“JAPAN WOOL TEXTILE Releases Earnings Results for FY2023 Q1, Showing Positive Growth”.

April 19, 2023

Earnings Overview

Japan Wool Textile ($TSE:3201) announced its financial results for Q1 of FY2023, which concluded on February 28 2023, on April 14 2023. The total revenue reached JPY 1.4 billion, a 19.9% decrease compared to the same period of the previous year, while net income was JPY 25.5 billion, a slight 0.3% dip year-on-year.

Stock Price

Japan Wool Textile announced its financial results for the first quarter of fiscal year 2023 on Friday, revealing a positive trend of growth. At the end of the day, the company’s stock opened at JP¥967.0 and closed at JP¥975.0, a decrease of 3.6% from its last closing price of 1011.0. Despite the minor decline, investors remain optimistic about the company’s future prospects. Japan Wool Textile is well-known for its high-quality wool fabrics, and their reliable reputation has attracted customers from all over the world. Moreover, Japan Wool Textile is actively investing in new technologies to improve its manufacturing process and expand its product offerings.

Such investments could bring further growth and profits to the company in the future. Japan Wool Textile has also taken steps to reduce its environmental impact, making it an even more attractive option for investors. Overall, while Japan Wool Textile’s stock declined slightly in the first quarter of 2023, investors remain confident in the company’s future prospects. With strong revenue growth and investments in new technologies, Japan Wool Textile is well-positioned to continue its successful trajectory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Japan Wool Textile. More…

| Total Revenues | Net Income | Net Margin |

| 108.97k | 6.93k | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Japan Wool Textile. More…

| Operations | Investing | Financing |

| 9.45k | -6.88k | -9.5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Japan Wool Textile. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 165.9k | 56.71k | 1.53k |

Key Ratios Snapshot

Some of the financial key ratios for Japan Wool Textile are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.3% | -1.3% | 9.7% |

| FCF Margin | ROE | ROA |

| 8.7% | 6.2% | 4.0% |

Analysis

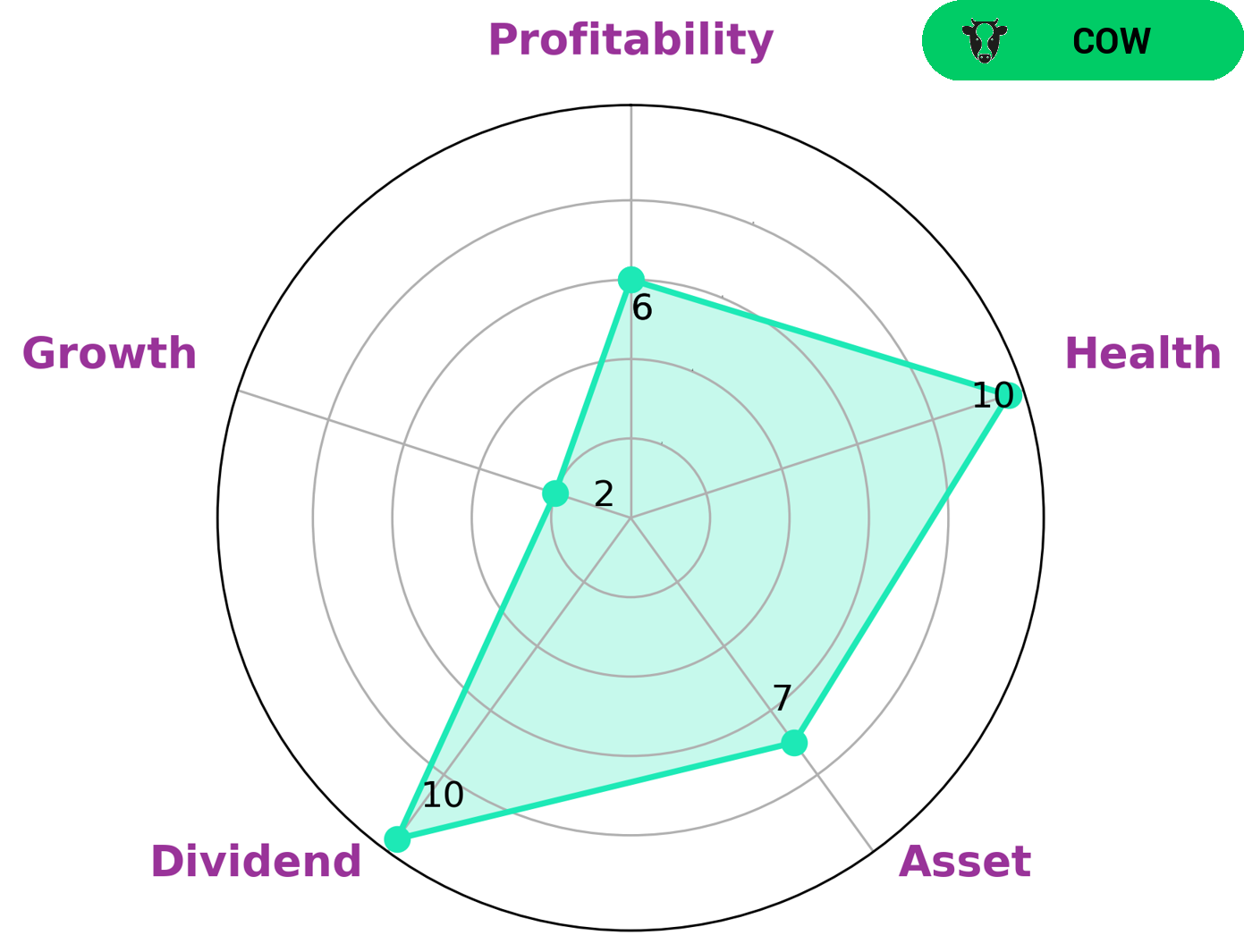

At GoodWhale, we have conducted a detailed financial analysis of JAPAN WOOL TEXTILE and the results are quite impressive. Our star chart shows that JAPAN WOOL TEXTILE has an extraordinary high health score of 10/10, indicating that it is in top-notch condition with regards to its cashflows and debt. This means that JAPAN WOOL TEXTILE is capable of sustaining future operations in times of crisis. Additionally, JAPAN WOOL TEXTILE is classified as a ‘cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends, making it very attractive to investors. The company is strong in terms of its asset and dividend strength, with medium profitability and weak growth. Overall, our analysis shows that JAPAN WOOL TEXTILE is a reliable company that could be a great addition to any investor’s portfolio. Its strong financials and dividend payouts make it an attractive option for those looking for steady returns. More…

Peers

The competition between Japan Wool Textile Co Ltd and its competitors has become increasingly fierce in recent years. PT Sri Rejeki Isman Tbk, Binny Mills Ltd, and ST International Holdings Co Ltd are all major players in the industry, and each company is striving to stay ahead of the competition by producing higher quality goods at lower costs. As the competition heats up, all of these companies are constantly innovating and adapting their strategies to stay ahead in the market.

– PT Sri Rejeki Isman Tbk ($IDX:SRIL)

Sri Rejeki Isman Tbk (SRITEX) is an Indonesian-based company that produces and distributes textile products. As of 2023, SRITEX has a market capitalization of 2.99T and a return on equity of 40.75%. This is an impressive market cap given the company’s size and established presence in the industry. SRITEX’s return on equity of 40.75% is also impressive and significantly higher than the industry average of around 15%. This indicates a strong performance by the company in terms of profitability and a sound financial strategy. Overall, SRITEX is well-positioned to continue its success well into the future.

– Binny Mills Ltd ($BSE:535620)

Binny Mills Ltd is a multinational industrial conglomerate that manufactures and supplies a range of products and services. It has a market cap of 291.65M as of 2023, which indicates that it is a large and established company. The company also boasts a Return on Equity of 3.49%, which means that it is generating returns on investments and is a good sign of financial health.

– ST International Holdings Co Ltd ($SEHK:08521)

ST International Holdings Co Ltd is a Hong Kong-based company that offers a range of services related to construction and engineering, project management, and property investment. With a market cap of 36.48M as of 2023, the company has seen a negative return on equity (ROE) of -4.08%. This suggests that the company has not been able to effectively utilize its assets to generate profits or generate cash flows to support its operations. This can be attributed to a number of factors such as high operating costs, lack of proper corporate governance, or poor strategic decisions. Despite this, the company is still able to maintain its market capitalization, which implies that investors are confident in its ability to turn around its operations and increase its profits in the future.

Summary

Japan Wool Textile reported its earnings results for the first quarter of fiscal 2023 on April 14, 2023. Total revenue was JPY 1.4 billion, a decrease of 19.9% year over year. Net income of JPY 25.5 billion was down by 0.3% from the same period in the prior year. The stock price dropped the same day in reaction to the earnings report. For investors looking to assess the company’s performance and future potential, key considerations include the company’s ability to recover from the lower revenue and profitability, its cash flow situation, and its dividend policy.

Additionally, investors may want to look into the company’s capital structure, its management team, and their outlook regarding future prospects. Finally, investors should also consider the current market trends and the competitive landscape when investing in Japan Wool Textile.

Recent Posts