JOHN WILEY & SONS Reports Third Quarter Earnings Results for FY2023 on January 31, 2023.

March 21, 2023

Earnings Overview

On Jan. 31, 2023, JOHN WILEY & SONS ($NYSE:WLY) announced their earnings results for the third quarter of fiscal year 2023. The total revenue for the quarter was USD -71.5 million, a decrease of 302.1% compared to the same period in the prior year. Net income for the quarter was reported to be USD 491.4 million, a decrease of 4.8% compared to the same period in the previous year.

Transcripts Simplified

Joining me on the call today are Brian Napack, Executive Vice President and President of Professional and Trade; Mark Allin, Executive Vice President and President of Global Education; and Dan O’Connell, Chief Financial Officer. Our digital transformation strategy is delivering increased profitability and cash flow, helping us navigate the challenges created by the current global climate. This was driven by a combination of revenue growth and realization of cost savings from prior investments in automation, efficiency initiatives, and ongoing optimization of our portfolio.

We are confident in our ability to generate strong cash flow going forward, which will enable us to continue investing in our digital business, pay down debt and return value to shareholders. With that, I’ll now turn the call over to Dan who will provide more detail on our financial results.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WLY. More…

| Total Revenues | Net Income | Net Margin |

| 2.04k | -7.96 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WLY. More…

| Operations | Investing | Financing |

| 234.33 | -122.05 | -89.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WLY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.15k | 2.12k | 18.52 |

Key Ratios Snapshot

Some of the financial key ratios for WLY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | -6.2% | 1.5% |

| FCF Margin | ROE | ROA |

| 6.0% | 1.9% | 0.6% |

Market Price

Upon the announcement of the results, the stock opened at $39.9 and closed at $36.0 per share – a plunge of 17.4% from the prior closing price of $43.5. This sharp decline in stock price reflects the poor performance of the company in the third quarter. Analysts had expected the company to outpace its revenue and operating income for the quarter, which was not the case. The drop in revenue is attributed to the challenges posed by the current economic climate and the effects of the ongoing pandemic.

Despite these circumstances, JOHN WILEY & SONS is confident that its long-term strategy and commitment to innovation will help it rebound from this dip in performance. The company plans to continue focusing on its digital transformation efforts in order to remain competitive and provide its customers with the most innovative products and services. Live Quote…

Analysis

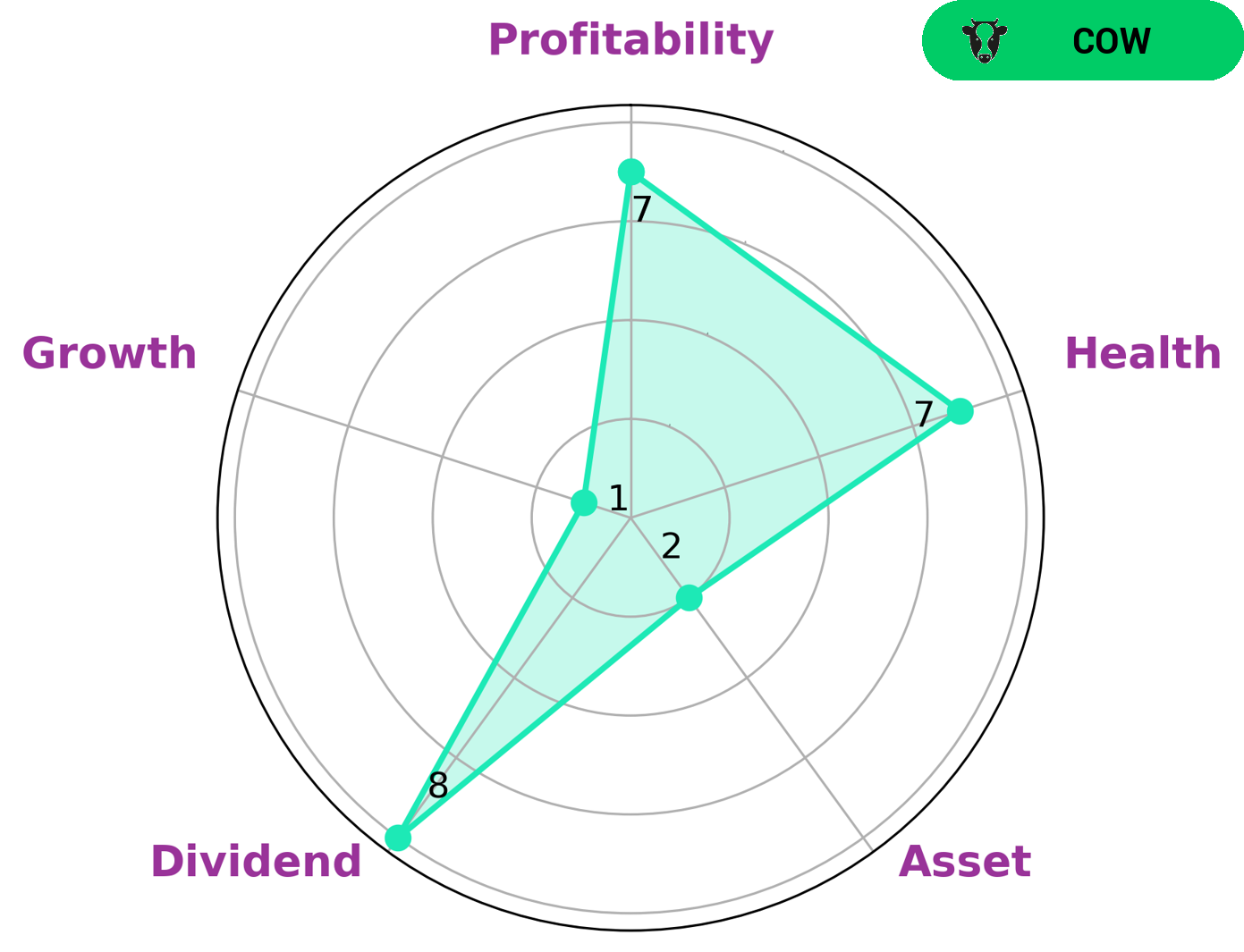

GoodWhale has performed an analysis of JOHN WILEY & SONS’s financials to uncover their performance across specific areas. The Star Chart displays that JOHN WILEY & SONS is strong in dividend and profitability but weak in assets and growth. Despite its weak assets, JOHN WILEY & SONS has a high health score of 7/10. This indicates that the company is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, the company is classified as a ‘cow’ due to its track record in paying out consistent and sustainable dividends. Given the company’s strong dividend and profitable nature, this type of company may be attractive to investors who are looking for a long-term stock with reliable returns. Such investors may also be interested in the company’s ability to withstand any economic crises due to its high health score. More…

Peers

Competition in the publishing industry is fierce, with John Wiley & Sons Inc. facing challenges from prominent rivals such as Sasbadi Holdings Bhd, Hanoi Education Investment and Development Joint Stock Co, and Promotora de Informaciones SA. Each of these companies has their own unique business model, but they are all vying for the same customers – readers and businesses who need the services they provide. With John Wiley & Sons Inc. at the helm, this competitive landscape will only grow more intense.

– Sasbadi Holdings Bhd ($KLSE:5252)

Sasbadi Holdings Bhd is a Malaysian educational publisher and learning solutions provider. It has a market capitalisation of 50.96 million as of 2023 and a negative Return on Equity of -5.29%. Market capitalisation is a measure of the company’s size and reflects the total value of all its assets, while Return on Equity measures the profitability of the company relative to the equity invested by its shareholders.

– Hanoi Education Investment And Development Joint Stock Co ($HNX:EID)

Promotora de Informaciones SA is a multinational information services company based in Spain. With a market capitalization of 212.27 million Euros as of 2023, the company is among the larger players in the industry. Its Return on Equity (ROE) of -4.03% indicates a high level of profitability and efficiency in the use of investor capital. The company provides a range of information services, such as market research, data processing, and analysis. It also offers customised solutions to clients and helps them make informed decisions through its comprehensive databases and analytics tools.

Summary

John Wiley & Sons reported their third quarter earnings results for FY 2023, with a decrease of 302.1% in total revenue compared to the same quarter last year. Net income declined by 4.8% as well. Consequently, the stock price of John Wiley & Sons moved down the same day.

Investors should take note of this sharp decrease in revenue, as well as the decrease in net income, when deciding whether or not to invest in John Wiley & Sons. It is also important to keep an eye on the company’s future performance and financials, to get a better understanding of the company’s overall financial health.

Recent Posts