ITT INC Reports 11.2% Increase in Total Revenues for Fiscal Year Ending December 31, 2022

March 30, 2023

Earnings Overview

On February 9 2023, ITT INC ($BER:2II) reported total revenue of USD 115.2 million for the fourth quarter of their fiscal year ending December 31 2022, a 11.2% increase on the previous year. The company also saw a 13.0% rise in net income, bringing the quarterly total to USD 774.6 million.

Price History

This positive news was met with a 2.9% decrease in the company’s stock, as it opened at €85.5 and closed at €83.0, down from its previous closing price of 85.5. The 11.2% revenue increase was driven by improved performance in the company’s core divisions, which include industrial products, energy and power, and water solutions and services.

Additionally, ITT INC attributed its strong performance to strategic capital investments and cost-saving measures implemented across its operations. Going forward, ITT INC plans to invest in furthering its current projects and focusing on long-term growth opportunities. ITT INC Chairman and CEO Luca Savi commented that “we have a clear strategy for growth for fiscal year 2023 that we believe will drive our total revenues even higher.” He further added that he was confident ITT INC will deliver on its financial targets for the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Itt Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.99k | 367 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Itt Inc. More…

| Operations | Investing | Financing |

| 277.8 | -255.1 | -83.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Itt Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.78k | 1.52k | 27.18 |

Key Ratios Snapshot

Some of the financial key ratios for Itt Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | 3.5% | 15.3% |

| FCF Margin | ROE | ROA |

| 5.8% | 13.3% | 7.6% |

Analysis

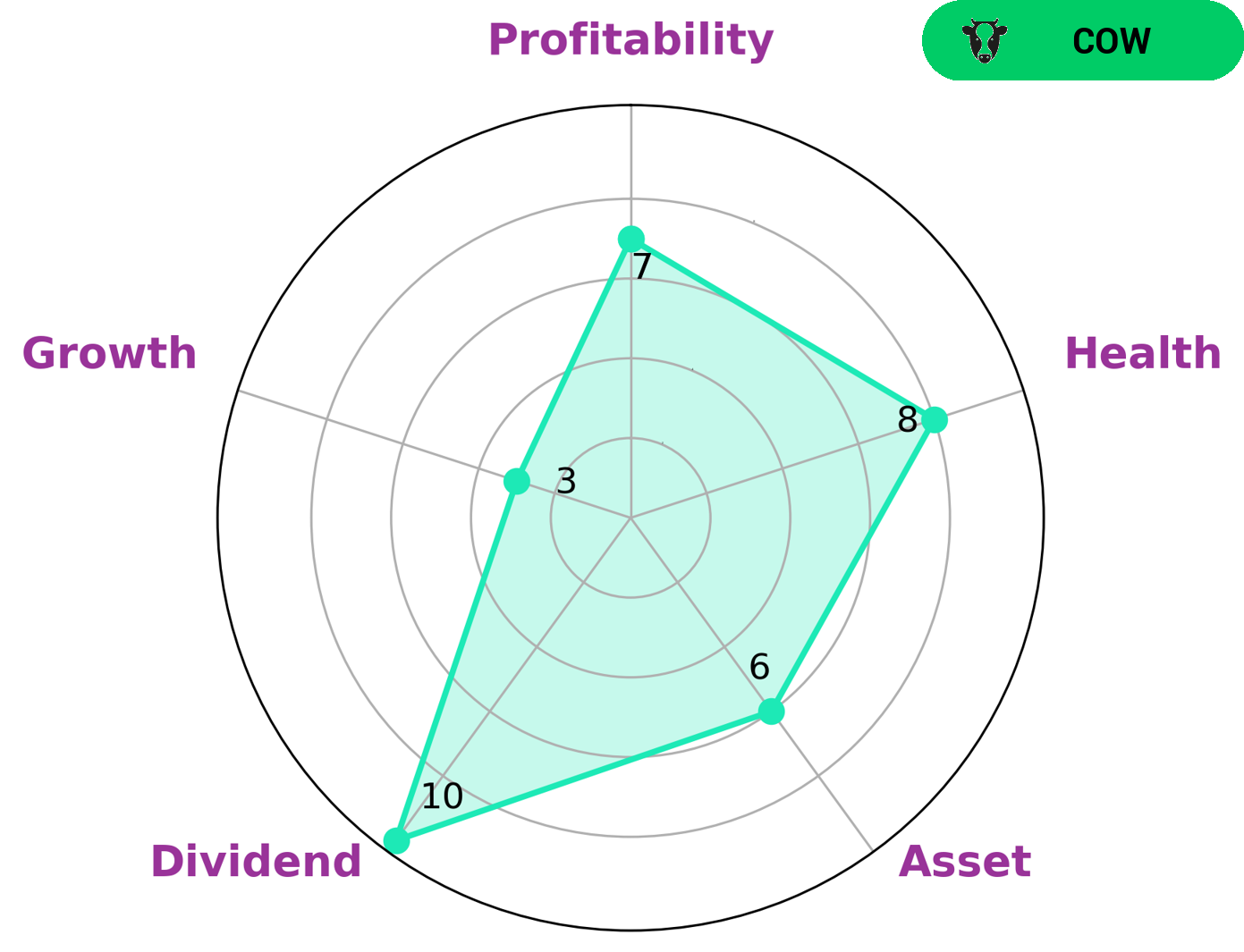

We at GoodWhale have conducted an analysis of ITT INC‘s wellbeing. Based on our Star Chart, ITT INC is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes ITT INC attractive to investors such as value investors, income investors and pension funds that seek stable returns on their investments over the long run. In addition, ITT INC has a high health score of 8/10 when we consider its cashflows and debt. This indicates that the company is capable of riding out any crisis without the risk of bankruptcy. When we further look into ITT INC’s Star Chart, we find that the company is strong in dividend and profitability, medium in asset and weak in growth. This makes ITT INC an excellent candidate for those looking for a reliable source of dividend income over the long term. More…

Summary

ITT INC has delivered robust financial performance in the fourth quarter of fiscal year ending December 31, 2022, with total revenue increasing 11.2% year-over-year to USD 115.2 million and net income rising 13.0% to USD 774.6 million. This impressive growth reveals an attractive investment opportunity for long-term investors, as ITT INC continues to generate strong returns from its core operations and capital allocation initiatives. Furthermore, potential investors are likely to be further encouraged by the company’s healthy balance sheet and sound cash flow position. All in all, ITT INC remains an appealing investment option for those seeking exposure to a high-quality firm with a track record of strong financial results.

Recent Posts