Is Definity Financial’s Earnings Performance Worthy of Your Investment?

May 30, 2023

☀️Trending News

When it comes to evaluating whether or not to invest in a company, it is essential to consider its earnings performance. In the case of DEFINITY FINANCIAL ($TSX:DFY), their current earnings performance is worthy of consideration. DEFINITY FINANCIAL is a publicly traded company that offers a range of financial products and services, including insurance, investment, and banking. Since then, their stock price has doubled, and their earnings have grown by more than 10% a year. The company has also seen strong growth in their dividend payout, which provides investors with an additional source of income. Furthermore, DEFINITY FINANCIAL has an established and well-respected management team, as well as a strong balance sheet that provides investors with the confidence they need to trust the company. When evaluating DEFINITY FINANCIAL’s earnings performance, it is important to consider their current and future prospects. The company has been making investments in new products and services, which should lead to increased revenues and profits in the coming years.

Additionally, the company has been focusing on expanding its presence internationally, which should result in further revenue growth. The company has a long history of strong returns and dividend payouts, and their recent investments indicate that this trend is likely to continue in the future. Furthermore, the company’s management team and balance sheet both provide investors with the confidence they need to trust the company. Therefore, investors should consider DEFINITY FINANCIAL’s current earnings performance when making decisions about their investments.

Earnings

DEFINITY FINANCIAL‘s earnings performance in the latest earning report of FY2023 Q1, as of March 31 2023, has been impressive. The company earned 1034.4M CAD in total revenue and 100.9M CAD in net income, showing an increase of 49.0% and 108.9% respectively. This growth was further compounded by the fact that DEFINITY FINANCIAL’s total revenue in the last 3 years had increased from 681.8M CAD to 1034.4M CAD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Definity Financial. More…

| Total Revenues | Net Income | Net Margin |

| 3.67k | 385.5 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Definity Financial. More…

| Operations | Investing | Financing |

| 305.8 | -285.6 | 58.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Definity Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.74k | 3.99k | 20.47 |

Key Ratios Snapshot

Some of the financial key ratios for Definity Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| 8.4% | 12.1% | 4.5% |

Share Price

When it comes to investing, evaluating the performance of a company is essential to making an informed decision. On Thursday, DEFINITY FINANCIAL stock opened at CA$36.2 and closed at CA$36.2, down 0.5% from its previous closing price of CA$36.4. This indicates that the company’s stock is not performing well. The answer to this question depends largely on the investor’s risk tolerance and individual goals.

For example, if the investor is willing to take on more risk in the hopes of earning higher returns, then DEFINITY FINANCIAL may be a good option. On the other hand, if the investor is looking for more stable returns with less risk, then they may want to consider other options. They should analyze the company’s financials and make an informed decision based on their own risk tolerance and financial goals. Live Quote…

Analysis

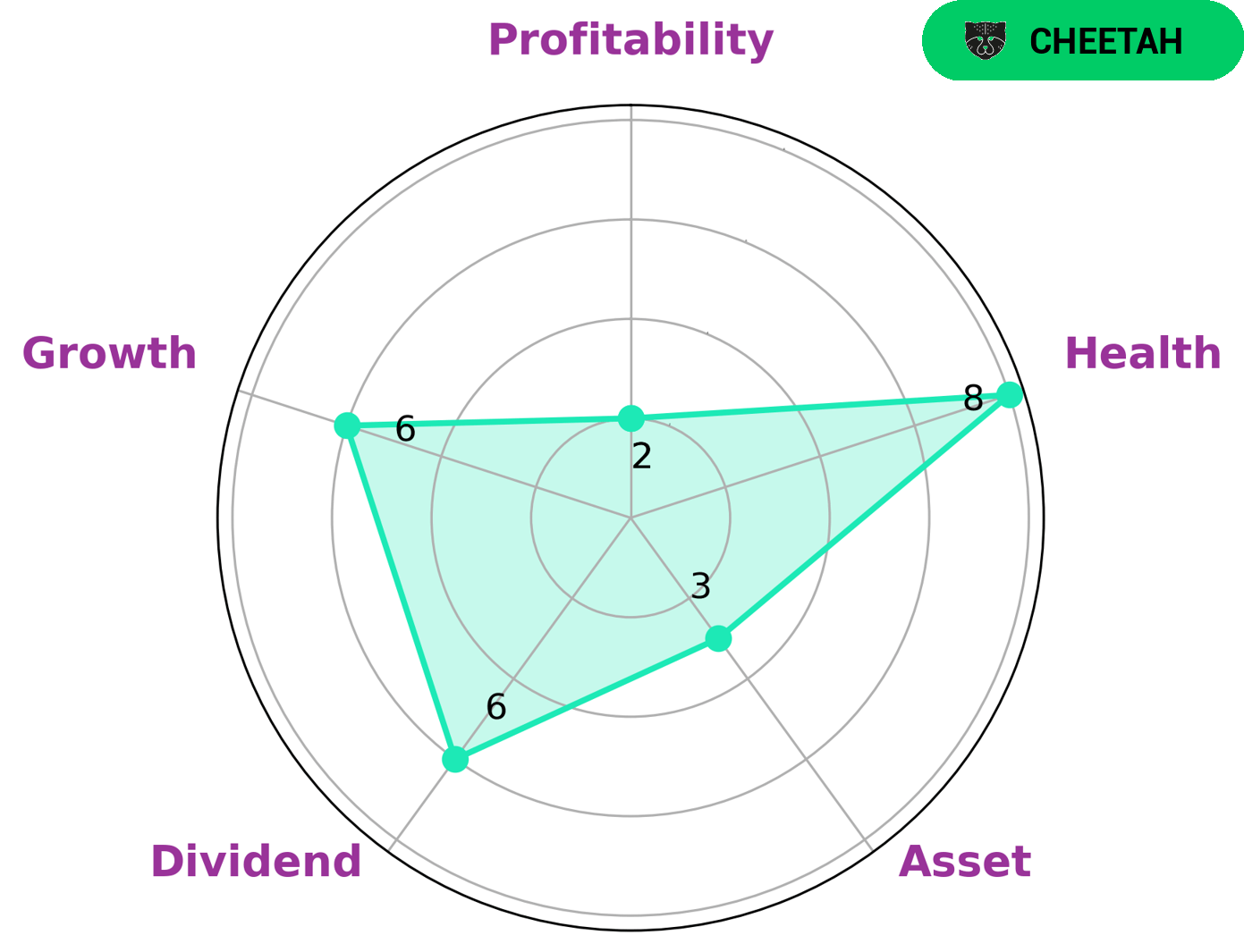

At GoodWhale, we have analyzed the financials of DEFINITY FINANCIAL and found that they have a strong position in terms of liquidity and debt. According to our Star Chart, DEFINITY FINANCIAL is strong in liquidity, medium in dividend, growth, and weak in asset and profitability. This suggests that DEFINITY FINANCIAL is classified as ‘cheetah’, meaning it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for growth and are willing to take on more risk may be particularly interested in this type of company. We have assigned DEFINITY FINANCIAL a health score of 8/10, which indicates that the company has enough cashflows and debt to be able to pay off debt and fund future operations. More…

Peers

Definity Financial Corp is in a competitive market, facing off against some of the biggest names in the industry such as Horace Mann Educators Corp, Nadejda AD, and Kemper Corp. All of these companies provide similar services and products, and each is striving to come out on top. As a result, Definity Financial Corp must stay ahead of the competition by offering innovative services and products, as well as competitive prices.

– Horace Mann Educators Corp ($NYSE:HMN)

Horace Mann Educators Corporation is an insurance holding company that provides insurance and financial services products to teachers and other education professionals in the United States. As of 2023, the company has a market cap of 1.54 billion US dollars, reflecting the company’s strong market presence and performance. Additionally, the company has a Return on Equity (ROE) of 4.11%, indicating that it has been able to generate returns for its shareholders from its investments. Horace Mann Educators Corporation has a long history of providing innovative insurance solutions for educators and has become a leader in the field of education-related insurance.

– Nadejda AD ($LTS:0LOK)

Kemper Corp is a financial holding company that provides insurance, investment and other financial solutions for individuals and businesses. The company has a market cap of 3.13 billion as of 2023, which is indicative of how highly the market values the company’s stock. Its Return on Equity (ROE) of -9.68% is lower than the average ROE of other financial companies in its industry, indicating that it is not generating as much profit from its assets as its competitors.

Summary

DEFINITY FINANCIAL is a publicly traded company that provides financial services to its customers. An analysis of the company’s recent earnings report shows that the company has achieved solid revenue growth and significantly improved its profitability over the past year. The company’s balance sheet is strong, with substantial cash and marketable securities on hand and low levels of debt.

The company’s dividend yield has also increased significantly, making it attractive for investors seeking income. Overall, DEFINITY FINANCIAL appears to be a solid investment opportunity with strong fundamentals, attractive dividend yield, and potential for further growth in revenue and profits.

Recent Posts