Iac Inc Stock Fair Value Calculation – IAC INC Reports Fourth Quarter Earnings Results for FY2022, Ending December 31 2022

March 30, 2023

Earnings Overview

On February 13 2023, IAC INC ($NASDAQ:IAC) reported their earnings results for the fourth quarter of FY2022 ending on December 31 2022. The total revenue reported was USD -1.4 million, a year-over-year decrease of 107.6%.

Stock Price

The stock opened at $52.1 and closed at $51.2, representing a decrease of 1.4% from its closing price of $52.0 the day prior. This represents an increase of 12% from the same quarter last year. Overall, IAC INC‘s fourth quarter earnings results were positive, with increases in both revenue and net income compared to the same period last year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Iac Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.24k | -1.17k | -9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Iac Inc. More…

| Operations | Investing | Financing |

| -82.79 | -494.81 | -112.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Iac Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.39k | 3.79k | 66.74 |

Key Ratios Snapshot

Some of the financial key ratios for Iac Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | – | -27.0% |

| FCF Margin | ROE | ROA |

| -4.3% | -15.0% | -8.5% |

Analysis – Iac Inc Stock Fair Value Calculation

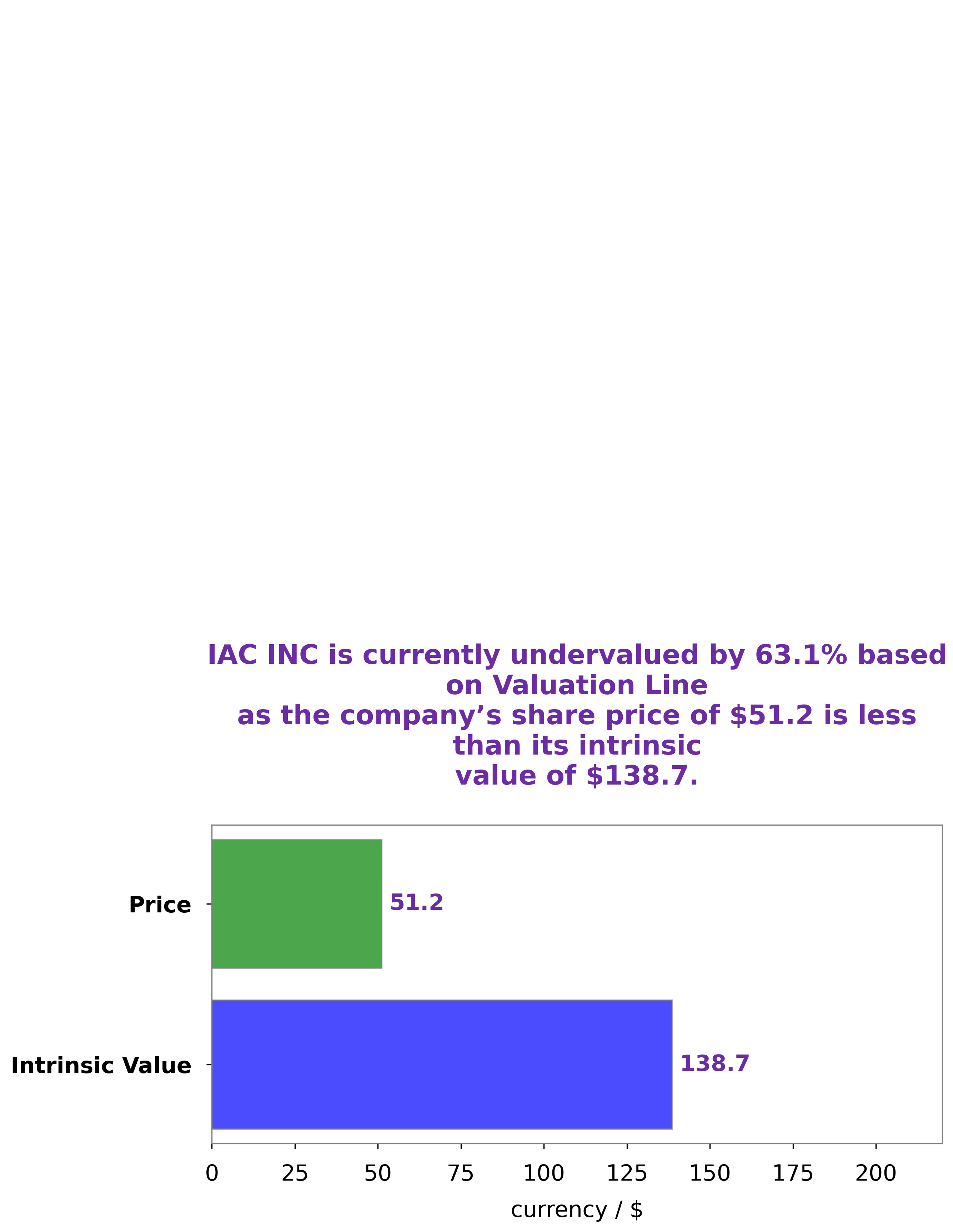

At GoodWhale, we have conducted an analysis of IAC INC‘s fundamentals. Our proprietary Valuation Line has calculated the fair value of IAC INC’s share to be around $138.7. Currently, IAC INC share is traded at $51.2, which is significantly undervalued by 63.1%. This presents a great opportunity to buying the stock at a discount price now and selling it at a higher price in the future. More…

Peers

IAC/InterActiveCorp is headquartered in New York City.

– Angi Inc ($NASDAQ:ANGI)

As of 2022, Angi Inc’s market cap is 971.35M and its ROE is -5.81%. Angi Inc is a provider of home services that connects consumers with service professionals. The company operates in two segments: HomeAdvisor and Angie’s List. Its HomeAdvisor segment offers a digital marketplace that connects consumers with service professionals for home repair, maintenance, and improvement projects. The Angie’s List segment offers a membership-based website and app that provides consumers with reviews of local service providers.

– Match Group Inc ($NASDAQ:MTCH)

Match Group Inc is an American Internet company that owns and operates several online dating websites and apps. The company has a market cap of 12.02B as of 2022 and a return on equity of -41.93%. Match Group Inc was founded in 1995 and is headquartered in Dallas, Texas. The company offers a variety of online dating services and apps, including Tinder, Hinge, OkCupid, PlentyOfFish, and Match.com.

– InfoSearch Media Inc ($OTCPK:ISHM)

Media Inc has a market cap of 52.49k as of 2022. The company is a provider of information and analysis on the media industry, including traditional and digital media companies.

Summary

IAC Inc. recently reported their fourth quarter of FY2022 earnings results on February 13 2023. From an investment standpoint, IAC Inc.’s financial performance in the fourth quarter indicates a shift towards profitability and is a positive indicator for investors. Despite the challenging pandemic-driven market conditions, IAC Inc. was able to turn a profit and increase their net income year-over-year, making them an attractive option for investors looking to add a stable stock to their portfolio.

Recent Posts