INFORMATICA INC Reports Fourth Quarter Earnings Results for FY2022

March 29, 2023

Earnings Overview

On February 8 2023, Informatica Inc ($NYSE:INFA). reported their financial results for the fourth quarter of FY2022 (ending December 31 2022). Compared to the same period in the previous year, revenue experienced a major increase of 93.4% to USD -4.4 million. However, net income decreased by 1.9% to USD 398.8 million.

Transcripts Simplified

Total ARR for the fourth quarter of 2022 increased to 11.5% year-over-year to $1.52 billion, at the high end of our revised guidance range, driven by strong new business sales and Subscription renewals. Cloud ARR increased over 42% year-over-year to $451 million, exceeding the high-end of our October guidance range by $20 million. Subscription ARR for Q4 was $994 million representing a 24% year-over-year increase with an average Subscription ARR per customer of approximately $263,000.

Maintenance ARR finished in line with expectations, down 6% year-over-year at $523 million, with a strong renewal rate of 96%. GAAP total revenues were $399 million in the fourth quarter, down 2% year-over-year, which was in line with our October guidance.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Informatica Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.51k | -53.67 | -3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Informatica Inc. More…

| Operations | Investing | Financing |

| 200.06 | -185.96 | 38.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Informatica Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.97k | 2.92k | 7.24 |

Key Ratios Snapshot

Some of the financial key ratios for Informatica Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | – | 2.9% |

| FCF Margin | ROE | ROA |

| 12.9% | 1.4% | 0.6% |

Stock Price

Investors were not happy with the results as the stock opened at $18.6 and closed at $18.3, a decrease of 1.3% from its prior closing price of $18.6. This was a disappointment for investors as the company had reported strong growth in the past few quarters. Overall, INFORMATICA INC had a mixed fourth quarter. While revenue and net income were up year-over-year, earnings per share were slightly lower than estimated and the stock price declined due to investor disappointment.

The company has declared a higher dividend than the previous quarter and their cash balance has also increased significantly. Investors will be looking for the company to improve on these figures in the upcoming quarters in order to restore investor confidence. Live Quote…

Analysis

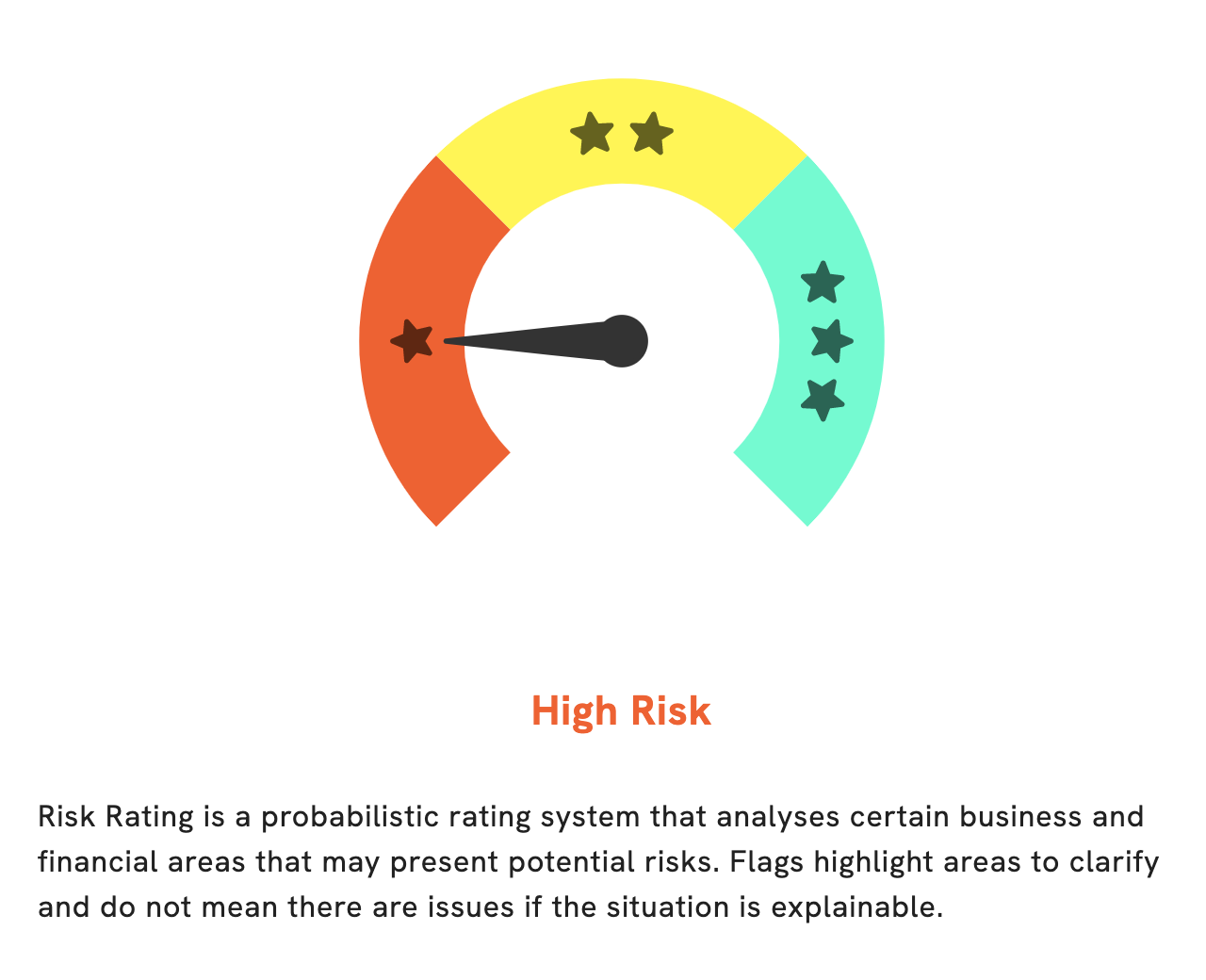

At GoodWhale, we have conducted a financial analysis of INFORMATICA INC and have determined that it is a high risk investment. We identified 3 risk warnings in the income statement, balance sheet, and cashflow statement. These warnings indicate potential weaknesses in the company’s financial performance and business operations that can lead to losses for investors. We encourage potential investors to register with us to get full access to our analysis and see for themselves exactly how INFORMATICA INC is situated. Our aim is to empower investors with the knowledge and information needed to make informed decisions. With GoodWhale, you can trust that you are getting the most accurate analysis of INFORMATICA INC to help you make smart investing decisions. More…

Peers

Its main competitors are Veritone Inc, Insig AI PLC, and IXUP Ltd. Each company offers a different set of features and benefits, and it can be difficult to choose the right one for your business. Here is a brief overview of each company to help you make a decision.

– Veritone Inc ($NASDAQ:VERI)

Veritone Inc is a media intelligence company that uses artificial intelligence to help its clients extract actionable insights from their audio and video content. The company has a market cap of 232.35M as of 2022 and a Return on Equity of -48.09%. Veritone’s AI platform enables its clients to index, transcribe, and analyze their content in a more efficient and cost-effective way. The company’s clients include media and entertainment companies, news organizations, and government agencies.

– Insig AI PLC ($LSE:INSG)

Insig AI PLC is a UK-based company that provides artificial intelligence solutions. The company has a market capitalisation of 28 million as of 2022 and a return on equity of -5.9%. The company’s products are used in a variety of industries, including healthcare, retail, and manufacturing.

– IXUP Ltd ($ASX:IXU)

Pixup Ltd is a digital media company that operates in the online advertising and marketing industry. The company has a market capitalization of 35.01 million as of 2022 and a return on equity of -39.2%. The company offers a range of services including online advertising, social media marketing, and web design and development.

Summary

INFORMATICA INC recently reported their fourth quarter earnings results for the 2022 fiscal year. Total revenue was up by 93.4% compared to the previous year, however net income decreased by 1.9%. This result is a positive indicator for investors as it suggests strong revenue growth, but could signal that the company is not yet able to convert this revenue into higher profits. Investors should take note of this and carefully consider whether INFORMATICA INC is a suitable investment for their portfolio.

Recent Posts