INGREDION INCORPORATED Reports Fourth Quarter Earnings for FY2022 on February 8 2023

April 4, 2023

Earnings Overview

On February 8 2023, INGREDION INCORPORATED ($NYSE:INGR) reported its earnings for the fourth quarter of the fiscal year ending on December 31 2022. Revenue had a 70.1% year-over-year increase to USD 114.0 million, while net income rose by 13.2%, totaling USD 1987.0 million.

Transcripts Simplified

Fourth quarter net sales of approximately $2 billion were up 13% year-over-year. Reported and adjusted operating income were $157 million and $168 million, respectively. Reported and adjusted earnings per share were $1.71 and $1.65, respectively. Price/mix contributed $336 million to net sales, driven by higher corn and input costs.

Foreign exchange impacts totaled $65 million, with the most significant impacts in Asia Pacific and EMEA. Full year net sales of almost $8 billion were up 15% versus prior year, with gross profit margin at 18.8%, down 50 basis points.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ingredion Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 7.95k | 492 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ingredion Incorporated. More…

| Operations | Investing | Financing |

| 152 | -320 | 103 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ingredion Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.56k | 4.3k | 48.63 |

Key Ratios Snapshot

Some of the financial key ratios for Ingredion Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.6% | 2.0% | 9.7% |

| FCF Margin | ROE | ROA |

| -1.9% | 15.2% | 6.3% |

Market Price

On Wednesday, INGREDION INCORPORATED released its financial report for the fourth quarter of Fiscal Year 2022. The fourth quarter also saw INGREDION INCORPORATED’s stock price rise steadily, with it opening at $100.2 and closing at $101.0, a 0.3% increase from its last closing price of 100.7. This increase reflects the company’s strong performance and investor confidence in its future prospects. With strong earnings and a bullish market outlook, shareholders can look forward to continued success in the coming year. Live Quote…

Analysis

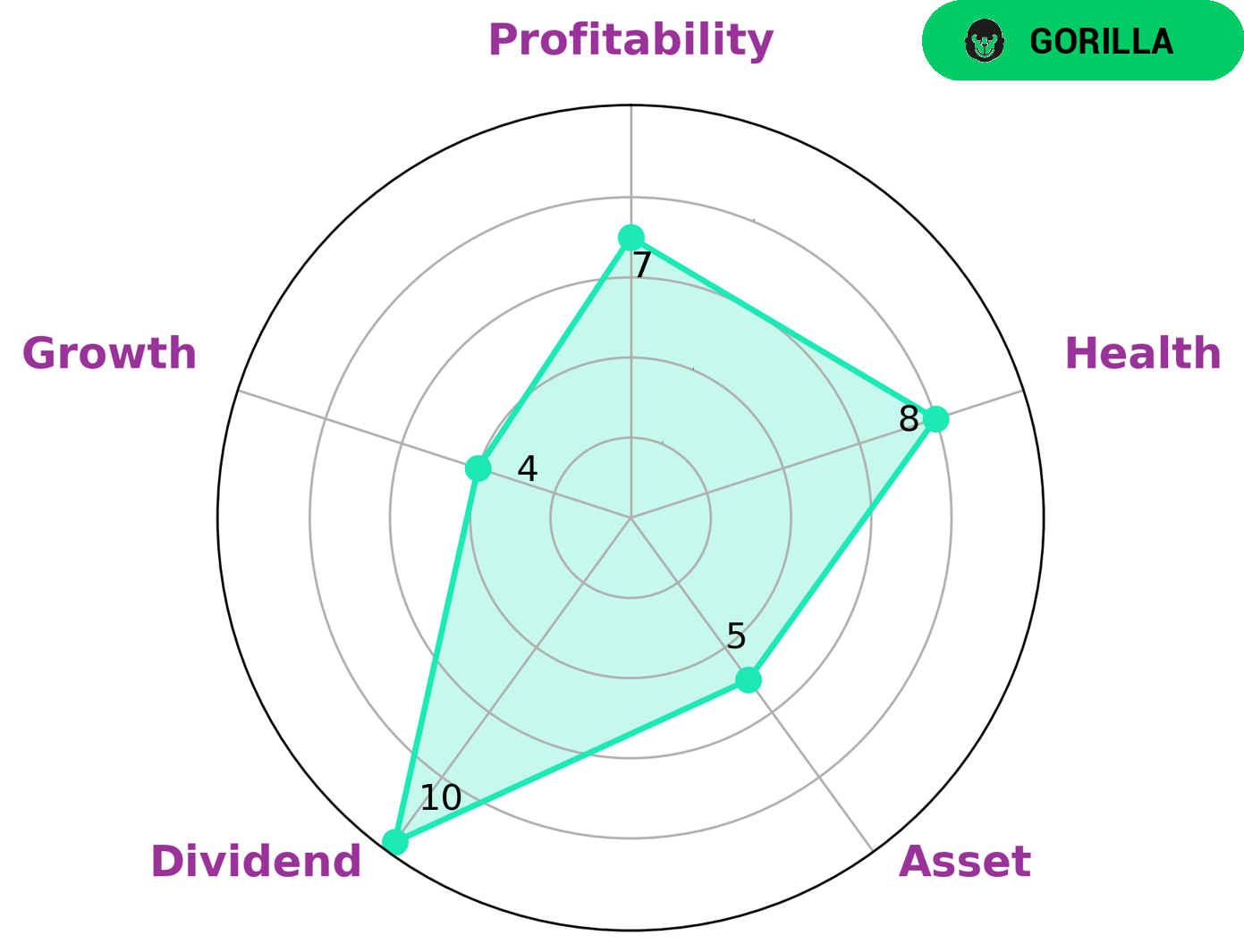

GoodWhale has conducted an analysis of INGREDION INCORPORATED‘s financials and our Star Chart reveals that the company has a very high health score of 8/10 with regard to its cashflows and debt. This means INGREDION INCORPORATED is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, based on our assessment, INGREDION INCORPORATED is classified as a “gorilla,” a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors may be interested in such a company because it offers consistent and reliable returns. Moreover, INGREDION INCORPORATED is strong in dividends and profitability, and medium in asset and growth. These characteristics make it an attractive investment for investors who are looking for stable yet high returns. More…

Peers

The competition between Ingredion Inc and its competitors, Procter & Gamble Co, Nestle SA, and Edita Food Industries S.A.E., is fierce as each company strives to be the leader in the global food and beverage industry. From product innovation and marketing to pricing and distribution, each company is looking for the edge that will give them the upper hand in the competitive landscape.

– Procter & Gamble Co ($NYSE:PG)

Procter & Gamble Co is a multinational consumer goods giant, headquartered in Cincinnati, Ohio. The company manufactures a wide range of household products, from laundry detergents to toothpaste. As of 2022, the company has a market capitalization of 362.18B and a Return on Equity of 25.38%. The company’s size and profitability are demonstrative of its success in the consumer goods industry. With a large market cap and high return on equity, Procter & Gamble Co has established itself as an industry leader.

– Nestle SA ($LTS:0QR4)

Nestle SA is one of the world’s largest food and beverage companies, serving consumers in over 190 countries. Its market cap of 305.36B as of 2022 is a testament to its success and industry leadership. The company’s return on equity (ROE) of 14.82% is also impressive, indicating that the company is efficiently utilizing the capital it has available to generate profit and create value for its shareholders. This impressive market cap and ROE are indicative of the strength of Nestle SA’s business model and its ability to remain competitive in an ever-changing industry.

– Edita Food Industries S.A.E ($LSE:66XD)

Edita Food Industries S.A.E. is a leading food manufacturing and distribution company based in Egypt. The company has a market capitalization of 371.8 million as of 2022 and has achieved a return on equity of 33.89%. This indicates that the company is financially healthy and is able to generate returns on its investments. Edita produces and markets a wide range of baked goods, snacks and confectionery products, including cakes, pastries, rusks and biscuits, in addition to providing products for specialty markets. It also provides ready-made meals, frozen fruits and vegetables, and frozen ready-meals for catering services. The company is well-positioned to benefit from the growing demand for convenience food products in Egypt and across the region.

Summary

Ingredion Incorporated reported strong financial results for the fourth quarter of FY2022 with total revenue increasing significantly by 70.1%. Net income also rose 13.2% to USD 1987.0 million, demonstrating the company’s sound financial performance. The company’s profitability and growth prospects make it an attractive investment option for investors.

In addition, the company’s diversified product portfolio and wide geographic reach should provide a steady stream of revenues and profits over the long-term. Therefore, investors should consider adding Ingredion Incorporated to their portfolio.

Recent Posts