INGREDION INCORPORATED Reports Third Quarter Fiscal Year 2023 Earnings on November 7, 2023

November 30, 2023

🌥️Earnings Overview

INGREDION INCORPORATED ($NYSE:INGR) released their earnings report for their fiscal year 2023 third quarter, which concluded on September 30 2023, on November 7 2023. Total revenue for the period amounted to USD 2033.0 million, a slight 0.5% rise from the same quarter the previous year. Net income saw a more significant change, having gone up by 49.1% from the same period in the prior year to USD 158.0 million.

Price History

The company opened at $98.1 and closed at $101.8, a 6.5% increase from the prior closing price of 95.6. The earnings report covers the period from July 1, 2023 to September 30, 2023. The report was highlighted by strong sales growth in the food ingredients and starches segment. The strong sales and profits were driven by continued acquisitions, as well as positive impacts from pricing strategies and cost-cutting initiatives.

Overall, INGREDION INCORPORATED had a positive quarter, and the company’s stock reacted positively to the earnings report with a 6.5% increase from the prior closing price. This is a good sign for investors as it indicates that the company has resilient fundamentals and is well-positioned for long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ingredion Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 8.23k | 626 | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ingredion Incorporated. More…

| Operations | Investing | Financing |

| 719 | -360 | -320 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ingredion Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.55k | 4.08k | 52.36 |

Key Ratios Snapshot

Some of the financial key ratios for Ingredion Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 12.5% | 11.1% |

| FCF Margin | ROE | ROA |

| 4.7% | 16.6% | 7.5% |

Analysis

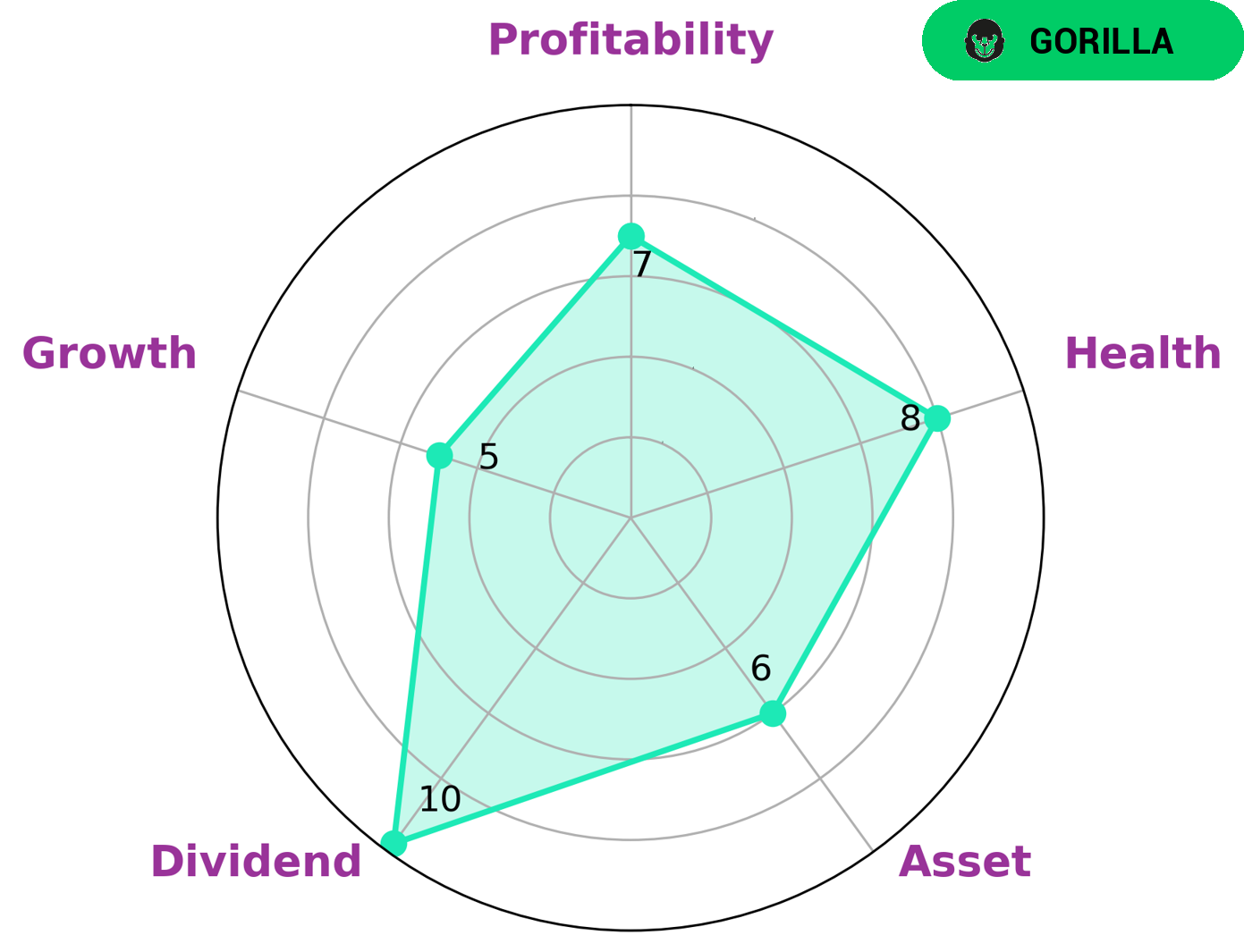

When analyzing INGREDION INCORPORATED’s fundamentals with GoodWhale, we classify the company as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. For this reason, INGREDION INCORPORATED would likely be of interest to investors who are looking for a durable and reliable stock that will provide them with steady returns. GoodWhale’s Star Chart also indicates that INGREDION INCORPORATED is strong in dividend, profitability, and medium in asset and growth. Additionally, its health score of 8/10 shows that it is capable to sustain future operations in times of crisis due to its strong cashflows and minimal debt. Consequently, investors who are interested in an unchanging and reliable stock may be attracted to INGREDION INCORPORATED. More…

Peers

The competition between Ingredion Inc and its competitors, Procter & Gamble Co, Nestle SA, and Edita Food Industries S.A.E., is fierce as each company strives to be the leader in the global food and beverage industry. From product innovation and marketing to pricing and distribution, each company is looking for the edge that will give them the upper hand in the competitive landscape.

– Procter & Gamble Co ($NYSE:PG)

Procter & Gamble Co is a multinational consumer goods giant, headquartered in Cincinnati, Ohio. The company manufactures a wide range of household products, from laundry detergents to toothpaste. As of 2022, the company has a market capitalization of 362.18B and a Return on Equity of 25.38%. The company’s size and profitability are demonstrative of its success in the consumer goods industry. With a large market cap and high return on equity, Procter & Gamble Co has established itself as an industry leader.

– Nestle SA ($LTS:0QR4)

Nestle SA is one of the world’s largest food and beverage companies, serving consumers in over 190 countries. Its market cap of 305.36B as of 2022 is a testament to its success and industry leadership. The company’s return on equity (ROE) of 14.82% is also impressive, indicating that the company is efficiently utilizing the capital it has available to generate profit and create value for its shareholders. This impressive market cap and ROE are indicative of the strength of Nestle SA’s business model and its ability to remain competitive in an ever-changing industry.

– Edita Food Industries S.A.E ($LSE:66XD)

Edita Food Industries S.A.E. is a leading food manufacturing and distribution company based in Egypt. The company has a market capitalization of 371.8 million as of 2022 and has achieved a return on equity of 33.89%. This indicates that the company is financially healthy and is able to generate returns on its investments. Edita produces and markets a wide range of baked goods, snacks and confectionery products, including cakes, pastries, rusks and biscuits, in addition to providing products for specialty markets. It also provides ready-made meals, frozen fruits and vegetables, and frozen ready-meals for catering services. The company is well-positioned to benefit from the growing demand for convenience food products in Egypt and across the region.

Summary

Ingredion Incorporated, a major food and beverage ingredient business, reported financials for the third quarter of their fiscal year 2023, with total revenue of USD 2033.0 million and net income of USD 158.0 million. This was a slight increase in revenues (0.5%), but an impressive jump in net income (49.1%) compared to the same period the previous year. As expected, the company’s stock price reacted positively to these results, moving up on the same day. For potential investors, this could be a good opportunity to consider investing in Ingredion Incorporated, with the company showing positive growth in both revenue and net income.

Recent Posts