INPOST SA Reports Q1 Earnings Results for FY2023, as of March 31 2023

May 26, 2023

Earnings Overview

On May 16th 2023, INPOST SA ($BER:669) reported its earnings results for Q1 of FY2023, ending on March 31st 2023. The company saw a considerable year-over-year increase in revenue of 29.3%, amounting to PLN 1987.6 million. Additionally, the company’s net income rose by 68.5% year-over-year, to PLN 115.9 million.

Stock Price

The company’s stock opened at €10.2 and closed at €10.2, a 0.7% decrease from its prior closing price of 10.3. This decrease in price comes after a period of relative stability for INPOST SA, with its stock price hovering around the €10 mark for the past few months. Overall, the company delivered a strong performance in the first quarter of FY2023, with revenues increasing despite the challenging economic conditions.

Additionally, cost-cutting efforts helped to bolster their bottom line, resulting in a healthy profit. Moving forward, INPOST SA looks well-positioned to continue its success in the coming quarters and is optimistic about its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Inpost Sa. More…

| Total Revenues | Net Income | Net Margin |

| 7.51k | 503.5 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Inpost Sa. More…

| Operations | Investing | Financing |

| 1.55k | -1.03k | -317.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Inpost Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.12k | 8.53k | 0.94 |

Key Ratios Snapshot

Some of the financial key ratios for Inpost Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 79.0% | 92.4% | 13.7% |

| FCF Margin | ROE | ROA |

| 6.9% | 121.8% | 7.1% |

Analysis

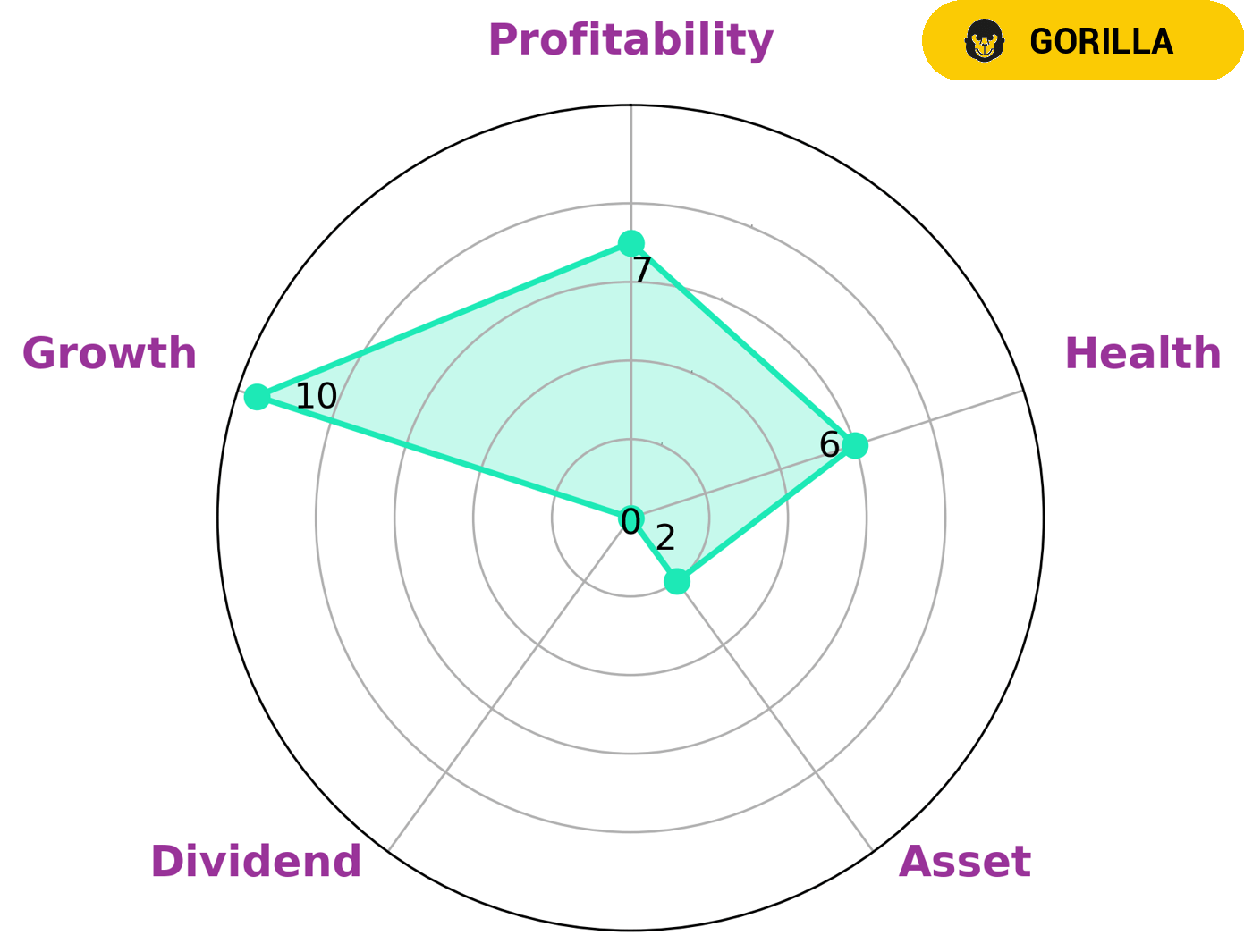

At GoodWhale, we conducted an analysis of the fundamentals of INPOST SA. Based on our Star Chart, we classified INPOST SA as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This makes INPOST SA a great investment opportunity for growth-oriented investors who are looking for reliable and consistent returns. In terms of financial fundamentals, INPOST SA is strong in growth, profitability, and weak in asset, dividend. Its health score is 6/10 considering its cashflows and debt, indicating that it might be able to safely ride out any crisis without the risk of bankruptcy. Overall, investors may find INPOST SA to be an attractive investment opportunity due to its competitive advantages and strong financial fundamentals. It is important to note, however, that this is a high-risk investment and caution should be exercised in considering it as part of your portfolio. More…

Peers

Inpost SA is part of a highly competitive market, going head-to-head with some of the leading players in the industry, including Mind Gym PLC, Servizi Italia SpA, and Staffline Group PLC. These competitors all offer similar services, so Inpost must strive to stand out in order to remain competitive.

– Mind Gym PLC ($LSE:MIND)

Gym PLC is an international provider of personal development services, with a focus on self-improvement and growth.The company has a market cap of 59.6M as of 2023 and a Return on Equity of 0.84%. This metric reflects the company’s ability to generate profits from its shareholders’ invested capital and indicates that the company has created strong returns for its investors despite a challenging economic climate. Gym PLC’s market cap and return on equity demonstrate the company’s success in providing quality self-development services to its customers and clients.

– Servizi Italia SpA ($LTS:0NJ3)

Servizi Italia SpA is a leading provider of facilities and services to the Italian market. The company offers a wide range of services, such as heating and cooling systems, electrical and plumbing services, engineering and construction services, and security and fire protection services. Its market cap of 38.67M is indicative of the company’s strong financial standing in 2023, and its Return on Equity of 4.82% is a testament to its commitment to delivering quality services to its customers. Servizi Italia SpA is well-positioned to remain a leader in the Italian market for many years to come.

– Staffline Group PLC ($LSE:STAF)

Staffline Group PLC is a leading human resource and recruitment services provider in the UK. It provides comprehensive recruitment services for permanent, temporary and contract jobs, as well as providing managed workforce services for clients. The company has a market capitalization of 61.33 million as of 2023 and a Return on Equity of 4.32%. Market capitalization is a measure of the company’s size and reflects its stock price times its number of outstanding shares. A higher market cap indicates that the company is more valuable and a greater ROE implies that it is more profitable. The company’s current market capitalization and ROE show that it is doing well in terms of financial performance.

Summary

INPOST SA reported positive earnings results for the first quarter of 2023, with a total revenue increase of 29.3% year-on-year and a net income increase of 68.5%. This highlights the company’s success in adapting to the changing market conditions. The result is a strong signal for investors, suggesting that INPOST SA is well-positioned for continued success and can be a strong investment. The combination of increasing revenue and net income presents a compelling opportunity for investors to capitalize on INPOST SA’s success.

Recent Posts