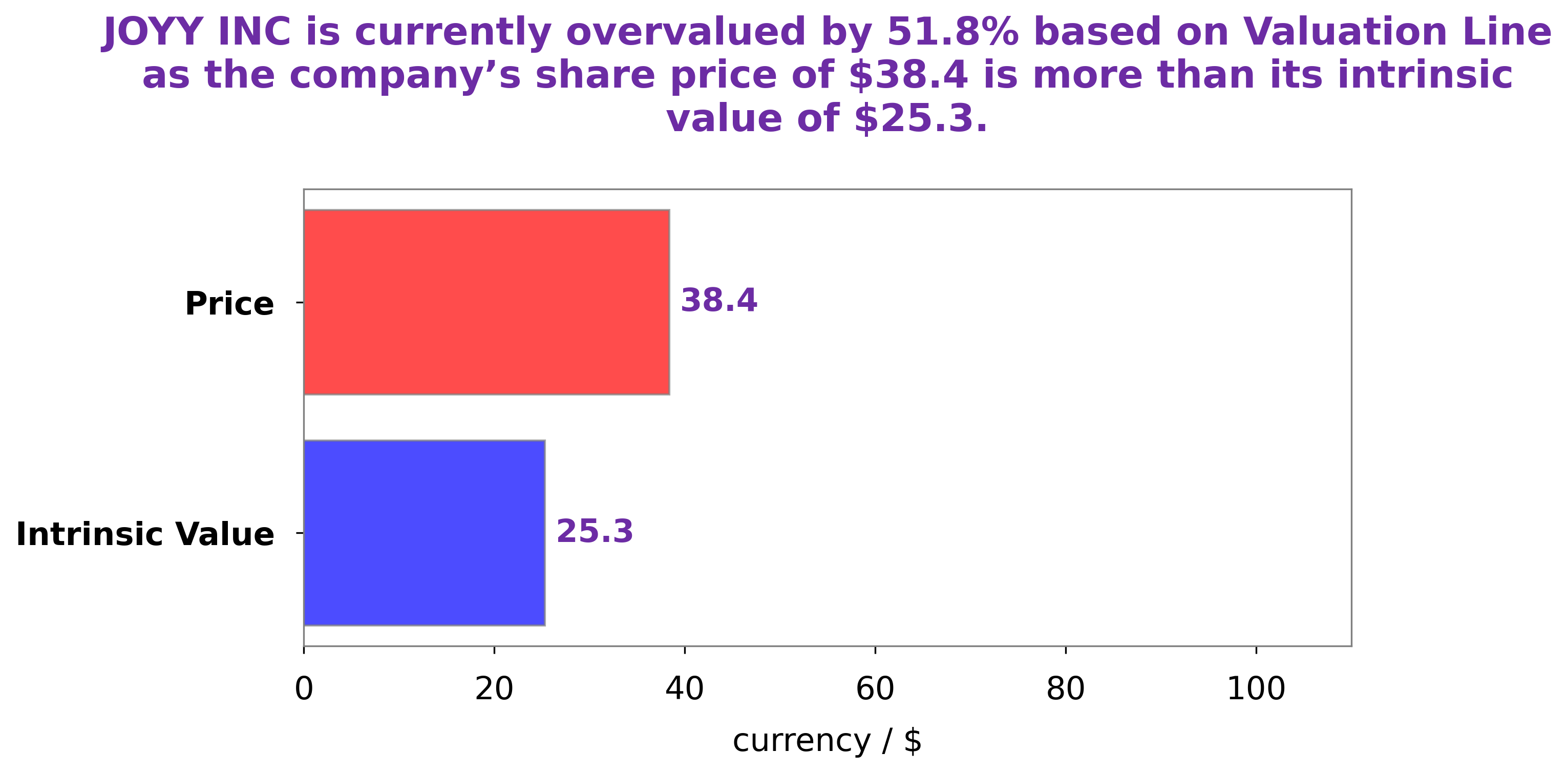

At GoodWhale, we have conducted an analysis of JOYY INC‘s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of JOYY INC share to be around $56.3. Interestingly, the stock is currently trading at $34.1, representing a 39.4% discount to its intrinsic value. This presents an opportunity for investors to benefit from the mispricing of JOYY INC stock. More…

Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investors looking to invest in JOYY INC may be interested in the company’s FY2023 Q2 earnings results, which were reported on August 30 2023. Despite the decline in revenue, JOYY INC’s strong performance in net income indicates a potential for long-term growth. The company’s positive earnings provide shareholders with confidence in the future of the company and its potential for long-term value.

Recent Posts